Contributors

- Michael Hung, Co-founder and CMO BYDFi

- Alex Guts, CEO of Banxe

- Bailey A. York, Data Lead at Galaxy Digital

- Sasha DiMarsico – Chief Communications Officer & Co-founder Banxe

- Guo Junxiu, CEO & Co-founder of Elven

- Charles Savva, Managing Director of Savva & Associates

- Tonia Damvakeraki, EU Blockchain Observatory and Forum

- Marianna Charalambous, EU Blockchain Observatory and Forum

- Juan Carlos Reyes, President Of The National Digital Assets Commission (CNAD) of El Salvador

- Florian Wimmer, CEO Blockpit

Forward

As we embark on another pivotal year in the evolution of the Web3 and cryptocurrency landscape, it’s my privilege to introduce the “Global Web3 Index 2024.” This comprehensive report underscores the dynamic shifts within the crypto ecosystem and highlights the resilient innovation and regulatory strides that continue to shape our industry.

At BYDFi, we remain at the forefront of this revolution, fostering partnerships and adopting strategies that enhance transparency, efficiency, and accessibility in crypto. This year’s index is a testament to our commitment to advancing the global understanding and adoption of blockchain technologies. It’s with great anticipation that I share our insights and outlook, reflecting on the significant milestones of 2024 and the exciting prospects for 2025.

Significant Developments in 2024 and Outlook for 2025

Reflections on 2023/2024: The period is marked by several groundbreaking developments that have significantly influenced the broader market landscape.

- Regulatory Clarity and Expansion: We have witnessed significant regulatory advancements in critical markets, notably with the launch of Bitcoin and Ethereum ETFs in the US and the anticipated implementation of the MiCA regulation in Europe.

- Technological Innovations: The development of more scalable DeFi platforms that enhance transaction speeds and reduce costs, and the integration of AI to improve smart contract algorithms for better security and efficiency. Also, we have seen the rise of multi-chain NFT platforms that allow for cross-chain interoperability, broadening the usability and marketability of digital collectibles across different blockchain networks.

- The Convergence of TradFi, Crypto, and Fintech: We witnessed the beginning of a significant blend between traditional financial institutions (TradFi), cryptocurrency service providers, and fintech companies. This year marked a shift in the crypto banking services and the expansive growth of offerings by crypto exchanges. These developments enable a more integrated and versatile financial ecosystem.

Five priorities for 2025

Looking ahead, investors, regulators, and businesses must adapt fast to the evolving landscape, focusing on strategic areas to maximize opportunities and mitigate risks associated with this surge. Here’s a focused outlook and strategic priorities set for BYDFi during this pivotal time:

- Investor Education and Engagement: Education will be crucial for novice and experienced investors. As the market dynamics shift rapidly, understanding the nuances of cryptocurrency investments, including the potential risks and rewards, becomes essential.

- Regulatory Alignment and Compliance: Regulators must enhance the framework that governs digital assets to protect all market participants without stifling innovation. BYDFi will work closely with regulatory bodies to help shape policies that support the growth and stability of the cryptocurrency market.

- Innovative Financial Products: Exchanges will continue expanding their financial product suite in 2025. This includes the introduction of new investment vehicles that cater to the needs of a diverse client base, from retail traders to institutional investors. Leveraging advanced technologies, these products will be designed to offer robust investment solutions during high volatility periods, providing options for hedging, trading, and long-term investment.

- Security Enhancements: With increased market activity, enhancing security measures will be paramount. The industry will continue researching and implementing state-of-the-art security technologies to safeguard investor assets against heightened risks, such as increased hacking attempts and fraudulent activities.

- Strategic Partnerships: Building on the convergence trend observed in 2024, the industry will continue to forge strategic partnerships across TradFi, FinTech, and crypto sectors. These collaborations will enhance service offerings and reach, allowing the market to tap into new markets and demographics during the bull run.

The path forward of the crypto industry and BYDFi has immense potential and exciting challenges. We are poised to redefine what is possible in the blockchain space through innovation, strategic partnerships, and our commitment to our clients and community. The “Global Web3 Index 2024” reflects where we are today and a roadmap to where we are headed. Let’s build a more inclusive, efficient, and secure digital future together.

