Spell Token Price Prediction: Will SPELL Recover?

Spell Token ($SPELL) is the native utility and rewards token of Abracadabra.money, a DeFi protocol that lets users borrow a stablecoin (MIM) against interest-bearing assets. Instead of sitting idle, collateral in Abracadabra keeps generating yield while also unlocking liquidity, making it one of the more modular lending platforms in the space.

As part of a growing multichain ecosystem, SPELL supports a range of staking options, collateralized lending mechanics, and vault-based strategies that reward both active and passive users. It plays a central role in governance, emissions, and fee sharing, while the protocol continues to expand features like automated vaults, MIMSwap, and cross-chain asset movement.

This article takes a closer look at how Abracadabra works, how SPELL fits into the picture, and how the project has evolved. It also explores the token’s price history, staking dynamics, and long-term prospects.

As always, none of this is financial advice. Cryptocurrency prices are volatile and subject to regulatory, technical, and market shifts that no prediction model can fully anticipate.

What Is Spell Token (SPELL)?

Spell Token powers the incentive and governance layers of Abracadabra.money, a decentralized platform where users can borrow Magic Internet Money (MIM) by locking up interest-bearing tokens. SPELL serves multiple roles across the ecosystem. It’s distributed as a reward, staked for a share of protocol revenue, and used to participate in governance decisions.

Unlike many tokens that operate in isolation, SPELL exists at the core of a system built around cross-chain lending, staking, and automated yield. Users who stake SPELL can earn either more SPELL (via sSPELL) or MIM (via mSPELL), depending on how they choose to participate. Both methods tie rewards directly to protocol usage, rather than relying on inflation alone.

Abracadabra launched in 2021 and was one of the early projects to implement isolated lending markets using Kashi technology from SushiSwap. This approach made it possible to offer collateral options that didn’t rely on blue-chip assets, opening up leverage and borrowing strategies for tokens like xSUSHI, yvWETH, and cvxCRV.

SPELL quickly integrated with major DeFi ecosystems, including Yearn, Curve, and Popsicle Finance. These connections helped the platform grow across multiple chains and positioned SPELL as one of the more active DeFi-native governance tokens during the 2021 cycle.

How Abracadabra Works

Abracadabra.money is built around the concept of isolated lending markets, referred to as Cauldrons. Each Cauldron allows users to borrow MIM against a specific type of collateral, with independent risk parameters. This structure, based on Kashi lending technology, ensures that bad debt in one market doesn’t affect the rest of the protocol.

Borrowing starts when a user deposits collateral (often an interest-bearing token) and receives MIM, a stablecoin pegged to the U.S. dollar. Unlike algorithmic stablecoins, MIM is fully collateralized. The minting process only occurs when eligible assets are deposited into Cauldrons, which are managed by smart contracts and governed by the community.

The platform also enables leveraged positions through recursive borrowing. Instead of receiving MIM directly, a user can loop the process, borrowing MIM, swapping it for more collateral, and depositing it again. This boosts exposure without requiring additional upfront capital, but it also introduces higher liquidation risk.

Liquidations are triggered when the collateral ratio falls below a set threshold. Anyone can repay undercollateralized positions and claim a portion of the collateral as a reward. A slice of each liquidation fee is sent to the protocol, which is then distributed to staked SPELL holders through the sSPELL and mSPELL reward pools.

Advanced users can also interact with GMX V2 Cauldrons, which rely on a two-step execution model. Borrowing and leveraging on GMX involves creating a pending order that must be fulfilled by off-chain keepers. This delays settlement slightly but helps prevent front-running and improves execution reliability.

For broader access, Abracadabra uses LayerZero’s OFT standard to support MIM transfers between chains. This feature, called MIM Beaming, allows users to bridge assets quickly and at a fixed cost (currently $1 per transaction) regardless of size. Beaming also unlocks future use cases like cross-chain borrowing and liquidation.

