Find out where to pay the lowest tax on your bitcoin investments worldwide

For crypto investors who want to keep more of their gains – we set out the most and least favorable locations for your crypto investing strategy.

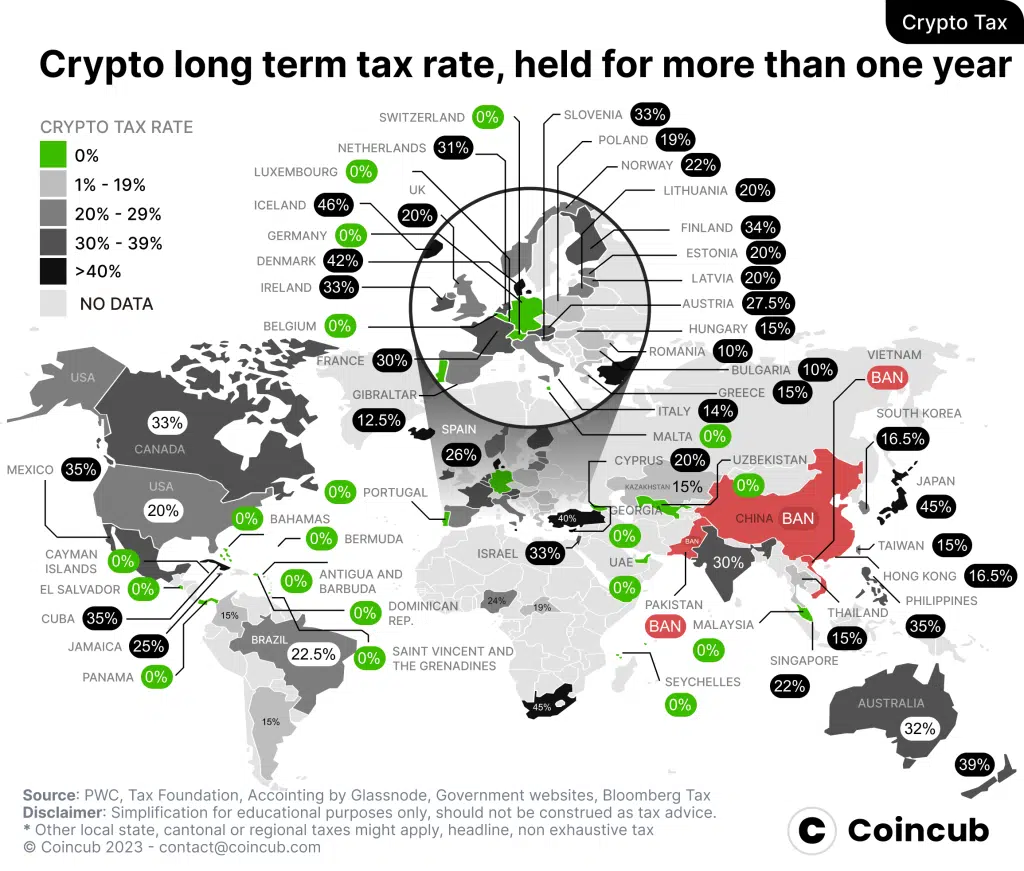

The world’s top twenty lowest crypto tax countries

Where in the world do you get to keep the most from your crypto gains – and are tax havens the only answer to paying the lowest tax?

Whether as an individual or a company, the top twenty low tax index shows some surprising – and not so surprising – answers. With bitcoin up more than 40% since June 2022 and many investors being caught off guard with their tax liabilities, it is now more important than ever for investors to reposition themselves and consider the tax implications of any gains or losses to maximize profits as prices keep rising.

Heading up the low crypto tax index from one to five are the classic havens of UAE, Bahamas, Bermuda, Cayman Islands and Seychelles. The UAE is now a top destination for crypto businesses and individuals seeking zero taxation on crypto gains. Crypto and blockchain companies are attracted to the UAE because it offers zero taxes on crypto earnings and its positive regulatory outlook.

In Europe, Monaco has no direct taxation – but you’d have to gain residency, which puts it out of the reach of all but the wealthiest investors (and racing drivers). Slightly easier to access is Panama, at number seven on the index, offering zero capital gains tax on crypto.

Not ‘zero’ but still low

Locating to the Caribbean for zero taxation is a matter for specialist accounting and taxation guidance, but there are plenty of countries that, whilst not being zero tax locations, still offer considerable tax advantages as part of their taxation environment. In this respect comes El Salvador (the world’s first adopter of Bitcoin as legal tender) which has taken all things Bitcoin to the heart of its economy.

Indonesia at nine presents a somewhat greyer area – with a 0.1% tax on transaction costs of buying crypto. The country also offers a zero percent tax on foreign domiciled investors who have obtained a ‘double taxation avoidance agreement’ – but this is not for the casual investor.