Executive summary

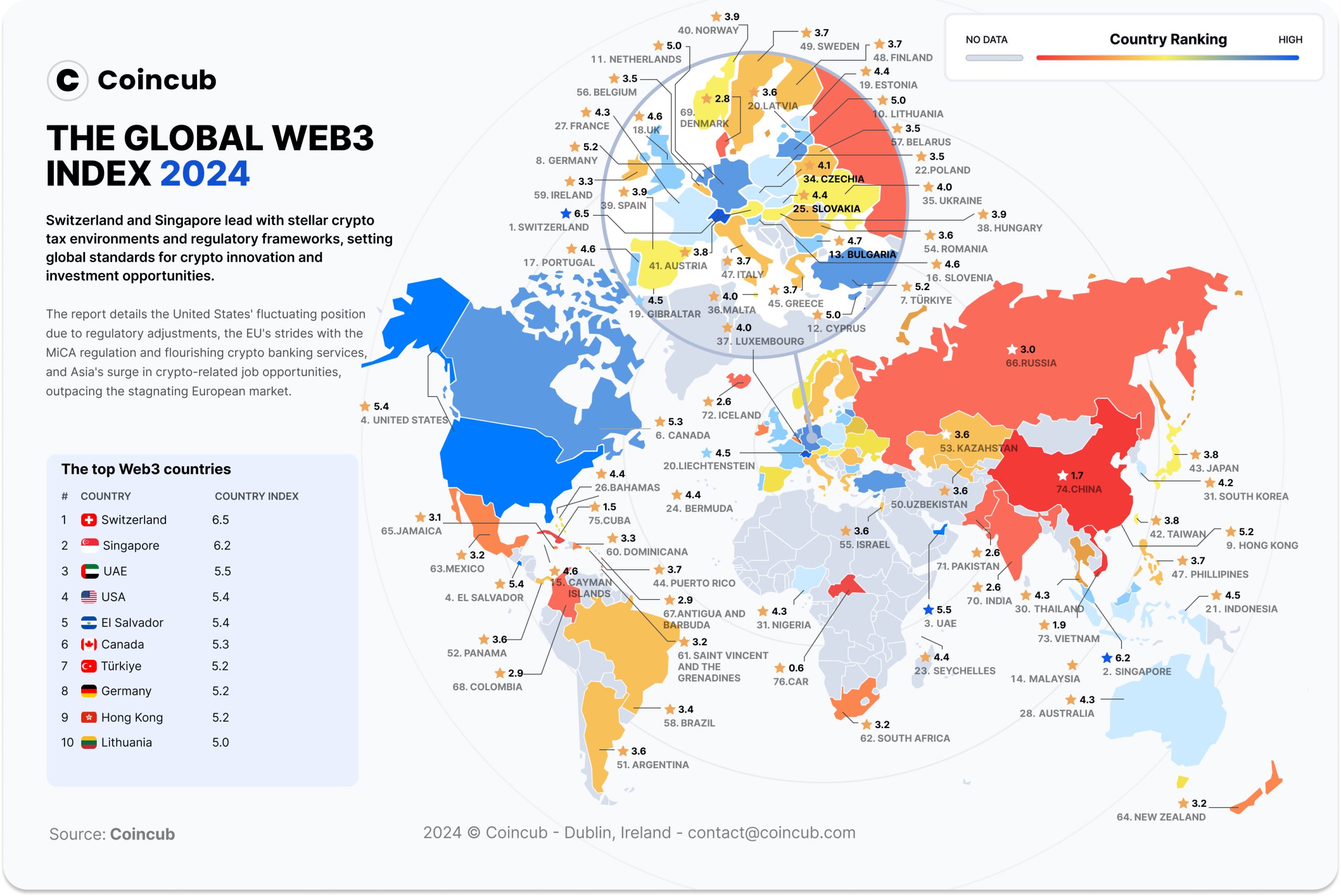

In the Global Web3 Index 2024, Switzerland, Singapore, and the UAE take the podium. Favorable taxation and stellar legislation have allowed these podium countries to advance faster than their global peers.

- Top Countries: Switzerland, Singapore, and the UAE lead the global crypto rankings, with the United States falling in fourth place.

- Switzerland: Leading due to its robust regulatory framework, favorable tax environment, and vibrant ecosystem.

- Singapore: High crypto adoption and strong regulatory and technological infrastructure.

- UAE: Significant crypto ownership, progressive regulations, and a growing ecosystem.

- Favorable Taxation: Zero-tax environments attract crypto businesses and investors.

- Regulation and Ecosystem: Smaller nations excel in creating favorable regulatory environments, with significant advancements in markets like the US and Europe’s MiCA

- Jobs and Talent: The crypto job market rebounded in the US and Asia, while Europe continues to decline.

- Crypto Financial Services: Switzerland leads with 32 crypto banks, US follows with 25.

Download the Global Web3 Index 2024 Database

Accelerating changes in global crypto asset regulation in 2024

In 2024, global regulation of crypto assets is rapidly evolving, with institutional demand driving this shift. Our regulatory study and data evaluate countries based on their adoption of favorable crypto policies, support for the crypto community, and restrictions such as banking and advertising bans.

In the top 10 for effective regulatory strides, Switzerland, El Salvador, Japan, Germany, France, Gibraltar, Latvia, United Arab Emirates, Bahamas, and Türkiye boast the most favorable regulatory environments. These nations lead with progressive approaches to crypto regulation. Smaller nations move as fast or even faster than larger ones. Switzerland, with a population of around 8.7 million, tops the list with a regulation score of 9.5. El Salvador follows closely with a score of 9.2. Despite their smaller sizes, these countries have developed robust regulatory frameworks that provide clarity and security for crypto operations.

Why are regulatory changes accelerating?

- Investor Protection: With the rising popularity of crypto assets, governments prioritize investor protection with stringent AML measures and clear guidelines to prevent fraud and financial crimes.

- Market Stability: Ensuring stable financial markets is usually critical for government officials. Regulatory frameworks aim to prevent excessive speculation and volatility, which could impact the broader economy.

- Institutional Adoption: The crypto ecosystem is nearing mass institutional adoption. Products like Bitcoin and Ethereum ETFs are being approved, facilitating entry for institutional investors. These products are expected to integrate into pension funds and company treasuries, demanding robust regulatory oversight.

- Technological Integration: As blockchain technology integrates into financial systems, regulators craft policies to address its unique challenges and opportunities. This includes licensing and registration requirements for crypto businesses, and clear guidelines for stablecoins and other digital assets.

Evolution of crypto regulation

- Comprehensive Legislation: More countries are enacting comprehensive crypto legislation covering various aspects of the digital asset ecosystem, including licensing, registration, and compliance requirements for Virtual Asset Service Providers (VASPs).

- Enhanced Supervision: Regulatory bodies are intensifying their supervision and enforcement activities, conducting risk assessments, supervisory inspections, and taking action against non-compliant entities.

- International Standards: Countries align their regulations with international standards set by organizations like the Financial Action Task Force (FATF).

- Positive Institutional Outlook: Governments, central banks, and financial regulators are adopting a more positive or ambivalent stance towards crypto assets, recognizing their potential benefits while managing risks.

The 0% tax advantage

New zero-tax leaders for long-term bitcoin hodlers

The trend of offering zero tax on long-term bitcoin hodlers is gaining traction. Notable countries that have introduced or maintained a 0% tax rate for selling bitcoin after one year include Germany, Gibraltar, Hong Kong, Liechtenstein, Luxembourg, Singapore, Slovenia, Switzerland and the UAE. These jurisdictions attract investors looking to minimize tax liabilities and foster an environment conducive to long-term crypto investment and innovation.

Some crypto hubs offer substantial tax advantages even if they don’t offer zero taxation. Malta, often called “Crypto Island,” along with Gibraltar and Liechtenstein, provides generous low-tax concessions to crypto entities, facilitating a thriving digital assets investment environment.

Expert article

Today, tax compliance in crypto is extremely low, with a global average of less than 2% of crypto traders actually declaring taxes on their gains. While we can assume that in most cases defrauding taxes is not intentional, it’s a fact that billions in tax revenue are missing and authorities have become aware of that.

To fill this gap, education, reporting tools, and specialized CPAs will be needed on the one hand and large-scale prosecution of tax fraudsters on the other. To get there, a better understanding of this new asset class and its challenges in accounting is mandatory.

Crypto assets bring many new variables to the table, which make both the declaration of taxes as well as the enforcement of tax compliance rather complex:

- A combination of centralized and decentralized data sources, which are not standardized at all

- The constant transfer of assets between exchange accounts, wallets, and smart contracts

- New transaction types like airdrops, staking rewards, hard forks, liquidity mining, etc.

- Unclear classification of many tokens (security, commodity, etc.)

- High volatility on prices, which makes traditional valuation methods obsolete

These are just a few challenges to be solved when someone wants to declare their gains correctly. While the overwhelming complexity prompted many to put the topic aside in the past, this won’t be an option much longer.

