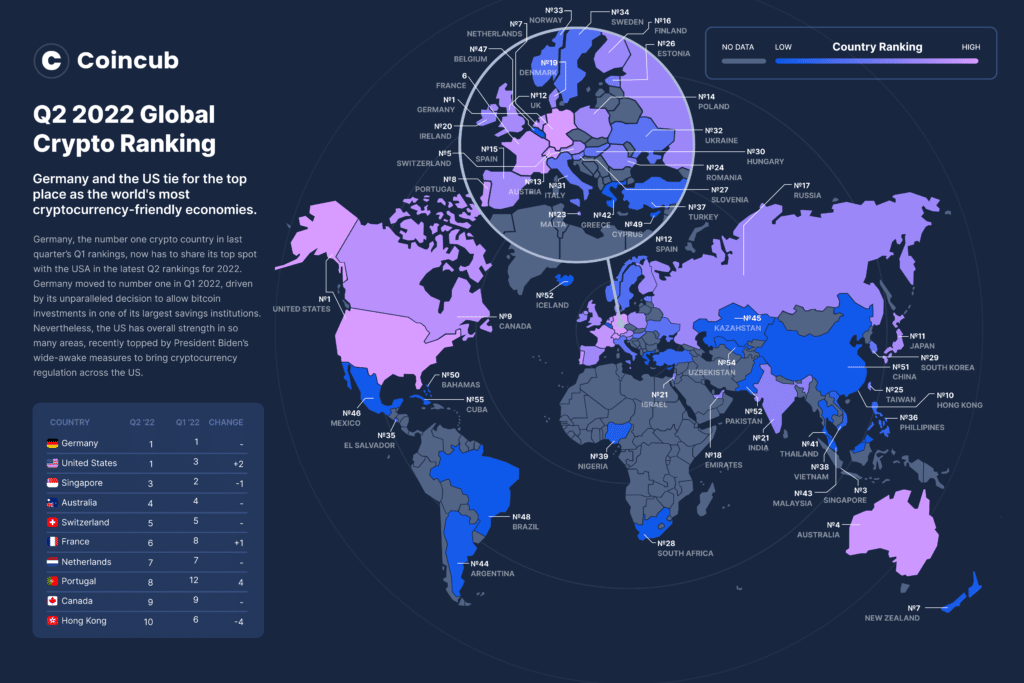

Germany goes head to head with the USA

Germany, the number one crypto country in last quarter’s Q1 rankings, now has to share its top spot with the USA in the latest Q2 rankings for 2022. Germany moved to number one in Q1, 2022, driven by its unparalleled decision to allow bitcoin investments in one of its largest savings institutions. Nevertheless, the USA has overall strength in so many areas, recently topped by President Biden’s astute measures to bring cryptocurrency regulation into line across the USA.

The result is that in Q2, both Germany and USA tie for top place as the world’s most crypto-friendly economies

Germany and USA leading the crypto world, but in different ways

The latest announcements by Biden offer the prospect of consumer protection along with a more cohesive anti-money laundering strategy across the USA (about time, some would say).

Both of the president’s measures (if implemented) score highly on Coincub’s ranking criteria which always shows that more regulation and safety improve people’s willingness to invest rather than when markets are left completely to themselves.

Source: Coincub

Additionally, there was the earthshattering news in early 2022 that worldwide pensions and investment giant, Fidelity, was to allow Bitcoin to form part of the portfolios of American pension funds.

Considering the value of Fidelity’s assets held under-investment and the number of American companies whose workers’ pensions are managed by the group, this is a monumental step, as groundbreaking an endorsement of bitcoin as that by the Sparkasse savings institution in Germany.

Germany has progressive crypto legislation – amongst the most well-conceived anywhere. It also has high volumes of crypto holders and bitcoin nodes. Adding to Germany’s rating is its favorable tax regime for Bitcoin investors. In this case, allowing anyone with crypto holdings, notably bitcoin and ether, to avoid tax providing such assets are held for more than one year (of course had you held it for the last 12 months, you probably would not be so keen on selling it right now).

One year, as we are seeing, is a long time in crypto affairs, but nevertheless, it represents a huge incentive when compared to the rule which applies to other assets in Germany, such as buy-to-let property, which must be kept for ten years to avoid tax.