Next in line are famous European crypto hubs, with Malta (‘Crypto-Island’), Gibraltar, and Liechtenstein, all countries with oft-stated aims of becoming leading centres for digital assets investment. Taxes on crypto can be waived for entities based permanently in Liechtenstein, and again generous low tax concessions apply to entities based in Malta and Gibraltar.

Top 20 crypto tax-friendly countries:

1. 🇦🇪 UAE

2. 🇧🇸 Bahamas

3. 🇧🇲 Bermuda

4. 🇰🇾 Cayman Island

5. 🇸🇨 Seychelles

6. 🇲🇨 Monaco

7. 🇵🇦 Panama

8. 🇸🇻 El Salvador

9. 🇮🇩 Indonesia

10. 🇲🇹 Malta

11. 🇬🇮 Gibraltar

12. 🇱🇮 Liechtenstein

13. 🇩🇪 Germany

14. 🇸🇬 Singapore

15. 🇨🇭 Switzerland

16.…— Accointing by Blockpit (@accointing) June 27, 2023

Reassuringly come a slew of traditional tax-based economies, starting with Germany at number 13. Germany surprised the world with its decision to promote zero tax to pay on crypto gains if held for at least twelve months before disposal (nb – this also followed an equally progressive decision to allow German savers to let Bitcoin form part of their institutional savings). Switzerland has no direct tax on crypto gains, per se, but can exact a proportional wealth tax on the value of your crypto holdings. Switzerland is also home to a large number of leading blockchain and crypto-related companies.

Low-tax countries in the top twenty include Romania and Bulgaria with just a 10% tax on crypto income followed by Hungary and Greece at 15% on income gained through crypto investment.

The top twenty index looks at the prevailing taxation considerations in all the countries featured, but much depends on a number of considerations. Chief among these are whether one is a casual or regular investor, where one is domiciled, the nature of your business, and the level of tax guidance you receive. Zero-tax economies may offer more in net terms, but so can traditional economies with favorable tax concessions.

Crypto taxation variable across the United States

UNITED STATES – There have been some profound changes in the US’s crypto economy this year, and the overall sentiment varies greatly from state to state. On taxes, you could be paying short-term income tax on your crypto gains as high as 37%, and long-term gains over a year at a still hefty 20%. But this is highly variable – we look at key states with the most tax-friendly approach to the crypto market. States like California, Colorado, Florida, Puerto Rico, Texas, and Wyoming want to attract the crypto industry by following specific approaches such as crypto payments adoption, friendly regulations, and much more.

PUERTO RICO – is a state of the US but has autonomy over its tax laws. If you become a resident on the island and relocate your business there – all your future capital gains on stocks, bonds, and crypto earnings can become tax-free if applicable. Some benefits include 100% tax exemption from Puerto Rico income taxes on all capital gains accrued, after establishing residency at the island. When you become a “bona fide” Puerto Rico resident, you can access multiple tax breaks like individuals pay no capital gains taxes or a corporate tax of 4%.

CALIFORNIA – has the highest income tax rate in the country at 13.3%. The Office of Financial Technology and Innovation recently created a cryptocurrency department to expand the encouragement of adoption and crack down on bad crypto practices.

COLORADO – Colorado is a leading state in the crypto revolution, it has high crypto usage and crypto-friendly laws.

FLORIDA – Home to many crypto enthusiasts and hosted one of the biggest crypto conferences (Bitcoin Conference in Miami). Currently, there is a proposal in discussion, hoping the state accepts crypto payments toward certain state taxes.

WYOMING – It has some of the most crypto-friendly regulations in the United States and has approved over 20 laws to make it easier for crypto businesses to operate. Also, the state doesn’t collect any corporate or personal income tax attracting many crypto enthusiasts.

TEXAS – Having no personal income tax and some pro-crypto laws plus low energy costs is particularly appealing to the bitcoin mining industry – giving incentives and tax credits to miners. Recently the legal status of cryptocurrencies was recognized, paving the way for financial institutions to provide custody services for crypto assets.

Zero crypto tax countries – highly crypto positive

Europe is home to the

✅highest number of #Bitcoin & #Ethereum nodes

✅largest absolute number & relative share of on-chain activity

✅the most comprehensive crypto-regulation globally (MiCA)

✅two thirds of global industry jobs

✅50% of venture funded crypto projects globally… pic.twitter.com/Hqh67uTGxK— Patrick Hansen (@paddi_hansen) July 2, 2023

🇦🇬 ANTIGUA & BARBUDA – Antigua and Barbuda’s residents are not free from taxation but enjoy relaxed tax conditions with no capital gains, inheritance, income, or wealth tax on worldwide income or assets. Overseas tax residents also incur no inheritance or capital gains tax. If non-residents, however, generate dividends, interest, or royalties in Antigua & Barbuda, a withholding tax of 25% is due.

🇧🇸 BAHAMAS – Highly favorable – No income or capital gains tax to pay on crypto investments. Business entities trading crypto are subject to 2.5% of turnover. Make hay while the sun shines.