We have seen a lot of progress by the regulator and industry players, which is expected to drastically raise tax compliance rates in the future.

On the consumer side, a variety of software tools have been built, which automate the tax reporting process for the most part by digesting on- and off-chain data in real-time. These tools not only calculate tax liabilities but also show ways to optimize them legally.

When it comes to enforcement, we recently passed the so-called Crypto Asset Reporting Framework (CARF), which will come in effect in 2026 and cover 48 countries (OECD & EU). This new directive will force every Crypto Asset Reporting Provider (exchanges, brokers, custodians, etc.)—who has a licence in either one of those countries—to share their users’ KYC and transaction data with the authorities in all countries.

This is the missing puzzle piece of criminal investigation units needed to combine transparent blockchain data with the centralized databases of financial service providers. Specialized departments in many jurisdictions have already acquired the know-how and software tools to process this data on a large scale. Once the first patch of information is reported, we can expect a wave of enforcement.

Despite setbacks like FTX and Terra, we managed to chip away at the dirty image of crypto assets over the last years, changing the narrative of dark net money, terrorism financing and gambling to that of serious financial instruments bit by bit. Clearing the accusation of blockchain as rails for tax avoidance will be another step towards large-scale adoption.

—

Crypto assets and tax heavens

With bitcoin prices having risen to new all-time highs, investors are increasingly aware of the need to consider tax implications to maximize profits as prices rise. The UAE, Bahamas, Bermuda, Cayman Islands, and Seychelles led the low crypto tax index in 2023. The UAE has become a top destination for crypto businesses and individuals seeking zero taxation on crypto gains. This zero-tax environment and a favorable regulatory outlook make it extremely attractive. Other countries like Bermuda and the Cayman Islands similarly offer zero taxes on crypto earnings, attracting significant crypto and blockchain investments.

Example of Cyprus non-domicile scheme

“The Cyprus non-domicile scheme is one of the world’s most attractive personal income tax regimes. By spending just 60 days in Cyprus in a calendar year and not residing in any other country for more than six months, high-net-worth individuals can benefit from a 17-year tax exemption on dividends, interest, and profits from the disposal of securities. This makes Cyprus a highly favorable destination for international tax planning.”

Crypto ecosystem and adoption

Crypto infrastructure and economic impact

The infrastructure supporting cryptocurrencies and their economic impact varies significantly across countries. The United States leads in several infrastructure metrics, with 160+ crypto exchanges, 31,720 ATMs, and 1,021 locations accepting Bitcoin. This extensive infrastructure supports many crypto users and facilitates widespread access to digital currencies.

This translates well into economic gains from cryptocurrencies. The United States tops the list with $9.4 billion, followed by the United Kingdom with $1.4 billion and Vietnam with $1.2 billion.

Why per capita and GDP metrics matter

When considering per capita and GDP metrics, different countries emerge as leaders. For example, despite its smaller size, Switzerland ranks highly in ATMs per capita due to the densest bitcoin ATM network supported by Swiss Rails. Swiss also score high on companies with bitcoin in their treasury for its size. Similarly, Ukraine, Vietnam, and Nigeria show high crypto gains relative to their GDP, indicating substantial economic impact from cryptocurrencies.

Crypto adoption on the rise globally

India, Nigeria, and Vietnam rank highest in crypto adoption. India’s large population translates to 117.8 million crypto owners, China follows with 62.3 million, and the United States has 53.2 million. Regarding per-capita data, the United Arab Emirates, Singapore, and Türkiye lead in crypto ownership percentages, with 25.3%, 24.4%, and 19.3%, respectively.

Enthusiasm for bitcoin in El Salvador and Nigeria

El Salvador has emerged as one of the most enthusiastic countries about bitcoin, reflected in its Google Trends score of 100 for “bitcoin” searches. The country’s bold move to adopt bitcoin as legal tender in September 2021 has positioned it at the forefront of web3 innovation. This historic decision was driven by the government’s vision to enhance financial inclusion, reduce remittance costs, and attract foreign investment.

Nigeria also ranks high in interest in Bitcoin and cryptocurrencies, with Google Trends scores of 77 for “bitcoin” and 100 for “crypto.” Several factors, including economic instability, high remittance fees, and a young, tech-savvy population seem to drive this high level of interest. Cryptocurrencies offer Nigerians an alternative means of preserving value and conducting transactions in an economy plagued by inflation and currency devaluation. Moreover, the Nigerian government’s restrictive foreign exchange and traditional banking policies have pushed many to seek decentralized financial solutions. The result is a vibrant and rapidly growing cryptocurrency community, making Nigeria a global crypto adoption leader.

Jobs and Talent

The shifting landscape of Web3 jobs

The crypto job market experienced a significant decline last year, particularly in Europe, with countries like Germany seeing a staggering 92% drop. This downturn is primarily correlated to the overall stagnation of the EU GDP compared to its international peers. At the same time, the ongoing war in Ukraine and economic disruptions from Russia, coupled with a shortage of skilled workers and rising immigration issues, do not seem to spur new life into the EU economy or the crypto job market for that matter. MiCA regulation (Markets in Crypto-Assets Regulation), Europe’s regulatory framework, initially spurred a surge in crypto job creation. However, the current landscape reveals a stark reversal, with political instability stifling growth.

While Europe continues to struggle, the crypto job market in the United States and Asia, particularly Singapore and Hong Kong, is recovering robustly. The United States saw its crypto job numbers rebound from 3,418 in 2023 to 17,154 in 2024. Similarly, Singapore’s crypto job market increased from 467 to 2,433 in the same period.

The U.S. and Asian markets benefit from a more favorable economic environment, attracting talent and investment that might have previously gone to Europe. This divergence highlights the growing gap between Europe and other regions in the crypto job market, reflecting broader economic and political trends.

Universities and blockchain education keep the course

While crypto jobs have vanished in Europe and rebounded in other parts of the world in as little as 12 months, universities have changed course more slowly. The overall output of blockchain university graduates is steadily increasing.

Regarding the number of universities, India leads with 5,349, followed by Indonesia with 3,277 and the United States with 3,180. These numbers reflect the educational infrastructure that supports a large student population and facilitates research and development in various fields, including blockchain technology. When we look at universities offering blockchain courses, the United States is ahead with 319 institutions, China follows with 221, and India with 200.

However, when considering per capita metrics, smaller nations shine. Iceland, Cyprus, and Taiwan have the highest number of blockchain universities per capita. This indicates a concentrated effort in these regions to specialize in blockchain education, potentially creating a more skilled and knowledgeable workforce relative to their population sizes. While larger countries provide widespread educational opportunities, smaller nations often focus on specialized and intensive programs.