Unlike many countries that adapt their tax systems to accommodate crypto, Germany’s approach is to meet it head-on. The crypto tax regime takes into account mining and airdrops and issues guidance that has been conceived by listening to the country’s federal states and leading financial bodies. Gaining approval and consulting with leading financial bodies isn’t unique to Germany, but coming away with some sort of agreement is. Similar approaches in Italy just lead to more confusion – it’s probably a German thing.

German efficiency – American strength

Germany has good form in cryptocurrency up to date and a strong lead in the rankings data. The USA too is a powerful crypto economy, mostly driven by the private demand for bitcoin trading and mining, and the vast number of bitcoin nodes and ATMs across the country. Holding the USA back was a somewhat ‘state-by-state’ approach to legislation and regulation, with a largely uncoordinated anti-money laundering strategy. This looks to be changing and the Biden measures, if fully implemented, will provide wider safeguards to restrict and prevent fraud

| Country | Rank Q2 ’22 | Rank Q1 ’22 | Change | Total Score | Regulation | Financial Services | Population | Tax | Talent | Proliferation | Trading | Fraud | Environmental |

| United States | 1Up | 3 | 2 | 49 | 9 | 13 | 1 | -5 | 4 | 21 | 7 | -3 | 2 |

| Germany | 1 | 1 | 0 | 49 | 9 | 13 | 2 | -1 | 4 | 17 | 3 | -1 | 3 |

| Singapore | 3Down | 2 | -1 | 43 | 6 | 9 | 2 | -2 | 4 | 18 | 6 | -2 | 2 |

| Australia | 4 | 4 | 0 | 42 | 9 | 12 | 2 | -3 | 4 | 15 | 3 | -2 | 2 |

| Switzerland | 5 | 5 | 0 | 40 | 7 | 8 | 2 | -2 | 4 | 16 | 3 | -1 | 3 |

| France | 6Up | 8 | 2 | 39 | 9 | 10 | 1 | -3 | 4 | 12 | 3 | 0 | 3 |

| Netherlands | 7 | 7 | 0 | 39 | 8 | 8 | 3 | -2 | 4 | 14 | 3 | 0 | 1 |

| Portugal | 8Up | 12 | 4 | 38 | 9 | 10 | 1 | -3 | 4 | 10 | 3 | 0 | 4 |

| Canada | 9 | 9 | 0 | 37 | 9 | 5 | 2 | -3 | 4 | 19 | 3 | -2 | 0 |

| Hong Kong | 10Down | 6 | -4 | 37 | 6 | 9 | 1 | -2 | 4 | 16 | 4 | -2 | 1 |

| Japan | 11Down | 10 | -1 | 37 | 9 | 12 | 1 | -5 | 4 | 13 | 3 | -3 | 3 |

| United Kingdom | 12Down | 11 | -1 | 36 | 5 | 10 | 1 | -5 | 4 | 17 | 5 | -3 | 2 |