🇧🇪 BELGIUM – Belgium has a no-nonsense approach to crypto and asks for a sturdy 33% capital gains tax on crypto earnings. Capital gains on speculative transactions of crypto assets are subject to tax. When gains are realized, it’s going to get slapped with a 33% tax. Crypto gains transactions regarded as professional income come under progressive taxation rates up to 50%. But there is no capital gains tax if held for more than one year. The chocolates are nice, too.

🇧🇲 BERMUDA – Like The Bahamas, Bermuda is highly enthusiastic about digital currencies in general and has even been promoting its own aligned central bank digital currency. No income or CGT tax to pay on crypto earnings for individuals. Professional crypto companies need to be licensed to gain tax exemptions.

🇰🇾 THE CAYMANS – Yet another sunny tax destination that imposes no income or capital gains tax on crypto dealings. Entities trading crypto must be licensed and are also tax-exempt.

🇸🇻 EL SALVADOR – El Salvador continues to forge ahead in its total adoption of bitcoin with zero taxes on technology companies. El Salvador’s President officially stated that any profits you accrue from Bitcoin would not be taxed – that’s no tax on either your crypto’s capital increase or on the income from it. Will it last? Will you go there? Can you find it?

🇩🇪 GERMANY – tax is pretty high in the short term, but hold on to your crypto for a year and the profits (if any) will achieve a zero tax rate. This tax-efficient incentive rewards its own citizens and not just non-doms and overseas investors, as is the norm in so many tax havens. Depending on your level of income from your crypto gains, you will be eligible for up to 45% Income Tax and a 5.5% Solidarity Tax. Wunderbar!

🇬🇪 GEORGIA has positioned itself as a global haven for cryptocurrency investors, thanks to its liberal regulatory framework and a zero percent tax rate on income from trading cryptocurrencies. According to the Georgian Ministry of Finance, cryptocurrency profits are exempt from income tax. For crypto held within a legal entity – for example, an LLC – profits are subject to a relatively low 15% corporation tax (CIT).

🇮🇩 INDONESIA – Taxation is light, and only this year, the Government’s Finance Ministry imposed a flat 0.1% tax on crypto-assets purchases. Earnings and capital gains have been subject to a standard 0.1% final income tax since the summer of 2022. Your crypto assets are subject to VAT, having been defined as a commodity rather than a currency, and the 0.1% capital gains tax payable is equivalent to the rate Indonesian investors are charged on shares. This flat VAT rate on crypto assets is way below the 11% levied on most Indonesian goods and services.

🇱🇺 LUXEMBOURG – If the gain occurred within more than six months from the purchase – or shows a total profit of less than 500 euros, then it will not be liable for tax – so there is no capital gains tax if you hold for more than six months. Otherwise, the gain is subject to the standard rates of individual income tax, up to a maximum of 45.78% (ouch!) For anyone trading regularly and professionally, any gains will be liable to the standard individual income tax rates up to a maximum of 45.78% – so no 500 euro breathing space if you’re doing it for a living.

🇵🇦 PANAMA – Overseas companies and individuals can pay little or no tax on income and business and there is zero capital gains tax on cryptocurrency. The country has also been attempting to introduce crypto into the mainstream of daily life whilst not declaring it as legal tender. Watch this crypto space.

🇸🇨 SEYCHELLES – As far as international investors are concerned, Seychelles is a tax-free destination for cryptocurrency traders. There’s no capital gains tax, income tax, or VAT, which puts it right up at the top of the list of the 0% crypto tax club. As we have seen before, the taxation of crypto becomes more successful when it is partially accepted by governments (whichever way it is designated or defined by the financial institutions). In Seychelles, this definition has not been forthcoming over the years, leaving crypto outside of being currency or security and, as such, making it difficult to tax. This, of course, maybe a deliberate policy or simply a super laid-back approach.

🇸🇬 SINGAPORE – One of the world’s friendliest crypto countries, thanks to the strength of its all-around crypto economy. Purely on tax terms, it is a highly desirable place to trade and invest in cryptocurrency. There is no capital gains tax on crypto earnings, which means traders are free to trade short- or long-term with no impact on their taxes.

🇨🇭 SWITZERLAND – A land of smooth running clocks and finance (at least before Credit Suisse). Switzerland loves a bit of crypto. Taxation varies from canton to canton. Overall, capital gains for individuals investing in crypto are tax-exempt. The country also has an income allowance of up to around $18,000 US dollars before tax kicks in (enough to buy you a cup of coffee and a crepe in Geneva). Much depends on exactly where you live.

🇦🇪 U.A.E. – Zero tax overall is a hard act to follow, and, like the Bahamas above, zero tax goes for crypto gains too. The UAE currently has no system of federal income taxation, relying instead on each of its individual emirates having their own corporate income tax decrees. There are also designated free zones in the UAE where any entity operating within them is not considered to be ‘onshore’ as such and thus only subject to the rules and regulations of that free zone. Benefits of a free zone include tax exemptions or 0% tax rates over given periods of time. For the individual or casual crypto investor, it does look like you’ll be able to indulge all your crypto gains…or losses – tax-free.