According to Tonia Damvakeraki (Managing Director) and Marianna Charalambous of the EU Blockchain Observatory and Forum (which ended in May 2024):

“As our recently published ecosystem report shows, this year’s graduates from top European universities are entering a job market that is not as robust as their counterparts in the US and Asia. Despite the growth in blockchain courses and programs across European institutions, including comprehensive educational initiatives at universities like the University of Nicosia and the University of Malta, job opportunities in Europe are limited.

The regulatory advancements in the EU, such as the Markets in Crypto-Assets (MiCA) regulation and the Digital Operational Resilience Act (DORA), have provided a stable legal framework for blockchain technologies. However, these regulations have yet to translate into a significant increase in regional job opportunities. The dynamic expansion of the business environment across Europe, with new startups and established enterprises engaging with blockchain technologies, has not been sufficient to create a substantial number of new jobs to accommodate the influx of graduates.

To tackle blockchain skill shortages and meet the current and future needs of the European Blockchain workforce, the EU has been proactively developing blockchain skills through initiatives like the CHAISE project, which provides forward-thinking training solutions.

Europe has made substantial strides in blockchain education and regulatory frameworks, yet the job market for blockchain graduates remains limited. The resurgence of blockchain jobs in the US and Asia post-crypto winter highlights the need for more proactive measures in Europe to bridge this gap.”

Advancements and trends in the Web3 ecosystem

China continues to dominate the global blockchain patent race

China continues to lead the blockchain patent landscape, with 19,832 blockchain patents submitted in the last 12 months, according to data from Google Patents and the World Intellectual Property Organization (WIPO). The United States follows with 6,700 patents, while international bodies such as the WIPO and the European Patent Office reported 2,003 and 877 patents, respectively. Countries like India, South Korea, and Japan contribute 462, 397, and 181 patents.

The controversial figure Craig Steven Wright, officially not the creator of Bitcoin, owns a substantial portion of the blockchain patents. Wright has aggressively pursued patents to assert his influence and control over blockchain technologies.

Crypto financial services

Crypto banks bridge traditional banking services to crypto. Switzerland leads with 34 crypto banks, the United States has 25, the United Kingdom has 17, and Japan has 8. These institutions provide services like crypto custody, loans backed by digital assets, and crypto-to-fiat conversion. The growth of crypto banks signifies increasing institutional interest and mainstream acceptance of digital currencies, further integrating cryptocurrencies into the global financial system.

“For the past decade, we have observed a downward trend in Bitcoin and altcoins’ day-to-day transactions for daily needs. At the same time, we see a significant increase in the number of Bitcoin transactions unrelated to e-commerce, goods sales, and payment per invoice. In the past two years, it is safe to say that BTC ETF and ETH ETF are likely to increase their adoption faster and provide a higher level of accessibility to the crypto market for enterprises and institutions. This will lead to increased investment through ETFs that will boost market liquidity, potentially reducing volatility over time.

Moreover, ETFs, comprehensive crypto regulations frameworks developed in past years all over the globe, and crypto integration into banking platforms like Banxe.com – bring higher adoption among businesses, enterprises, startups, sole entrepreneurs, and individuals. Undoubtable benefits of crypto payments, such as cost-effectiveness, prompt settlements, 24/7 availability, and global reach, make crypto payment the perfect transaction method for business, erasing frustration with accounts receivable and risk of indue settlements.

At Banxe, a banking and crypto platform for businesses and individuals, 99% of transactions are done via USDT or USDC. The introduction of BTC and ETH ETFs will reduce volatility, and regulatory adoption will lead to increased demand for BTC and ETH payments in the upcoming years.

We see Banxe’s role as an adopter of crypto payments for every individual and business on the market, making crypto and fiat money work together and erasing any uncertainties among entrepreneurs and regular users considering crypto operations for their needs. Our platform’s enhanced scope of services, features, and opportunities makes Banxe the perfect day-to-day solution for anyone looking for a better banking and crypto app. Banxe introduces regular users to crypto payments and provides them with local and international payments, foreign exchange, debit cards, role and team management, accounting, and mass payments in fiat and crypto.”

Bitcoin price rises driven by institutions amidst low public interest

The current separation between bitcoin prices and Google search trends for “bitcoin” indicates a first divergence between market movements and public interest. Historically, spikes in bitcoin searches on Google coincided with significant price surges, such as in December 2017, when searches peaked at 100 on the Google Trends scale, and Bitcoin’s price reached approximately $14,034.

However, this pattern is not mirrored today, with bitcoin prices reaching a new all-time high of $73,750 in 2024, while search interest remains around 19-31. This might suggest a sign of market maturity, driven more by institutional investments than public hype. The influence of institutional investors is reducing the impact of retail sentiment, although a resurgence in public interest could still trigger a new peak in the current cycle.

Global crypto asset trends and future outlook

- Bitcoin halving cycles and price trends: Bitcoin’s market trends often follow its 4-year halving cycles. The 2024 halving is expected to trigger a bull run, while bear market periods may occur in 2026 and 2027. Price predictions for Bitcoin and Ethereum indicate bullish trends, with new all-time highs expected.

- Regulatory impact: Countries worldwide are grappling with crypto regulations. In the United States, ongoing developments, such as the SEC’s actions against major crypto platforms, play a pivotal role. Clear regulations can either limit or pave the way for crypto asset leadership. The SEC’s perception of the crypto market matters. A shift away from its negative stance would yield positive outcomes for the US crypto industry. However, a presidential veto of crypto laws could lead to disillusionment and affect the country’s ranking further.

- Incentive-driven regulations: Türkiye’s cryptocurrency asset law has significantly impacted its rankings, while the UAE has risen to the third position due to incentive-driven regulations. Large nations will continue driving adoption, while smaller ones refine regulatory frameworks and focus on education and economic impact.

- Tokenization and Real-World Assets (RWAs): Tokenization, especially of RWAs, has gained prominence globally. As more assets become digitized and countries activate legislation in this space, the steps taken in this direction will impact future positions in the index.

- Accelerating institutional adoption: The recent surge in institutional interest and filing applications for a Bitcoin exchange-traded fund (ETF) by asset management giants like BlackRock, WisdomTree, and Invesco signal a significant shift. Notably, HSBC in Hong Kong has also entered the crypto arena, offering clients access to cryptocurrency-linked investment products, accelerating regional institutional adoption.

The Web3 landscape remains incredibly dynamic, and these trends are subject to change. However, keeping an eye on these factors will help navigate the exciting web3 world in the coming years.