| Austria | 13 | 13 | 0 | 35 | 9 | 10 | 2 | -2 | 3 | 11 | 2 | 0 | 0 |

| Poland | 14 | 14 | 0 | 35 | 9 | 10 | 1 | -4 | 4 | 12 | 3 | -2 | 2 |

| Spain | 15Up | 16 | 1 | 35 | 9 | 10 | 1 | -6 | 4 | 12 | 3 | -1 | 3 |

| Finland | 16Down | 15 | -1 | 34 | 8 | 8 | 1 | -2 | 3 | 12 | 2 | -2 | 4 |

| Russia | 17Up | 20 | 3 | 34 | 4 | 4 | 1 | -2 | 4 | 17 | 6 | -1 | 1 |

| UAE | 18Up | 22 | 4 | 34 | 8 | 7 | 1 | 0 | 4 | 9 | 2 | 0 | 3 |

| Denmark | 19Down | 18 | -1 | 33 | 8 | 9 | 1 | 2 | 2 | 10 | 2 | -1 | 0 |

| Ireland | 20Down | 17 | -3 | 33 | 7 | 9 | 1 | -4 | 4 | 12 | 2 | -1 | 3 |

| India | 21Down | 19 | -2 | 31 | 3 | 11 | 1 | -5 | 4 | 11 | 4 | -1 | 3 |

| Israel | 22Up | 23 | 1 | 31 | 8 | 9 | 1 | -5 | 4 | 10 | 2 | -1 | 3 |

| Malta | 23Up | 25 | 2 | 31 | 7 | 6 | 1 | -2 | 4 | 10 | 4 | -1 | 2 |

| Romania | 24Up | 26 | 2 | 31 | 5 | 7 | 1 | -3 | 4 | 12 | 2 | 0 | 3 |

| Taiwan | 25Down | 24 | -1 | 31 | 8 | 8 | 1 | -2 | 4 | 10 | 2 | 0 | 0 |

| Estonia | 26 | new | n/a | 30 | 9 | 8 | 0 | -2 | 4 | 10 | 0 | 0 | 1 |

| Slovenia | 27 | new | n/a | 30 | 9 | 7 | 2 | -3 | 4 | 7 | 4 | 0 | 0 |

| South Africa | 28Down | 27 | -1 | 30 | 6 | 6 | 1 | -4 | 4 | 11 | 4 | -1 | 3 |

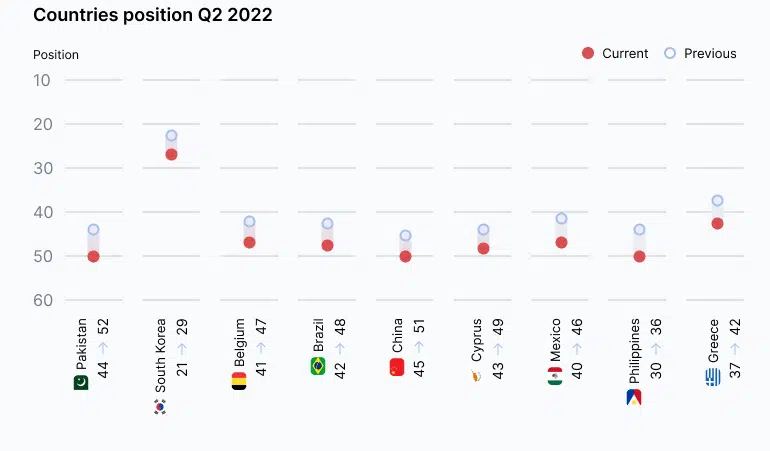

| South Korea | 29Down | 21 | -8 | 30 | 8 | 6 | 1 | -3 | 4 | 11 | 3 | -3 | 3 |

| Hungary | 30Down | 28 | -2 | 29 | 6 | 5 | 1 | -1 | 4 | 12 | 2 | 0 | 0 |

| Italy | 31Up | 32 | 1 | 29 | 5 | 9 | 1 | -4 | 3 | 13 | 3 | -1 | 0 |

| Ukraine | 32Down | 29 | -3 | 29 | 7 | 3 | 1 | -1 | 2 | 12 | 5 | 0 | 0 |

| Norway | 33Down | 31 | -2 | 28 | 7 | 9 | 1 | -3 | 3 | 10 | 2 | -1 | 0 |

| Sweden | 34Down | 33 | -1 | 27 | 5 | 9 | 1 | -5 | 4 | 10 | 3 | 0 | 0 |

| El Salvador | 35Up | 36 | 1 | 26 | 9 | 6 | 4 | -4 | 1 | 5 | 5 | 0 | 0 |

| Philippines | 36Down | 30 | -6 | 26 | 8 | 6 | 1 | -2 | 2 | 8 | 3 | 0 | 0 |

| Turkey | 37down | 35 | -2 | 25 | 2 | 5 | 2 | -2 | 4 | 9 | 3 | 0 | 2 |

| Vietnam | 38down | 34 | -4 | 24 | 4 | 7 | 1 | -2 | 2 | 9 | 4 | -1 | 0 |

| Nigeria | 39down | 38 | -1 | 23 | 5 | 4 | 2 | -2 | 2 | 8 | 2 | -1 | 3 |

| New Zealand | 40down | 39 | -1 | 23 | 7 | 9 | 1 | -4 | 3 | 7 | 2 | -2 | 0 |

| Thailand | 41 | new | n/a | 23 | 5 | 6 | 1 | -5 | 3 | 9 | 4 | 0 | 0 |

| Greece | 42down | 37 | -5 | 22 | 5 | 4 | 1 | -2 | 2 | 10 | 2 | 0 | 0 |

| Malaysia | 43 | new | n/a | 22 | 8 | 5 | 1 | -2 | 2 | 8 | 0 | 0 | 0 |

| Argentina | 44 | new | n/a | 21 | 1 | 2 | 1 | -2 | 4 | 8 | 4 | 0 | 3 |

| Kazakhstan | 45 | new | n/a | 21 | 8 | 5 | 0 | -2 | 2 | 8 | 0 | 0 | 0 |

| Mexico | 46down | 40 | -6 | 21 | 4 | 6 | 1 | -5 | 3 | 9 | 3 | 0 | 0 |

| Belgium | 47down | 41 | -6 | 20 | 4 | 4 | 1 | -4 | 3 | 9 | 3 | 0 | 0 |

| Brazil | 48down | 42 | -6 | 19 | 1 | 7 | 1 | -5 | 2 | 10 | 4 | -1 | 0 |

| Cyprus | 49down | 43 | -6 | 18 | 3 | 7 | 1 | -4 | 2 | 8 | 2 | -2 | 1 |

| Bahamas | 50 | new | n/a | 17 | 9 | 7 | 0 | -2 | 2 | 1 | 0 | 0 | 0 |

| China | 51down | 45 | -6 | 16 | -1 | 3 | 0 | 0 | 2 | 12 | 2 | -2 | 0 |