Despite its slow start and suspicion of bitcoin going back to the early days of crypto, the UAE now wholeheartedly embraces the whole crypto and blockchain community with the aim of turning itself into the region’s foremost crypto/financial hub. If that impetus is maintained, cryptocurrency transactions are unlikely to be subject to direct or withholding tax soon.

🇹🇼 TAIWAN – Regardless of the ominous clouds that hang over Taiwan (and the fact that most people associate it with making microchips for the world) crypto is very much endorsed here. When it comes to crypto, there is a tax to pay, but huge incentives not to pay much at all. Taiwan is another country with no capital gains tax on crypto earnings. It also has a huge NT$6.7 million tax-free allowance per year and a flat rate of 20% tax rate on overseas income.

Now, let’s shift our focus to other countries that, although not offering complete tax exemption, provide significantly low tax rates, making them highly attractive destinations for cryptocurrency investors.

Low taxation – below 19% – positive outlook toward crypto

🇦🇷 ARGENTINA – Favourable for crypto investors. Argentina’s population has a long-held enthusiasm for Bitcoin and cryptocurrencies due partly to people wishing to protect their savings and investments against traditionally high inflation and economic uncertainties. Taxation of crypto has been constantly under review, but a lowish figure of 15% on income on gains with a 15% CGT appears to be a policy designed to encourage investors – and discourage tax avoidance.

🇧🇬 BULGARIA – Generally favorable. Bulgaria closely follows the directives of the EU and is awaiting pronouncements from the forthcoming MiCA. It offers a lowish income tax of 10% for crypto gains for investors and 15% on professional/business crypto gains.

🇨🇾 CYPRUS – Cyprus offers considerable tax advantages for individuals (20% rising to 35%) and entities trading and making gains from cryptocurrency. Though not as favorable as Caribbean tax havens, the climate is distinctly positive towards overseas investors. VAT is also exempted. Resident visas are available when you buy that dream home too.

🇬🇮 GIBRALTAR – Once again, specific tax regulation is hard to ascertain with much, as we pointed out in our introduction, being in the realm of definitions and types of transactions but whilst tax is charged on income overall – of which crypto gains will be included – there is no capital gains tax which offers some alleviation from tax liability will arise. No tax liability will arise if a transaction is defined as capital gains rather than a trade.

🇬🇷 GREECE – Greece taxes 15% on capital gains arising from cryptocurrency transactions. There is no regulatory framework for Bitcoin or cryptocurrencies in Greece. Like Cyprus, it has a very popular visa scheme when you buy an (expensive) property and locate there. Bitcoin is regarded for VAT purposes as a ‘negotiable instrument’ and exempt from VAT, also mining activities. Businesses have to pay corporate income tax.

🇭🇰 HONG KONG – If you trade cryptocurrencies professionally, you’ll be eligible for income tax of about 16.5%. Trade casually and you can avoid tax. However, you’ll have to iron out whether you are trading cryptocurrencies professionally or as an amateur with a specialist advisor. Taxation issues around cryptocurrencies may appear straightforward, but expert advice is advisable as everything crypto is changing all the time. There is also no capital gains tax on buying and selling crypto – only income tax. Your crypto purchases and sales will make up the revenue figure in a given year, from which you will deduct the costs of cryptocurrency purchases. Also, investment costs from previous consecutive years can be added to the following returns until they are fully deducted.

🇭🇺 HUNGARY – Hungary introduced a flat rate for cryptocurrency trading profits. Currently standing at 15%, this was reduced from 30.5% in 2021. One of the main appeals is the simplicity of their crypto tax strategy and their reasonably low tax rate for crypto profits. This rate of tax is only for individuals. The situation for corporations trading cryptocurrency seems less clear. Nevertheless, a convincing case exists for anyone who wants a low and simple tax regime. Hungary may be the place for those who don’t want to complicate their taxes.

🇰🇿 KAZAKHSTAN – The gains from cryptocurrency mining operations are taxed at a very low rate of 15% – partly to incentivize mining but also to potentially increase the total taxable tax by incentivizing compliance. As a coal and oil state, crypto mining is seen by the government as a form of diversification for the economy.

🇱🇮 LIECHTENSTEIN – As one of the oldest and most famous low-taxation financial havens, crypto gains not surprisingly have an easy time with crypto tax covered in its general taxation rules for worldwide income. This means a 12.5% flat-rate tax for overseas income and tax exemption for enterprises based permanently in the state. Consumer protection money laundering laws are well-defined.

🇱🇹 LITHUANIA – Like so many countries, the taxation of Bitcoin and crypto depends on whether you are a casual or professional (regular trader). Investing as a professional, naturally, is likely to incur more tax considerations. In Lithuania, the crypto tax for anyone trading comes at an increased tax rate of 20% for all non-work-related income – thus including dividend income, interest income and capital gains – when the total gains are more than 120 times greater than the average salary for that taxation period. Depending on the nature of its crypto activity, any company will be at least subject to corporate Income Tax (CIT) at 15%.

