Bybit’s advanced trading features for crypto traders

What is Bybit?

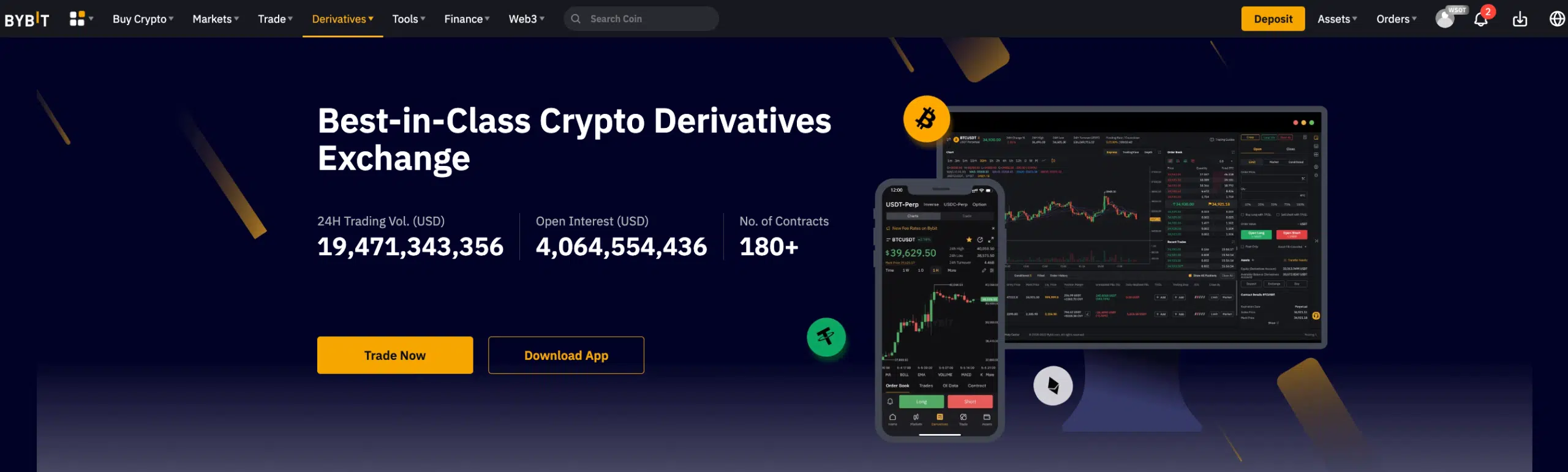

Bybit is an online platform where you can buy and trade cryptocurrencies

Established: 2018

Nature: Cryptocurrency and derivatives trading exchange.

Features: Boasts a professional-grade, high-performance matching engine.

User Base: Over 2 million users worldwide.

Reputation: Known for advanced trading options, commendable customer support, and a commitment to crypto education.

Asset Exchange Feature:

Bybit’s Asset Exchange is an innovative feature that allows traders to swap their cryptocurrencies in the spot market swiftly. This feature is particularly useful for traders wanting to capitalize on rapid market fluctuations. When using the Asset Swap, traders aren’t directly trading with Bybit or other traders. Instead, their orders are routed to other spot crypto exchanges for execution, ensuring they receive the best market price.

Trading Platform Insights:

Bybit’s trading platform is designed with the user in mind. The layout is intuitive, with easy access to wallets, account management, and market toggles. The main interface showcases the chart, market depth, order book, recent trades, order forms, and contract details.

For a more personalized trading experience, Bybit offers a customizable interface. Users can adjust, detach, and rearrange modules to suit their preferences. Night mode is also available for those who prefer a darker theme.

Charting and Analysis:

Bybit has integrated TradingView’s charting technology, a renowned tool in the trading community. With its extensive features, TradingView offers multiple indicators and a user-friendly interface, making it suitable for both beginners and seasoned traders. This integration allows traders to conduct in-depth technical analysis, plot trendlines, and use various studies.

Additionally, Bybit allows switching between TradingView price charts and market liquidity charts, aiding traders in gauging market sentiment.