| Pakistan | 52down | 44 | -8 | 15 | 1 | 5 | 1 | -2 | 2 | 5 | 3 | 0 | 0 |

| Iceland | 53 | new | n/a | 13 | 6 | 3 | 0 | -2 | 2 | 4 | 0 | 0 | 0 |

| Uzbekistan | 54 | new | n/a | 11 | 7 | 3 | 0 | -2 | 2 | 1 | 0 | 0 | 0 |

| Cuba | 55 | new | n/a | 10 | 5 | 3 | 0 | -3 | 2 | 3 | 0 | 0 | 0 |

| CAR | 56 | new | n/a | 3 | 3 | 2 | 0 | -2 | 0 | 0 | 0 | 0 | 0 |

Source: Coincub

The Top Five crypto-friendly economies in the world

Germany and the USA tie for first place in the Q2 rankings as explained above, leaving three places up for grabs in the latest Q2 top five crypto-friendly economies.

Singapore slows down

And so in third place is Singapore. Singapore was the former outright top crypto economy in our Q4 2021 rankings but has slipped gently downwards over the past two quarters. Recent anecdotal stories about difficulties experienced by investors – who seem to be joining the queue to set up in the UAE – have added to accusations of an uneven playing field for crypto investors. These stories have yet to manifest themselves one way or another and so we watch this space. Despite the slippage, Singapore is still a crypto economy powerhouse with a high number of ICOs and people holding cryptocurrencies, but it has slipped over the past two quarters partly for its attempts to cool the market by issuing restrictions on the third-party advertising of virtual asset service providers (VASPs).

Australia hangs on in there!

Sitting at number four is Australia, a former number two crypto-economy that retains its top-five position thanks to its government and institutions having a very positive outlook on blockchain payments technology. Amongst its many crypto credentials is a high number of Initial Coin Offerings and number of crypto exchanges and many leading universities offering blockchain and crypto educational courses. The country also has a well above average score for the volumes of crypto sent and received, showing that crypto is much used as a peer-to-peer transactional service. The country has ambitions to stay ahead of the curve in distributed ledger technology and crypto payments systems in order to break itself free of reliance on outside global players making all the running in this area. Nevertheless, Australia is not a huge bitcoin mining country and stays at number five, simply through being overtaken rather than by any regressive crypto policies.

Swiss on a roll!

Moving up smoothly, like melting raclette, into fifth place is Switzerland. Switzerland has been steadily rising up through the rankings thanks to progressive legislation and high trading volumes. Also influencing its score was the largely unexpected announcement in March 2022 that the Canton of Lugano had made Bitcoin de-facto legal tender. In Lugano, Bitcoin can now be used for everyday purchases, including the payment of taxes – making it just like El Salvador – but without the mosquitos.