🇳🇬 NIGERIA – Nigeria’s crypto tax situation is complicated. However, it boils down to whether a crypto asset counts as a security or a commodity. Those classed as a commodity are subject to Income Tax, whereas Securities are subject to Capital Gains Tax. And there’s plenty more of that to deal with. However, long-term Capital Gains are taxed at a flat rate of a very reasonable 10%.

🇲🇹 MALTA – Malta always crops up when it comes to tax, money, and bitcoins. It’s a highly prized location to invest and trade in crypto. The country has a complicated tax system for high-rolling crypto traders, making it a haven for tax advisors. The sunny “Blockchain Island” doesn’t apply capital gains tax to long-held digital currencies like Bitcoin. However, crypto trading is on par with share trading and is liable to a business income tax of 35%. However, this can be mitigated through structuring options, making it a draw for professional investors who find ways to ‘mitigate’ (that means ‘reduce’ by the way) the rather unwieldy 35% down to something much more affordable – like, say…say 5% or even nothing. Malta distinguishes between bitcoin and those financial tokens that are equivalent to dividends or interest, in which case these are treated as income and taxed accordingly. You’ll need some serious tax advice.

🇲🇾 MALAYSIA – It’s almost uncanny, but countries with the lowest taxes are hot countries. And yet another is Malaysia. Crypto tax policy has not been specifically formulated, but crypto gains are taxed as per general income once again. Much depends here on the definition of types of trading. Malaysia doesn’t tax capital gains on crypto, but frequent trading is considered to be a profession. Cryptocurrency transactions are currently tax-free, and cryptocurrencies generally do not incur capital gains tax. Okay? However, profits from active (you’re doing it for a living) crypto trading may be regarded as revenue and thus considered taxable income. So, just to hammer it home. If the transaction is more of a capital gain or done casually, then any profit is untaxed – if your business is involved in cryptocurrency, you’ll fall under Malaysian income tax laws.

🇲🇽 MEXICO – Cryptocurrencies, for a long time seen as risky by the Mexican government, are now booming within the country. There is no centralized and structured approach to crypto. Any profit arising from the purchase and sale of crypto assets should be subject to a corporate income tax of 30%. Depending on their accruable income, individuals can be subject to income tax of 1.92% to 35% or even be exempt in some cases.

🇵🇱 POLAND – Poland is an enthusiastic crypto country with plenty of trade incentives. Personal income tax on gains stands at 19%. This rate also applies to large business enterprises whose gains from crypto are also taxed at a flat rate of 19%. As a smaller company or enterprise, you could only be liable for a flat taxable rate of 15%.

🇵🇹 PORTUGAL – Crypto income is not taxed for individuals who only ‘do it’ casually. It is a largely crypto-tax-free country. A commercial operation dealing in crypto will be taxed between 28% and 35% on their profits, paying a capital gains tax on that income. Gains from crypto held for longer than this period of time (365 days) would still be exempt (0% tax). Crypto has a special classification, and the new law states that it should not be subject to Capital Gains Tax when held for over a year. If held for less than this time, then it would be taxed at 28%.

🇵🇷 PUERTO RICO – For its natural attractions, it can also offer huge tax savings that crypto investors can bask in. As a part of the United States and with its people deemed US citizens, the country enjoys a good degree of autonomy. In Puerto Rico, resident investors can take advantage of tax exemptions, resulting in zero tax on capital gains earned from crypto, interest, or dividends. If you’re a US citizen trying to claim you’re Puerto Rican and enjoy zero tax, things can get a little bit complicated. As Puerto Rico is a US territory but not a state, it also has a super low corporate tax rate of 4% – great for all overseas companies (that aren’t from the US).

🇷🇴 ROMANIA – Crypto taxes are pretty light. The profits you make from cryptocurrencies are subject to income or capital gains tax, both at a flat rate of 10% on crypto earnings exceeding a cumulative 600RON per year (121 Euro). Income from cryptocurrency trade is considered income from other sources, and the gains are subject to income tax and the health insurance contribution (CASS). Employer obligation of your 10% gross income, but not to the social security contribution (CAS). The way you invest in Bitcoin will largely affect its qualification for income tax purposes. The special status of Bitcoin as a non-currency makes it, at present not eligible for VAT.

🇸🇮 SLOVENIA – This hotbed of crypto and blockchain levies no capital gains tax on individuals when they sell bitcoin. Also, crypto gains are not considered to be income. However, enterprises have a tougher time and must pay tax on crypto at the corporate rate. Things may change as the country seeks to reappraise its tax law.