Order-Matching Engine:

A standout feature of Bybit is its powerful order-matching engine. It can handle 100,000 transactions per second for each contract, ensuring swift and efficient trade executions. This dedicated capacity for each asset ensures that as Bybit expands its offerings, the platform remains robust and responsive.

Bybit continues to enhance its platform, prioritizing user experience and security. With features like the Asset Exchange, advanced charting tools, and a powerful order-matching engine, Bybit is poised to remain a top choice for crypto traders worldwide.

Contract Types

USDT Contract: Uses Tether (a stablecoin) as the underlying margin. It’s similar to having USD as the base currency, ensuring the dollar value of your collateral remains consistent.

Inverse Contract: The underlying cryptocurrency itself acts as the margin. For instance, if you’re trading the ETHUSD contract, Ethereum is the margin. This contract type is riskier since both the market exposure and the collateral value can fluctuate. These contracts allow traders to use cryptocurrencies like BTC as the base currency. They differ from USDT Perpetual Contracts regarding margin calculation, Profit and Loss (P&L), and risk exposure. For a detailed understanding, Bybit offers an article titled “Introduction to Inverse Perpetual Contracts.“

Margin Options

Isolated Margin: The margin is specific to that particular trade, unaffected by other trades or equity levels.

Cross Margin: All available balances are combined to prevent liquidation, considering all open positions for the same trading pair.

Recommendation: Isolated Margin is generally preferred for better risk control.

Market Analytics

Bybit offers a comprehensive market data section with downloadable charts and data.

Available Data: Includes BTC Daily Realised Volatility, Monthly Price Range, Price Moving Averages, and Rolling Volatility.

Additional Data: Information on the specific index price, funding data, and the insurance fund is also available.

Order Execution Speed

The speed of order execution is crucial in the fast-paced world of cryptocurrency trading. Bybit’s advanced order-matching engine ensures rapid order execution, which minimizes the risk of slippage and trading errors. Given the volatile nature of assets like Bitcoin, instantaneous matching of both sides of the order book is essential for traders.

Order Functionality Overview: Bybit offers comprehensive order functionality, allowing traders to effectively tailor their entry and exit strategies.

Order Types:

- Market Order: An order executed immediately at the current market price. For selling, it matches the highest bid, and for buying, it matches the lowest ask.

- Limit Order: An order set at a specific price level may or may not be the current market price. The order remains active based on its defined order life.

- Conditional Order: This order becomes active as a market or limit order once a predetermined price level is achieved. It requires defining parameters like trigger price, direction, quantity, and leverage.

- Stop Losses: Essential for leveraged trading, Bybit offers three ways to set up stop losses, detailed in their dedicated article.

Order Life Options:

- Good-Till-Cancelled (GTC): The order remains active until manually canceled by the trader.

- Immediate-or-Cancel (IOC): Designed for immediate execution at the best price. Any unfilled portion of the order is automatically canceled, allowing for partial order execution.

- Fill or Kill (FOK): The order must be executed entirely at the best available price, disallowing partial executions.

Additional Order Features:

- Post Only: For Limit and Conditional orders, this feature ensures the order is executed as a “market maker”, qualifying the trader for the maker fee.

- Reduce Only: This ensures the limit order only reduces the trader’s position. If the order would increase the position, it’s either adjusted or cancelled.

- Close on Trigger: Available for Conditional orders, this feature ensures stop losses reduce the position without increasing it.

FAQ

Can I lose more money than I put in?

If you’re doing leveraged trading, it’s possible. But the system usually closes your trade before you lose more than your initial amount.

What happens if the value of my trade goes down?

If the value drops significantly, your trade might be automatically closed to prevent further loss. This is called a “liquidation.”

Does Bybit offer a demo or paper trading account for beginners to practice without risking real funds?

Yes, Bybit offers a testnet where users can practice trading with play money. This helps new users familiarize themselves with the platform and trading strategies without financial risk.

How does Bybit’s liquidation process work, especially for leveraged positions?

If a trader’s margin falls below the maintenance margin level, Bybit will start the liquidation process. The trader’s position will be closed to prevent further losses. The exact mechanism varies based on market conditions and the position size.