A growing suite of tools rounds out the ecosystem. Position dashboards show collateral, health ratios, and repayment schedules across chains. MIMSwap handles stablecoin conversions, while the Markets and Farms pages offer filters for active cauldrons, APRs, and staking options across Ethereum, Arbitrum, Avalanche, and other supported networks.

Staking and Vault Mechanics

Abracadabra offers two staking models for SPELL holders: sSPELL and mSPELL. Both options give users access to protocol revenue, but the rewards are distributed differently.

Staking into sSPELL compounds SPELL over time. The token represents a growing share of the protocol’s SPELL fee pool, similar to xSUSHI. As more fees are collected (from interest payments, borrow fees, and liquidations) the value of sSPELL increases relative to unstaked SPELL. Holding sSPELL also grants governance rights across the DAO’s Snapshot page.

Alternatively, users can opt for mSPELL, which distributes revenue in MIM. This model pays out stablecoins generated from lending activity, allowing users to earn without increasing SPELL exposure. mSPELL is available across multiple chains and follows the same lock rules: a 24-hour cooldown on staking and claiming rewards.

In addition to staking, the protocol supports several auto-compounding vaults. Products like magicGLP (for GMX), magicAPE (for ApeStake), and magicLVL (for Level Finance tranches) let users earn native yields while compounding returns back into the base asset. These vaults work by issuing derivative tokens (i.e. magicGLP) that grow in value over time as fees are harvested and reinvested.

Liquidity providers on MIMSwap can also boost earnings by staking their MagicLP tokens. These represent positions in stablecoin pools like MIM-USDT or MIM-USDB. LPs earn swap fees by default, but staking MagicLP adds additional rewards through SPELL emissions or temporary boosts like the “Founder Boost” on Blast.

Across all staking products, lock durations are minimal, with most mechanisms requiring only a one-day wait. APRs are variable and based on the protocol’s rolling revenue performance. Vault token ratios, such as sSPELL:SPELL or magicGLP:GLP, adjust automatically, and users can track them via the dashboard.

Tokenomics

SPELL has a capped supply of 210 billion tokens. At launch, the total supply was set at 420 billion, but half of that was sent to an inaccessible contract in a one-time burn. The remaining 210 billion tokens form the base of all incentive, governance, and staking activity across the Abracadabra ecosystem.

Distribution is weighted heavily toward liquidity and protocol growth. Roughly 63% of SPELL is allocated to farming incentives, 30% to the team under a four-year vesting schedule, and 7% was sold through an initial DEX offering. The token follows a halving model that reduces emissions annually, with 50% of team tokens unlocked in the first year.

Currently, the protocol unlocks about 135 million SPELL per week, spread across liquidity pools, bribing programs, and staking incentives on Ethereum, Arbitrum, and other supported chains. The weekly benchmark is adjusted through governance and has been revised several times to reflect evolving yield strategies.

SPELL also includes a buyback mechanism defined in AIP #10. A portion of protocol revenue (especially fees from liquidations) is used to purchase SPELL from the open market. These tokens are then redistributed through staking pools or sent to the treasury, depending on governance settings. This design attempts to offset inflation, but net emissions still outpace burn activity under normal usage.

The balance between ongoing emissions and staking demand is central to SPELL’s price action. Without consistent growth in vault usage, leverage activity, and stablecoin volume, excess supply can pressure the token’s value over time.

Ecosystem & Governance

Abracadabra operates through a DAO-lite framework where decisions are made via Snapshot votes. SPELL holders participate in governance by staking their tokens for sSPELL or by depositing SPELL-ETH LP tokens into the designated farm. Both methods grant voting power on proposals related to emissions, new product launches, and protocol upgrades.

The fee-sharing model gives direct incentives to active participants. A percentage of liquidation fees, interest payments, and other protocol revenue is allocated to stakers. These mechanics ensure that governance is tied to actual usage, not just passive holding.