🇹🇭 THAILAND – The latest tax laws state that trades of digital assets on government-approved exchanges will be exempt from a 7% value-added-tax VAT, and transfers via Thailand’s central bank digital currency CBDC, will be exempt from the VAT. The move is to support the crypto industry and improve its competitiveness and effectiveness within the digital economy. This is yet another positive move to boost the crypto economy and follows the scrapping of a proposed 15% withholding tax on crypto gains that had been planned earlier. Income earned from crypto activities now only incurs a 15% capital gains tax which was introduced at the beginning of January, instead of an additional 15% tax mentioned above.

Average taxation 20 – 29%, crypto-friendly

🇦🇹 AUSTRIA – Income tax on your crypto transactions is treated as a special case and stands at 27.5% on crypto gains and applies on earnings over 11,000 euros. This tax rate of 27.5% is kept entirely separate from the taxation of your other income, by the way. Professional entities can expect 24% corporate tax. Zero VAT on crypto transactions is in accordance with the EU.

🇧🇷 BRAZIL – Brazil once debated allowing Bitcoin as a legal tender, and has endured lots of internal controversy over its management of the crypto industry. There is also considerable complexity regarding crypto taxation. Upper rates of 27.5% on personal and corporate income from crypto gains and 22.5% on capital gains realized on crypto are not particularly generous. Income allowances against gains are quite low.

| CAPITAL GAIN | PERCENTAGE LEVIED AS TAX |

|---|---|

| < BLR 5 MILLION | 15% |

| BLR 5 MILLION – BLR 10 MILLION | 17.5% |

| BLR 10 MILLION – BLR 30 MILLION | 20% |

| > BLR 30 MILLION | 22.5% |

🇩🇴 DOMINICAN REPUBLIC – The Dom Republic might seem to have a very simple taxation system for crypto gains comprising 27% CGT on gains for individuals and businesses. However, much depends upon gaining serious tax advice as the implications can be obscure.

🇪🇪 ESTONIA – Estonia’s enthusiastic adoption of the crypto industry has been curtailed by its membership of the EU – the regulatory directives in place and yet to come, and the Ukraine war. It is still a low-tax environment for crypto trading with flat rates on income tax of 20% and lowish corporate tax.

🇯🇲 JAMAICA – Taxation on crypto trading gains is not clear at the moment. Although the standard income tax rates start at 23%, individuals are generally liable to income tax at the rate of 25% on their chargeable income not exceeding JMD 6 million per annum. Taxable income over the JMD 6 million per annum threshold is subject to income tax at 30%.

🇱🇻 LATVIA – Latvia is a thriving fintech country and a strong regional hub for startups in finance, many of them among the fastest growing in Europe. The Income-tax falls just outside our band for this category at 31%, but we include it here rather than in our high taxation band, which starts at 30%. Latvia also has an attractive flat rate of 20% capital gains tax on your crypto gains.

🇰🇷 SOUTH KOREA – Cryptocurrency transactions were not been subject to specific tax laws – but this has been changing with The Ministry of Strategy and Finance pushing for a tax policy on crypto transactions profits. From 2022 taxes were imposed on gains from the sale of virtual assets, to be separate from other taxable income, amounting to 22% of income gained over KRW 2.5 million ($1,900) in a one-year period. However, for breathing space, this proposed tax has been postponed until 2025.

🇪🇸 SPAIN – At present, the personal income tax rates for crypto traders rises from 19% on gains of 6,000 euros up to 26% on gains of over 200,000 euros. If you lose out, your capital loss can offset the gains. If you’re out of luck and your losses exceed the gains, the non-offset losses can be compensated in the declarations of the following four years, up to a limit of 25% of the gains on each of those years.

🇬🇧 UNITED KINGDOM – The UK offers no particular favors to crypto investors. There is a tax-free personal allowance of around £12k. You are then taxed on any gains above that threshold. These are charged at 20% to 45%. For capital gains from crypto over the £12,300 tax-free allowance, you’ll pay 10% or 20% tax.

Average to high taxation 30%-40%, but with long-term concessions

🇦🇺 AUSTRALIA – Favourable for crypto investors. Like many countries, Australia differentiates between professional and casual crypto traders. As the latter, investors can claim a 50% discount on the Capital Gains Tax due on any crypto that has been held for over a year. A yearly income tax of 32% only applies to earnings over 18,200 dollars per year. In Australia, how you are taxed on crypto transactions depends on what you intend to do with your crypto assets. If you do any of the following, your crypto activity will be classed as income and taxed accordingly.

🇨🇦 CANADA – Favourable. Canada has long been a crypto advocate and regularly stays high in the coincub ranking of crypto-friendly countries. Capital Gains Tax on crypto gains can rise to 33%, but there is an allowable discount of 50% of your earnings on this. 15% CGT is payable on your crypto gains up to a generous $49,020 of your overall taxable income.

🇮🇹 ITALY – Italy has newly derived taxation policies aimed at attracting high-net-worth individuals. The result is a complex and ever-developing tax system. Gains sourced in Italy are taxable as income, with an exemption from tax on crypto asset gains that do not exceed a whopping €51,000, whilst foreign income and gains can be sheltered from Italian tax. For long-term crypto trades

Italian taxpayers may be motivated to hold their crypto longer to benefit from the “substitute income tax” on 14% of the value of the assets held as of January 1st of next year rather than the cost at the time of purchase. Do you need specialist tax advice? Absolutely.