Top crypto countries

The Global Web3 Index 2024 highlights the top countries leading in crypto assets based on regulation, taxation, ecosystem, population, talent, and finance factors. Switzerland has a comprehensive regulatory framework and favorable tax policies, making it a leading hub for crypto innovation. Singapore follows closely with its strong talent pool and strategic regulatory environment. The UAE’s rapid regulatory advancements, support for blockchain businesses and leading population adoption secure its place in the top three.

El Salvador, Canada, Türkiye, Germany, Hong Kong, and Lithuania are all in the top ten, each excelling in different areas of the crypto ecosystem, from regulatory clarity to talent development and financial integration.

1. Switzerland

Switzerland’s leading position in the web3 index is underscored by its robust regulatory framework, favorable tax environment, and vibrant ecosystem. The Swiss crypto ecosystem, centered in the “Crypto Valley,” is a conducive environment for blockchain technology and cryptocurrency enterprises. With over 1,000 blockchain and cryptocurrency-based businesses, Switzerland is home to major crypto entities such as Ethereum, Tezos, Cardano or Bitcoin Swiss. This ecosystem is supported by a strong talent pool and world-class educational institutions like the University of Zurich, which hosts a premier Blockchain Research Center. Furthermore, the presence of regional banks integrating digital assets highlights the seamless blending of traditional banking with digital innovation.

With six companies holding Bitcoin in their treasury, Switzerland demonstrates a forward-thinking approach to integrating cryptocurrency into corporate finance. Its robust crypto financing sector, coupled with a high score in the Crypto Adoption Index, help position Switzerland as the leader in 2024.

Lugano further exemplifies the country’s leadership position. This Swiss city has declared bitcoin legal tender and started accepting Bitcoin and Tether for all municipal payments, enabling citizens and companies to make any municipal payment using two of the world’s best-known cryptocurrencies.

The canton of Zug in Switzerland has a significant place in the crypto world, being in the heart of the “Crypto Valley”. Also, since February 2021, individuals and companies that are taxpayers in the Canton of Zug can pay their tax bills with Bitcoin and Ether. Additionally, the canton of Zug brings together some of the best crypto professionals and companies with its Crypto Valley.

Switzerland gets the top regulation score of 9.5 and leads the world in this category. This reflects its stringent and comprehensive regulatory framework, which provides stability and security while empowering the crypto ecosystem. The Swiss Financial Market Supervisory Authority (FINMA) provides a comprehensive regulatory environment supporting innovation while ensuring investor protection. In February 2024, the SIX Swiss Exchange introduced new rules to enhance investor protection for exchange-traded products (ETPs) and derivatives with crypto-asset underlying. These include eligibility criteria for crypto-assets and requirements for prudential supervision of custodians.

Switzerland’s regulatory framework for cryptocurrency, highlighted by FINMA’s guidance on staking services, underscores its advanced approach to digital assets. FINMA mandates the segregation of staked cryptoassets to protect customers in the event of a provider’s bankruptcy. This guidance clarifies supervisory practices and risk mitigation, ensuring transparency and security. By addressing legal uncertainties and detailing staking methods and risks, FINMA exemplifies Switzerland’s commitment to a robust and forward-thinking crypto regulatory environment.

The Swiss National Bank (SNB) launched a pilot project for a central bank digital currency (CBDC) focusing on wholesale transactions using distributed ledger technology. The project aims to improve efficiency and transparency in financial transactions. Finally, regional banks, including Zuger Kantonalbank and Luzerner Kantonalbank, have integrated digital assets into their services, partnering with Swiss crypto banks like Sygnum and Amina.

At the end of 2023, 34 banks and securities firms in Switzerland were actively engaged in activities related to crypto assets, reflecting the country’s progressive stance in integrating digital finance into its traditional banking system. This chart showcases the distribution of various crypto-related activities among these institutions.

Source: FINMA

Nevertheless, the disappearance of one of Switzerland’s two global banks, Credit Suisse, has been traumatic for the Swiss financial services sector. In March 2023, the federal government, the Swiss National Bank (SNB), and FINMA enforced new measures to safeguard Credit Suisse’s solvency and facilitate its acquisition by UBS.

Also, Switzerland seem to favour regulating crypto banks over crypto exchanges, which might hinder the fast adoption of new crypto projects. Despite its prominence, the country has relatively few bitcoin nodes, and while some locations accept BTC, broader adoption across businesses and services remains relatively limited. However, Switzerland continues to surprise everyone with new initiatives, like operating the densest Bitcoin ATM network in the world, which significantly impacts usability.

2. Singapore

Singapore is a global leader in cryptocurrency ownership per capita, with 24.4% of its population involved in crypto. This high level of participation is supported by Singapore’s robust regulatory framework and favorable tax policies, which make it an attractive destination for crypto enthusiasts and investors. The country also ranks highly in blockchain jobs, with 2,433 open positions in June 2024.

Additionally, Singapore is a top 3 destination for crypto exchanges, with 81 exchanges headquartered in the city-state. This robust exchange ecosystem enhances liquidity and provides diverse trading options for users. Singapore’s ascent to the top ranks of the global crypto landscape can be attributed also to its well-balanced and sophisticated regulatory framework. The Monetary Authority of Singapore (MAS) has established itself as a forward-thinking regulator, implementing the Financial Services and Markets Bill.

- Financial Services and Markets Bill: In early 2024, Singapore introduced this bill to enhance the regulatory framework for digital payment token services.

- Expansion of Licensing Regime: The licensing requirements for crypto businesses were expanded, requiring more types of digital asset services to obtain MAS licenses to operate.

- Enhanced Consumer Protection: New guidelines were issued to ensure greater consumer protection in crypto transactions.

Although Singapore is a significant crypto hub, its crypto ecosystem faces several challenges. The absence of cryptocurrency ATMs limits public access to digital currencies. Moreover, companies in Singapore have yet to adopt Bitcoin in their treasury, reflecting a lack of institutional confidence and adoption. Additionally, the government’s ban on crypto advertising hampers public awareness and might restrict the growth of new crypto projects.

3. United Arab Emirates

The United Arab Emirates (UAE) has the highest crypto ownership percentage globally, with 25.3% of its population owning crypto. This high adoption rate is driven by the government’s supportive stance on digital assets and its efforts to position the UAE as a leading fintech hub. The country also boasts a solid regulatory environment with a score of 8.75. It provides a secure and predictable framework for crypto activities attracting multiple companies and 20 registered VASPs (Virtual Asset Service Providers).