Abracadabra’s early contributors and multisig signers include builders from some of DeFi’s most influential projects. The group features names from Yearn, Curve, and Popsicle Finance, among others. This mix of experience shaped the platform’s architecture and helped it gain early traction across Ethereum and multichain environments.

MIM is minted through a multisignature process involving a 5-out-of-10 threshold. This multisig is composed of members from Yearn, Iron Bank, StakeDAO, Curve, and Abracadabra itself. It oversees the injection of MIM into smart contracts after users deposit collateral. The protocol relies on LayerZero’s OFT standard to maintain interoperability across chains, ensuring that MIM remains stable and transferable in cross-chain setups.

Market Performance

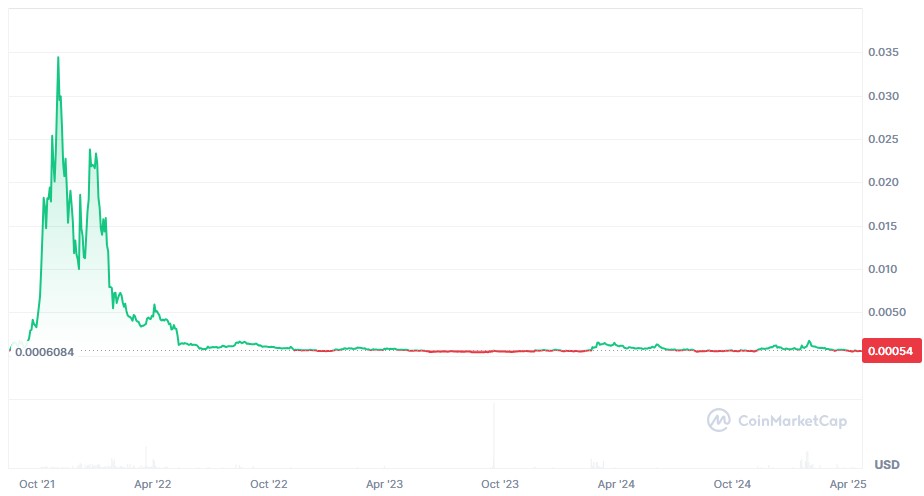

SPELL reached its all-time high of $0.075 in November 2021 during the peak of the DeFi bull cycle. The token rode a wave of hype tied to high-yield staking, leveraged farming, and integrations with protocols like Curve and Yearn. TVL surged as users flocked to mint MIM and loop collateral positions, pushing SPELL demand higher across both CEXs and DeFi platforms.

The drop that followed was steep. As broader market sentiment shifted in 2022, SPELL’s value fell in line with other high-emission DeFi tokens. The token lost over 99% of its value from peak to trough, bottoming around $0.00038 in August 2023. Most of the decline was driven by sell pressure from ongoing emissions, limited offset from buybacks, and falling usage across the lending side of the platform.

Since mid-2023, SPELL has shown relative stability. As of April 2025, it trades near $0.00054 with daily volume hovering around $40 million. The platform has minted nearly $49 million worth of MIM and currently holds about $142 million in total value locked. These figures show that while user activity continues, it’s no longer speculative but rather operational.

SPELL remains listed on major centralized exchanges including Binance, Coinbase, Bybit, and Gate.io. Liquidity is consistent across pairs, and users can also trade it on Curve, Sushiswap, and other decentralized venues. Its presence across chains helps maintain access and volume even during periods of low price momentum.

🧙🏼♂️!

Henlo, and furthermore, MIM is now live on @berachain mainnet.@KodiakFi and @InfraredFinance cauldrons are coming soon. 🔮

SPELL first omnichain deployment has been approved by the DAO, powered by @LayerZero_Core.🪄

Stay Tuned Beras.🐻

Q5 is here. https://t.co/T10JFKEbao pic.twitter.com/vyQTO8tbFM

— 🧙🏼♂️ (@MIM_Spell) February 6, 2025

Spell Token Price Prediction 2025 & 2030

SPELL’s price outlook for 2025 depends heavily on renewed activity in DeFi. If vault usage grows, MIM integrations expand, and Abracadabra maintains a steady stream of staking participation, SPELL could trade between $0.0025 and $0.008 by the end of the year.