High taxation on crypto – 30%, 40%, and above – no concessions

🇩🇰 DENMARK – Denmark’s taxation system struggled to cope with crypto in the early days, but that has gradually changed. Taxes for individual traders are high, although there is no VAT on crypto. Crypto gains incur Income Tax at around 37%. If you’re a high earner, your crypto gains – as part of your overall income – could go up to 52% tax. Wonderful, wonderful Copenhagen.

🇫🇮 FINLAND – Your crypto income is subject to a capital income tax in Finland. For profits up to €30,000, the tax rate is a hefty 30%. Any profits above €30,000 are subject to a tax rate of 34%. However, if your cryptocurrency has increased in value significantly since you acquired it, you may be able to benefit from Finland’s deemed acquisition cost rule. The deemed acquisition cost lets you subtract from the sales price either the actual cost of the cryptocurrency or a fixed percentage of the sales price (20% if held for less than ten years or 40% if held for ten years or more) to determine the profit.

🇫🇷 FRANCE – Tax on your crypto gains kicks in after a very low threshold of just 305 euros in one financial year. After that, even if you are an occasional (non-professional trader), you’ll hit 30% – do it professionally, and your gains incur 45%.

🇮🇸 ICELAND – There’s not much in the way of concessions for crypto traders here. Progressive tax rates apply for earnings that kick in quite early. Any crypto gains up to $7k will incur just under 40% tax, whilst anything over goes up to 46%. Phew.

🇮🇳 INDIA – India has seen years of uncertainty over how to tax cryptocurrency but recently took a strong line with a flat rate tax of 30% on all profits or income from cryptocurrency. There is also a 1% tax on crypto transactions exceeding 50,000 INR (approx $600) in a financial year – a pretty low threshold for regular investors.

🇮🇱 ISRAEL – Israel confers none of the usual exemptions to cryptocurrency gains that apply to normal currency gains. So the sale of a cryptocurrency is generally subject to a capital gains tax of up to 33%. If the crypto investing activity is deemed to be on a business basis, income tax is applicable up to some 50%.

🇮🇪 IRELAND – Dealings are subject to Income Tax and Capital Gains Tax. Corporation Tax may also apply for companies dealing in cryptocurrency transactions, and a possible Capital Acquisitions Tax may apply. Transactions eligible for Income Tax fall within the standard 20% or 40%, and on those transactions eligible for Capital Gains Tax – a flat rate of 33% applies.

🇯🇵 JAPAN – Japan has stiff taxes on crypto gains but is an avid crypto and blockchain country. It set up the Digital and Decentralised Finance Planning Office as an organization developing policy around cryptocurrency. It has no special treatment of crypto – a small allowance of around $1500 per year is tax-free, but after that, tax kicks in on a sliding scale from 5% up to a maximum of 45%. Any crypto assets are taxed as income and come under the prevailing income tax brackets.

🇳🇱 NETHERLANDS – The Netherlands has no capital gains tax, and crypto traders who do not reach the 50k EUR tax threshold miss the country’s wealth tax. For those that do, a hefty 31% tax is waiting for them. However, if you have a strategy to keep your gains below this amount or, alternatively, don’t see it as a big issue, the Netherlands could be the place for you.

🇳🇴 NORWAY – Crypto gains are taxed at 22%, but progressive levies kick in once you start making larger gains. Regular gains from trading could put you up for corporate tax consideration.

🇳🇿 NEW ZEALAND – Encouragingly, if you plan to trade, New Zealand does not have a broad capital gains regime, which means that, generally, crypto assets will be taxable only when you buy, trade, or sell them for the purpose of gain. In this case, any gain or loss you make needs to be recorded and declared and taxed between rates of 10.5% to 39% – so quite a steep rise if you start to make good. If you decide to trade more advanced crypto products, often the realm of the experienced investor, the tax you need to consider depends on the specific type of crypto product you are buying, so you may need specialist advice.

🇵🇭 PHILIPPINES – There’s no tax on any income under $4.500 dollars, but after that, any income (including your crypto gains) will be taxed at an increasing incremental scale which can go up to 35%. Of more concern for crypto investors are impending moves to follow India’s lead and impose a transaction tax along with a flat rate tax – this proved to be very unpopular in India by the way!

🇿🇦 SOUTH AFRICA – Trading gains on your cryptocurrency counts as income, and tax must be paid according to prevailing tax laws. Much depends on the regularity by which you buy and sell cryptocurrency. Under such circumstances, your crypto gains could count as revenue and be taxed at a maximum of 45% – or they could be deemed a capital gain and taxed at a less stress-inducing 18% maximum.