Switzerland is obviously a long-standing financial hub, so it is no surprise that it wishes to keep up with developments in blockchain and decentralized ledgers as well as….oh yes, money!

The country boasts some 1000 blockchain and virtual asset service providers (VASPs) and is also home to a significant BIS FinTech Innovation Hub. It also has an enthusiastic bitcoin population with high scores for its numbers of nodes and bitcoin ATMs. On the legislation side there are stringent anti-money laundering (AML) and Know Your Customer (KYC) policies (although recent accusations and fines directed at Credit Suisse for blatant money laundering seem to pose a few questions on this). Nevertheless, Switzerland is a crypto powerhouse and a progressive top five country. The Swiss Financial Market Supervisory Authority ‘FINMA’ is the country’s financial regulatory authority and those VASPs looking to operate in Switzerland need to apply for a license from FINMA. Licensing applies to all crypto exchanges, naturally.

Despite not rating a high score for mining, the country has a strong crypto infrastructure and an above-average number of ICOs supporting blockchain start-ups – second only to the UK in Europe in this regard. FINMA is actively granting licenses to a growing number of financial institutions to provide crypto custody services for customers seeking to buy and sell digital assets. One further important aspect is The Blockchain Act passed by the Swiss parliament. This paves the way for Distributed Ledger Technology (DLT) to be more widely promoted and accepted within the wider economy. Property and art, for example, could be listed and traded on blockchain systems.

Crypto Risers – check out the fastest risers in the Coincub Q2 ranking

Each quarter countries change direction, some improve their crypto economy, some add regulations and incentives…some simply ban it. All of which means the quarterly ranking is always changing.

In Q2 2022, the fastest riser is the United Arab Emirates, moving up from 22 to 18, with a turbo-charged foray into the crypto world. This highly diversified trading nation views new technology and ideas positively but was not sold on blockchain and crypto at first, probably fearing the worst with fraud and lack of controls. From banning crypto trading, only a few years ago, the country is now offering licenses to the exchanges and blockchain-related companies to boost the crypto economy.

The United Arab Emirates (UAE) has also moved swiftly forward with clear guidelines on ICOs and roles of agencies providing crypto services. The UAE relies on established overseas exchanges for its transactions, including Kraken and BC Bitcoin. The mining of bitcoin or other crypto is not regulated in the UAE or in any of the free zones within the UAE and, of course, the UAE is a zero tax location – what more could you ask for?

Portugal, the land of sunshine and bad tempered football managers, is also a crypto hotspot. It is a favourite for non-doms, offering them generous tax incentives and low taxes on crypto trading profits – no wonder investors rate it. The country has taken crypto to heart and the government is open to mining, trading, and the encouragement of VASPs. EU guidance on AML legislation also helps to reassure investors. There was a recent attempt to clamp down on the lax tax status of non-doms by the opposition government but this was thwarted – bringing a sigh of relief to rich, sunbathing foreigners and moving Portugal ever upwards.

Russia is a surprising mover-upper, but the Russia crypto story is suffused with bans and then the lifting of bans. Trading but not spending your gains is okay (or at least not spending them on foreign goods) and mining for bitcoin is back on the menu. The population still are keen crypto advocates – and the country is probably desperate to keep open any channels of finance it can, including cryptocurrency.

At four is the USA, which actually moves up to joint top place in the Q2 rankings with Germany. The USA has always been a strong top-five crypto country with lashings of crypto investors, ATMs, bitcoin nodes, and strong mining figures. Now that fund and pension giant, Fidelity, is adding crypto into the pension mix, the US is bringing crypto into the mainstream (there’s probably even a beef burger named after it as we speak).

Ooh la, la it’s France moving up a cheeky two places from its number eight position. France has lots of strong scores, notably for the strength of its blockchain community, number of people holding crypto and number of bitcoin nodes. The government outlook towards blockchain and crypto is positive and banks are well-positioned to offer crypto facilitation services to those wishing to buy cryptocurrency. France is turning into a ‘can-can’ crypto country.

Crypto crashers!