A shift in macro sentiment or rising demand for stablecoin liquidity tools could benefit SPELL indirectly. Abracadabra’s ability to operate across multiple chains and support leveraged strategies gives it flexibility that may appeal during a more active market cycle. New vault products, cross-chain MIM usage, and DAO-driven emission adjustments would all support a recovery in price.

That said, SPELL remains an inflationary token with ongoing emissions. Unless staking absorbs a meaningful share of weekly output, price growth could be capped. If adoption lags or fees flatten, demand may not keep pace with supply, especially if MIM minting plateaus. Under those conditions, SPELL could struggle to sustain upward momentum, staying closer to its current range.

Longer-term, SPELL’s performance will be shaped by how well Abracadabra evolves beyond its original use case. If the protocol succeeds in making MIM a widely accepted cross-chain stablecoin, and if SPELL becomes a preferred staking asset across DeFi ecosystems, the token could reach between $0.01 and $0.03 by 2030.

Key drivers would include deeper integrations with external protocols, more automation across collateral management, and sustained governance activity. A tighter emission schedule or successful proposals to burn a portion of unclaimed rewards could improve the token’s supply dynamics over time.

But this scenario assumes Abracadabra remains relevant through multiple DeFi cycles. Competition is increasing, and many newer protocols offer staking mechanics without the same inflation pressure. If SPELL fails to expand its utility or if the platform loses share to competitors, price appreciation could stall, even in favorable market conditions.

Conclusion

SPELL sits at the center of a mature DeFi platform with real usage, active governance, and a well-defined token model. Its role in powering MIM minting, staking rewards, and community voting gives it utility beyond price speculation. The protocol continues to ship new features (automated vaults, multichain support, custom staking options) all built around the same core mechanism: unlocking stablecoin liquidity from yield-bearing assets.

At the same time, SPELL faces structural headwinds. High emissions and a large token supply have kept its price low despite ecosystem growth. The balance between inflation and adoption remains a key factor in any future recovery. Until demand for staking and vault usage consistently outpaces new issuance, upward price pressure will remain limited.

What happens next depends on how well Abracadabra scales MIM across chains, supports new DeFi integrations, and evolves its revenue-sharing systems. SPELL’s value will follow the utility it enables, especially as stablecoin infrastructure becomes more competitive and users demand more than passive staking rewards.

Frequently Asked Questions (FAQ)

What is SPELL used for?

SPELL is the native token of Abracadabra.money. It’s used to incentivize liquidity, distribute protocol revenue to stakers, and enable governance voting through sSPELL.

Is SPELL inflationary?

Yes. SPELL follows a weekly emission schedule of roughly 135 million tokens across chains. While there are buybacks through protocol fees, overall supply continues to grow.

What’s the difference between sSPELL and mSPELL?

Staking into sSPELL earns users more SPELL by compounding their position, while mSPELL distributes MIM directly from protocol revenue. Both require a 24-hour lock before unstaking or claiming rewards.

Can SPELL reach $1?

Unlikely, unless the total supply is dramatically reduced. SPELL has a max cap of 210 billion tokens. Hitting $1 would imply a fully diluted market cap far above most Layer 1s. Modest burns or emission reductions could support price growth, but not at that scale.

How do you earn MIM with SPELL?

By staking into mSPELL. This option pays out stablecoin rewards based on lending revenue generated by the platform. Rewards can be claimed at any time after the lock period.

Where can you buy SPELL?

SPELL is listed on Binance, Coinbase, Bybit, Gate.io, and several decentralized exchanges including SushiSwap and Curve.