The UAE has rapidly emerged as a global leader in the crypto space thanks to its progressive regulatory framework, strategic economic policies, and significant investments in blockchain technology. Dubai’s Virtual Asset Regulatory Authority (VARA) and Abu Dhabi Global Market (ADGM) have implemented comprehensive guidelines and incentives. These regulatory bodies have established robust frameworks for compliance, risk management, and consumer protection, promoting the UAE a highly secure and attractive destination for digital asset ventures.

The UAE’s economic vision and strategic initiatives, such as significant tax advantages and creating free zones with specific regulations for crypto businesses, demonstrate its long-term commitment to becoming a global hub for blockchain and digital assets.

“The UAE has introduced a significant tax advantage for crypto investors. If cryptocurrency investments are held for over 12 months, they qualify for an exemption from the 9% corporate income tax. This policy, combined with the UAE’s favorable corporate tax environment, positions it as a leading jurisdiction for crypto investments and business operations.” – Charles Savva, Managing Director of Savva & Associates

Furthermore, the UAE’s strong support for innovation and technology, coupled with its forward-thinking regulatory approach, positions it as a leader in the crypto industry, fostering a vibrant ecosystem that attracts global talent and investment.

- Virtual Asset Regulatory Authority (VARA): Dubai’s VARA introduced comprehensive guidelines for virtual asset service providers (VASPs), focusing on compliance, risk management, and consumer protection.

- Free Zone Regulations: UAE updated its framework to attract more crypto businesses, simplifying the registration process and offering incentives for compliance.

- AML/CFT Measures: Strengthened anti-money laundering and combating the financing of terrorism (AML/CFT) regulations specific to crypto activities were implemented, enhancing financial authorities’ monitoring and enforcement capabilities.

4. United States

The United States remains a formidable player in the global crypto arena due to its extensive market size, advanced technological infrastructure, and complexity of their financial sector. The U.S. ranks high for the number of crypto banks, with 25 institutions, and it dominates the global Bitcoin mining scene, contributing 40% of the global hashrate. The high volume of crypto exchange traffic, the largest in the world, further reflects the vibrant and active crypto trading environment in the United States.

The recent approval of spot Bitcoin and Ethereum ETFs in the United States by the U.S. Securities and Exchange Commission (SEC) has been a significant development for the crypto industry. These exchange-traded funds (ETFs) allow investors to gain exposure to bitcoin and crypto without directly holding them, potentially making it easier for large institutions and newcomers to participate in the crypto market in a regulated and trusted manner.

The recent guidelines introduced by the SEC and CFTC have provided more clarity on the classification and trading of digital assets. The United States currently boasts over 17,000 open jobs in the Web3 sector, the highest number worldwide, reflecting the strength of its job market and the dynamic growth of the crypto economy.

With a vast and dynamic ecosystem, the U.S. is home to numerous blockchain startups, major crypto exchanges, and a thriving community of developers and innovators. The state-level regulatory advancements, particularly in crypto-friendly states like New York, Florida or Colorado, provide a diverse and supportive landscape for blockchain enterprises.

It also leads in the number of universities offering blockchain courses, with 319 institutions integrating blockchain into their curricula. Bailey York, highlights the importance of blockchain clubs in U.S. universities. “From my experience, students who participate in blockchain clubs during their sophomore or junior years often translate to internships and jobs in the industry. Despite many universities offering blockchain courses, club experiences help drive more interest and career opportunities in crypto. This insight underscores the critical role of practical, hands-on experiences in fostering the next generation of blockchain professionals.

- Stablecoin Regulation: Federal initiatives to regulate stablecoins were advanced, focusing on ensuring that issuers maintain adequate reserves and meet stringent operational standards.

The United States has seen a decline in its crypto ranking due to several factors following. The SEC’s regulation by enforcement has created a climate of uncertainty, leading to numerous lawsuits against various projects and exchanges. Despite its vast ecosystem and significant profits, crypto remains a relatively minor part of the American economy on a per GDP basis. The business community’s declaration that “Crypto is dead in America” last year and the negative sentiment fueled by the FTX collapse seem to have further

5. El Salvador

El Salvador has rapidly become a significant player in the global crypto landscape, securing its position as a leading country in the Global Web3 Index 2024. This rise is driven by its president Nayib Bukele‘s pioneering decision to adopt bitcoin as legal tender, making it the first country in the world to do so. This bold move, aimed at enhancing financial inclusion and attracting foreign investment, positions El Salvador at the forefront of cryptocurrency innovation.

A favorable regulatory environment and proactive government policies bolster El Salvador’s crypto ecosystem. The country boasts one of the highest per capita businesses accepting bitcoin, with 430 registered businesses. The National Digital Assets Commission (CNAD) has approved 20 new VASPs in the past year, bringing the total to 21, making it one of the most active regulatory agencies globally.

“El Salvador’s commitment to fostering a robust Bitcoin ecosystem is a testament to our forward-thinking approach. Ranking at the top of the Global Web3 Index reflects our nation’s dedication to innovation and our strategic regulatory framework, which empowers technology and ensures a secure and prosperous digital future for all El Salvarodians. We continue to build and support a framework that accommodates the rapid evolution of Web3 technologies and actively enhances their integration into our society.” Juan Carlos Reyes, President Of The National Digital Assets Commission (CNAD) of El Salvador.

In addition, El Salvador scores highly on taxation, with zero taxes on both long-term and short-term bitcoin gains, providing a highly favorable environment for investors. The presence of two crypto banks and strong government support further solidify El Salvador’s status as a crypto-friendly destination.

The nation’s tech-savvy youth and strategic initiatives have led to a vibrant crypto adoption environment. El Salvador also ranks first in Google searches for Bitcoin, reflecting high public interest and engagement with digital assets.

The country’s focus on integrating Bitcoin into its financial system includes promoting its use for everyday transactions and encouraging businesses to accept Bitcoin payments. El Salvador’s innovative approach to cryptocurrency regulation and adoption sets a precedent for other nations looking to embrace digital currencies.

El Salvador’s strategic policies and growing ecosystem underscore its commitment to becoming a leading global digital asset hub, making it a noteworthy contender in the Web3 space.

6. Canada

Canada is notable for its substantial number of Bitcoin ATMs, ranking second globally in absolute numbers after the US, facilitating widespread access to cryptocurrency for its citizens. The country also holds a significant position in the global Bitcoin mining industry, contributing 5% of the total hashrate. Additionally, Canada has a notable presence in at the institution level, with 22 companies holding Bitcoin in their treasury.

Canada’s position in the crypto rankings is attributed to its robust regulatory framework, proactive financial policies, and thriving ecosystem. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has continued its registration requirements for MSBs dealing in virtual currencies. However, their official directory and numbers are currently unavailable, as it introduces a new reporting system.