Brazil and Cyprus both drop six places on account of mixed governmental messages. Brazil famously drew back from making bitcoin legal tender only last year, but the government is keen to harness the wave of enthusiasm for crypto. Brazil is concentrating on bringing about stricter regulatory scrutiny regarding companies in the crypto-economy, along with increasing investor protection. With over 200 million people, many of them holding and trading crypto, Brazil will bounce back when a clearer strategy emerges.

Cyprus, although a favored destination for investors, lacks the crypto regulation and development of its blockchain community to keep it moving onward and upwards. Another mover-downer is Belgium. Belgium has no particular drive towards a crypto strategy, adopting a cautious approach – it moves down because taxes are pretty stiff with no wriggle room on gains for investors – unlike fun-loving Germany, for example.

Mexico, like Brazil, has a hugely enthusiastic crypto-holding and trading population. However, although regulations apply for VASPs wishing to operate, there is no detailed and consolidated strategy on how crypto is taxed and regulated. Clearer guidance would drive the country upwards – as it is, it drops down the ranking.

Greece has had enough financial problems over the past ten years to completely obviate any need to add crypto into the mix. Yet the country’s population is keen on crypto – perhaps because of those problems. The recent emergence of a cryptocurrency exchange registry by the Hellenic Capital Markets Commission (HCMC) offers clearer and more cohesive regulation but more needs to be done to attract overseas investment in the sector – Greece may have dropped but it could easily spring back – watch this space.

Methodology

The Coincub ranking continues to evolve. The rankings take into account quantitative figures such as crypto trading or mining volumes, as well as qualitative findings like the latest government legislation and the institutional stance of central banks and financial sectors.

We continue to find that purely quantitative numbers don’t always point to the most progressive countries – in under-developed countries, popular demand for cryptocurrency often isn’t matched by government or institutional enthusiasm. The Coincub ranking attempts to look beyond pure numbers to find those countries that are positioning themselves strategically.

In this regard, a wider analysis of criteria such as government strategy, institutional acceptance, and legislation – along with quantitative data points – offers a more consolidated view of a county’s ambitions.

Points-scoring

The ranking we used is based on points scoring and accumulation. Scores for government regulation can reach +9 points if all categories are positive – but reduce to -4 points if the legislation is negative. One example of negative regulation is China where a total ban on crypto is currently in place.

The ranking has nine overall categories and 21 sub-categories, ranging from numbers of recognized crypto education courses to startups. All of these categories are point-scoring, the totals of which are added together to comprise our rankings list. This latest ranking for Q1 2022 includes 44 of the most active crypto economies worldwide – although this number may increase going forward. For this current ranking, a number of new categories have been added, such as crypto education courses and initial coin offerings. Going forward we expect more countries and categories to be added in order to make our ranking as comprehensive and wide-ranging as possible.

Below are the point scoring categories, the totals of which ultimately make up the Coincub rankings.

Vision for the ranking

Coincub has been compiling the global crypto country ranking since 2021. Our vision is to provide the most comprehensive overview of active crypto economies across the globe for investors, journalists, and anyone interested in the cryptoeconomy.

Coincub brings you the latest, most comprehensive insights into this global financial phenomenon. Each year Coincub continually widens the scope of the quarterly ranking. Relevant categories are included and out-of-date ones replaced. Evolving metrics ensure that the Coincub ranking remains accurate year after year.

The Coincub ranking aggregates diverse data points, from the numbers of ATMs to the crypto trading volumes within a country. Blockchain technology development is accelerating. Some countries try to direct crypto policy and bring it within the mainstream with progressive legislation. Others try to block crypto entirely; a difficult feat considering crypto’s mainstream adoption. Blockchain-focused courses are in many universities and colleges around the world, and organizations funded by initial coin offerings are proliferating.

Editorial notes

Whilst the Q2 rankings have been compiled with data assembled up to the recent market falls in crypto prices – the outcomes of which will be reflected in the Q3 rankings at end of October 2022 – the rankings are compiled from wider-ranging data than price. These include government policies toward cryptocurrency, current legislation (positive or negative), taxes, investments, blockchain education courses, the number of blockchain start-up companies, and the advancement of CBDCs on a countrywide basis. These criteria give a far more comprehensive account of cryptocurrency, and blockchain acceptance and progress within any country or continent.