Crypto uncertain – restrictive trading outlook

🇨🇫 CENTRAL AFRICAN REPUBLIC – Uncertainty rules. The CAR famously recognized Bitcoin as legal tender as a panacea for its economic situation, but this decision now appears to be reversed owing largely to an undeveloped internet infrastructure. Taxes of 19% on personal income and 30% corporate income are waived for cryptocurrency exchanges but not individual traders.

🇨🇳 CHINA – Crypto trading and mining are banned in China. We have shown prevailing personal and corporate tax rates, but the issue of taxation of gains awaits the next inscrutable Chinese U-Turn on crypto generally. Paradoxically a recent tax of 20% on income from crypto gains has been announced.

🇨🇴 COLOMBIA – Colombians are hugely enthusiastic about Bitcoin, but the government is moving to tighten up the industry. Tax policy appears to be ambivalent and compounded with high rates on personal income from gains.

🇨🇺 CUBA – Like Colombia, Cuba has no consistent crypto taxation strategy. We have shown prevailing tax rates for corporates and individuals. Overseas companies are taxed highly. American citizens who think of retiring to Cuba with their crypto gains will still come under the tax remit of Uncle Sam. Best to wait for the revolution.

🇵🇰 PAKISTAN – The ban on crypto trading in Pakistan only made it more popular and drove much of the industry into the hands of less secure and unreliable exchanges. The issue of tax on gains is a very grey area. The unregulated and haphazard growth of the crypto economy in Pakistan offers no clear direction on the taxation of cryptocurrency gains. Many exchanges and wallets are offshore and unregulated. One to miss as your investment location.

🇹🇷 TURKEY – Specific taxation policies tend to lag behind widespread adoption, but this is changing rapidly. Exchanges and crypto service providers fall within the standard tax for businesses of 20%, but a new tax policy surrounding the purchase and trading of crypto assets is underway. In addition to standard income tax that may be applicable to your crypto income, there is also the possibility of Value Added Tax as trading may be deemed as a performance and sale of services. In this case, your liability could be 5% VAT on the revenue unless the monthly sales amount is within $1,300. The latest ban on crypto spending and the potential arrival of new tax laws means it’s difficult to see how using cryptocurrency for long-term investment plans is going to play out.

🇻🇳 VIETNAM – Crypto is subject to complex classifications and taxing it creates problems. Although there is a ban operating on crypto trading and purchasing, and apparently no tax to pay on your crypto gains – stories of companies being taxed for their gains are not uncommon. Vietnam may be one to miss.

Methodology

This report is aimed at providing a simplified, high-level view of cryptocurrency taxation policies for individuals and companies across various countries. The first phase of data collection involved gathering information from primary sources, including government websites and official publications from tax authorities, to gain insights into the current taxation laws and regulations for cryptocurrencies. We also scrutinized legal documents, such as tax codes and government ordinances, to understand the specifics of cryptocurrency taxation. Additionally, secondary sources such as research papers, articles, and financial reports from international financial institutions were consulted to provide a deeper analysis and context to the data gathered.

In the second phase, a comparative analysis was undertaken to categorize and rank countries based on the favourability of their cryptocurrency tax policies for individuals and companies. This involved creating a matrix to compare different tax rates, incentives, and regulations. Expert opinions were also solicited through interviews with tax experts, financial analysts, and legal professionals specializing in cryptocurrency to gain further insights and validate the information collected. The final step involved continuously updating and verifying the data to ensure accuracy and relevance, considering the dynamic nature of tax laws and regulations. Each piece of information was cross-verified through multiple sources to uphold the reliability and credibility of the report.

Tax laws concerning cryptocurrencies are highly complex and vary significantly from country to country. Most jurisdictions lack a straightforward, comprehensive regulatory framework for taxing crypto assets. Always consult with a professional tax advisor or legal expert.

Disclaimer

This report is intended for informational and educational purposes only and should not be construed as tax advice. Tax laws and regulations related to cryptocurrencies are complex and subject to change. The content provided in this report is based on information available at the time of publishing and may not reflect the most current legal developments. Individuals and companies are strongly encouraged to seek the counsel of qualified tax advisors with expertise in the respective countries’ tax laws and regulations concerning cryptocurrencies before making any tax-related decisions. Additionally, utilizing specialized tax software that accommodates the specific regulations of the relevant jurisdiction may also be beneficial for accurately managing crypto taxes. Neither the authors nor the publishers of this report assume any liability for any actions taken in reliance upon the information provided herein.

Partner

3 Comments on “Crypto Tax Report 2023”

Leave a Reply

You must be logged in to post a comment.

Looks great, nice job

This article contains several errors, especially when it mentions zero tax rates in some countries for capital gains but fails to mention that these gains are subject to income tax, which makes the final calculation more expensive. In Brazil, the tax rate for capital gains is 15% (zero for sells under 7k usd) and not 22.5%. There are many other misconceptions as well.

Thanks Paul, we are updating this report. Please share any other information that could help others get a better understanding of tax in your region