The Ontario Securities Commission (OSC) has introduced new regulations for crypto investment funds, focusing on investor protection and market integrity. Canada’s dynamic ecosystem, characterized by many blockchain startups, research institutions, and a highly skilled talent pool, supports the development and adoption of blockchain solutions.

- Cross-Provincial Coordination: Initiatives to harmonize crypto regulations across provinces were launched to provide a more unified regulatory landscape for crypto businesses.

7. Türkiye

Türkiye has emerged as a top-10 player in the Global Web3 Index, marked by its high adoption rate, progressive regulatory advancements, and influential figures in the crypto industry.

The country ranks third globally in cryptocurrency adoption, with 19.3% of its population owning digital assets. Like Argentina, this robust adoption rate in Türkiye reflects a tech-savvy population and an economic climate fostering alternative financial solutions. Notably, the surge in inflation after 2020 played a significant role in driving interest in cryptocurrencies. Additionally, in Türkiye, crypto interest grew during the COVID-19 lockdowns and has continued to this day.

Türkiye is fourth globally in crypto exchange traffic, contributing 4.48%. It also leads the world in stablecoin spending per GDP, which reaches 4% of its GDP. Crypto exchanges are at the heart of this adoption. A prominent crypto exchange in the country, CoinTR, is notable for its leadership, which includes high-profile figures such as Murat Uysal, the former Governor of the Central Bank of Türkiye.

Türkiye ranks also in the top 10 globally for cryptocurrency regulation. Recent enhancements in its regulatory framework have provided a more secure and structured environment for cryptocurrency activities.

With 209 universities, 33 of which offer blockchain courses, Türkiye is fostering a new generation of blockchain professionals and enthusiasts. The emergence of blockchain student communities in several leading universities highlights the fervent interest among young people in Türkiye.

Türkiye’s financial sector increasingly integrates cryptocurrency, with two crypto banks and 22 crypto exchanges in the country. The nation’s regulatory advancements have also made it a more attractive environment for local and international crypto firms.

8. Germany

Germany excels in its regulatory environment and crypto financial services, scoring 9.2, among the top jurisdictions globally. The country’s strong emphasis on regulation provides a secure framework for crypto activities. Germany also ranks second globally in Bitcoin nodes and has a robust renewable energy ranking, adding to its friendly tax environment for bitcoin hodlers.

“We have already seen major specific regulation for crypto assets with AMLD5 in 2020 and now MiCAr in 2024, but what’s going to impact every stakeholder in the industry will be the implementation of the Crypto Asset Reporting Framework (CARF or DAC8 in the EU) in 2026, which will enforce global information exchange on KYC and tax data of all crypto exchanges with authorities in 48 countries.”

– Florian Wimmer, CEO Blockpit

Germany’s robust regulatory framework and dynamic ecosystem in cities like Berlin have cemented its position as a top-tier crypto destination. The Federal Financial Supervisory Authority (BaFin) has issued new guidelines for crypto custody services and token issuances, enhancing compliance and investor protection. Implementing the Markets in Crypto-Assets (MiCA) regulation further aligns Germany’s national laws with the EU framework, ensuring consistency and high standards across the European market.

- BaFin Guidelines: The Federal Financial Supervisory Authority (BaFin) issued new guidelines for crypto custody services and token issuances, emphasizing compliance and investor protection.

9. Hong Kong

With a high regulation score of 8.42, Hong Kong supports its vibrant financial market. The city is also notable for its high ranking in web3 jobs, with 1,138 positions available, one of the highest per capita scores. It scores high on Google search rankings for Bitcoin, complemented by Hong Kong’s strategic initiatives and regulatory advancements. The Securities and Futures Commission (SFC) has introduced a mandatory licensing regime for virtual asset service providers (VASPs), which enlarged its stringent AML and CFT standards, with new elements like prudential requirements, governance, ICT, internal controls, market integrity, cybersecurity, insurance, customer protection or suitability. Hong Kong’s concentration of blockchain startups, research institutions, and tech-savvy talent, positions it as a leading destination for innovation and investment in the crypto sector.

Hong Kong has become a playground for experimentation by the largest banks in the world, the Chinese banks, to launch new products and services. This includes the introduction of its first Bitcoin ETFs. HSBC Hong Kong has launched Bitcoin and Ethereum ETFs, broadening access to digital asset derivatives in the region.

We have observed a notable surge in demand for crypto accounting software, particularly for reconciliation and compliance purposes in Hong Kong and Singapore. This trend may be attributed to the absence of a capital gains tax regime in these jurisdictions, coupled with a robust regulatory environment. Guo Junxiu, CEO & Co-founder of Elven, a professional crypto accounting software.

Additionally, main Chinese investment funds like Harvest Fund and China Southern Fund are actively applying for spot Bitcoin ETFs in Hong Kong. This is seen as a strategic move to capitalize on the growing interest in digital assets. This positions Hong Kong as a significant hub for crypto innovation, attracting substantial investment and regulatory support from mainland China. Furthermore, with its retail gold token launch in Hong Kong, HSBC is the first to issue a digital twin of a real-world asset to everyday investors.

- VASP Licensing Regime: Hong Kong’s Securities and Futures Commission (SFC) implemented a mandatory licensing regime for VASPs

- Integration with Mainland China: Regulatory efforts to harmonize crypto regulations with mainland China were initiated to facilitate cross-border crypto transactions under a unified framework.

On the downside, the government acknowledged that the VASP licensing regime is more rigorous and comprehensive than those in Singapore, the UK, and Japan, and several applicants like OKX have discontinued their applications.

10. Lithuania

Lithuania has carved a niche in the global crypto landscape, scoring 50.3 out of 130 max points in the Global Web3 Index and being featured in the top 10. With a population of 2.7 million and a nominal GDP of around $80 billion in 2023, Lithuania excels in regulation (9.1), reflecting a robust legal framework overseen by the Financial Crime Investigation Service (FCIS).

The country has 538 registered Virtual Asset Service Providers (VASPs) and crypto adoption is notable, with 6.6% of the population owning digital assets and significant exchange traffic. Historically, Lithuania has a sophisticated fintech regulation and served as a haven for fintech behemoths like Revolut. Leveraging its regulatory advantages, Revolut successfully expanded into challenging banking European markets like Ireland.

Challenges include scaling its blockchain workforce and patent submissions. It also lacks companies holding Bitcoin in their treasury. However, proactive regulation and educational initiatives provide substantial growth opportunities.

Methodology

The data has been collected from public sources or compiled by Coincub. While most countries in the top 10 excel in specific dimensions, they have yet to achieve a perfect overall score. This reflects the considerable journey ahead for most economies to realize their web3 potential fully. Simultaneously, it’s an exciting and dynamic space.

Scoring

Scoring was done per dimension, up to a score of 5, with a per capita or GDP division. This approach reflects which countries punch above their weight and are doing more to establish themselves as crypto hubs. By considering this, we better understand the concentration of crypto services, reducing the dominance of large markets that do not actively encourage crypto innovation or where crypto is merely a side effect of their large economy and population.

Including per capita/GDP metrics rather than absolute values provides a nuanced perspective on global crypto trends. While large countries like the United States might dominate in sheer numbers, smaller countries excel in creating real crypto hubs that empower their crypto communities.

Weights

Weighted scores adjust for the significance of each dimension, resulting in a country’s position in the index. The regulatory environment is given the highest weight because clear, supportive regulations are crucial for fostering innovation and protecting stakeholders in the crypto space, making the market more efficient. Countries with well-defined regulations can attract more businesses and investors, ensuring sustainable growth.

Similarly, Tax policies significantly impact a country’s attractiveness for crypto-related activities. Favorable tax treatment can incentivize investment and operational activities, while high or ambiguous taxes can deter them. The tax score reflects how crypto-friendly a country’s tax policies are for short-term traders and long-term investors.

With this in mind, the following weights have been assigned to each category, ensuring a balanced consideration of the multifaceted factors essential for a robust and flourishing crypto market.

- Regulation: 26.67% – Regulatory environment

- Tax: 20% – Long-term and short-term tax score

- Ecosystem: 13.33% – Bitcoin mining %, Global hashrate, Bitcoin nodes, Renewables rank

- Population adoption: 13.33% – Crypto ownership %, Crypto Adoption Index, Crypto exchange traffic # visits, ATMs, Google “bitcoin,” Google “crypto,” Locations accepting BTC

- Talent: 13.33% – Number of universities, Universities with blockchain courses, # Jobs in blockchain, # Patents 2023

- Finance: 13.33% – # Crypto banks, CBDC stage, # VASPs registration, # Companies with bitcoin in treasury, Crypto gains ($B), # Exchanges based in the country

The impact of positive regulation

To assess the positive impact of regulation in different countries, we considered 29 data points across various dimensions. These dimensions include early adoption of specific crypto policies, active support for the crypto community, recognition of leading crypto assets, and instances where crypto is accepted as legal tender (e.g., El Salvador).

Tax score

We assessed short-term and long-term crypto tax per country. Specifically, the scoring favors countries that offer low or favorable tax incentives for hodlers and provide short-term low tax rates. Our approach captures these variations across countries and acknowledges the impact of tax havens on the crypto ecosystem, similar to fintech and traditional finance systems.

Adjustments

The methodology incorporates expert insights, adjusting overall scoring and weightings. As a result, Germany receives a boost of +5 points, propelling it into the top 10. Despite challenges such as the decline in Bitcoin-related jobs and the financial impact of the war in Ukraine for Europe, Germany’s innovative approach, crypto regulatory leadership, and financial advancements make a compelling case for its higher ranking. A longstanding favorite in our assessments, Germany also paved the way for the industry by allowing crypto investments in savings and is leading in the tokenization of RWA.

Appendix

Top 3 per dimension, absolute value

| Country | Population |

| India | 1,428,627,663 |

| China | 1,425,671,352 |

| United States | 339,996,563 |

| Country | Regulation Score |

| Switzerland | 9.6 |

| El Salvador | 9.2 |

| Japan | 9.1 |

| Germany | 8.9 |

| Country | Number of Universities |

| India | 5,349 |

| Indonesia | 3,277 |

| United States | 3,180 |

| Country | Universities with Blockchain Courses |

| United States | 319 |

| China | 221 |

| India | 200 |

| Country | CBDC Stage |

| Nigeria | Launched |

| Jamaica | Launched |

| Bahamas | Launched |

| Country | # VASPs registration |

| Lithuania | 538 |

| Poland | 352 |

| Italy | 150 |

| Country | # Crypto Banks |

| Switzerland | 34 |

| United States | 25 |

| United Kingdom | 17 |

| Country | # Companies with bitcoin in treasury |

| United States | 44 |

| Canada | 22 |

| Switzerland | 6 |

| Country | Crypto Gains ($B) |

| United States | 9.4 |

| United Kingdom | 1.4 |

| Vietnam | 1.2 |

| Country | # Exchanges based in country |

| United States | 166 |

| United Kingdom | 95 |

| Singapore | 81 |

| Country | Crypto owners (users) |

| India | 117,844,262 |

| China | 62,340,819 |

| United States | 53,177,732 |

| Country | Crypto Ownership % |

| United Arab Emirates | 25.3% |

| Singapore | 24.4% |

| Türkiye | 19.3% |

| Country | Crypto Adoption Index |

| India | 1 |

| Nigeria | 2 |

| Vietnam | 3 |

| Country | Crypto Exchange Traffic # visits |

| United States | 554,025,072 |

| India | 347,943,363 |

| Indonesia | 277,284,816 |

| Türkiye | 215,825,838 |

| Country | # Patents 2023 |

| China | 19,832 |

| United States | 6,700 |

| India | 462 |

| Country | # Jobs in Blockchain |

| United States | 17,154 |

| United Kingdom | 2,673 |

| Singapore | 2,433 |

| Country | ATMs |

| United States | 31,720 |

| Canada | 3,015 |

| Switzerland | 1,130 |

| Country | Google bitcoin |

| El Salvador | 100 |

| Nigeria | 77 |

| Liechtenstein | 74 |

| Switzerland | 60 |

| Netherlands | 53 |

| Country | Google crypto |

| Nigeria | 100 |

| Netherlands | 70 |

| Singapore | 52 |

| Cyprus | 50 |

| Belgium | 47 |

| Slovenia | 46 |

| Country | Locations accepting BTC |

| United States | 1,021 |

| Brazil | 972 |

| Czechia | 841 |

| Italy | 810 |

| Country | Bitcoin Mining % Global hashrate |

| United States | 40.00% |

| China | 15.00% |

| Russia | 12.00% |

| Canada | 5.00% |

| Country | Bitcoin Nodes |

| United States | 1,741 |

| Germany | 1,689 |

| France | 461 |

| Netherlands | 330 |

| Finland | 296 |

| Country | Renewables Rank 2023 |

| Denmark | 1 |

| Lithuania | 2 |

| Luxembourg | 3 |