Winner of Irish Enterprise Awards

Winner of Irish Enterprise Awards

Coinbase Review 2024

Learn more about Coinbase, one of the most popular crypto exchange platforms in the world. It makes it easy to buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and more

Coinbase info

| Founded | 2012 |

| Headquarters | USA |

| Website | https://www.coinbase.com/ |

| Daily volume trading | $2.51 billion |

| Number of cryptocurrencies | 56 |

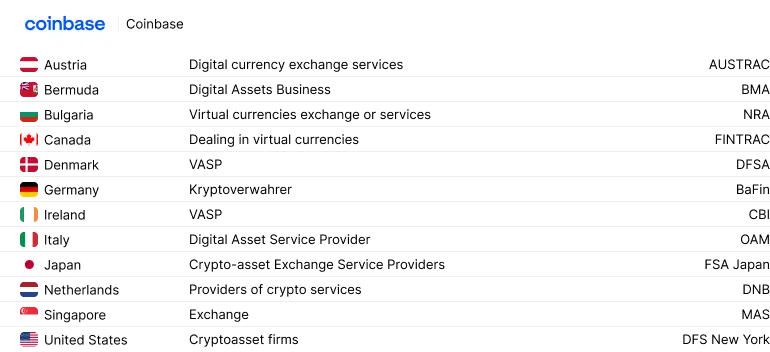

| Crypto licences | Australia, Bermuda, Bulgaria, Canada, Denmark, Germany, Ireland, Italy, Japan, Netherlands, Singapore, United States |

| Cryptocurrency Fees | 2.99% - 4.99% |

| Minimum deposit | $2.00 |

| Digital Wallet | Yes |

| Promotion | - |

| Currency | Cryptocurrency and Fiat |

| Deposit Method | Credit Card, Bank Transfer |

Coincub Score

Coinbase Review

Founded in 2012, Coinbase is one of the best cryptocurrency exchanges in the world. Based in the United States, Coinbase is fully regulated and a market leader in the crypto exchange and digital assets space.

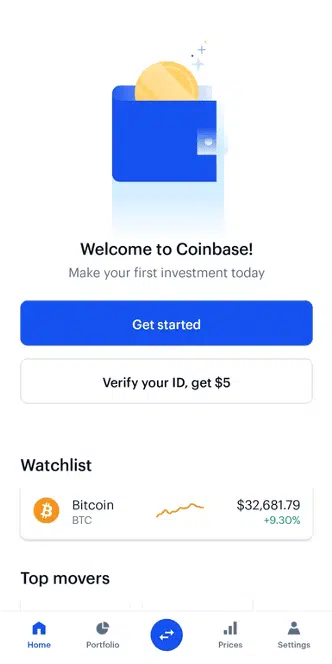

With a smooth trading interface and a variety of well-integrated mobile apps, Coinbase overall has a very pleasant user experience.

The first exchange to launch on the stock exchange as of April 2021, Coinbase holds over $90 billion worth of assets. Funds are insured and kept offline in cold storage for maximum security.

It also provides trading access for over 50 cryptocurrencies including major coins such as Bitcoin, Ethereum, XRP and others.

Coinbase is a secure platform available both online and as an app for buying, selling, transferring and storing digital currencies. Coinbase app reviews often mention the clean interface and ease of use. It provides access to crypto such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Cardano (ADA), and 50+ others.

Launched in 2012, it is one of the oldest crypto exchanges in the space and has grown rapidly in the last decade. Coinbase can be used to convert one cryptocurrency to another or to send and receive cryptocurrency. Traders can view price movement, trends, portfolio summaries, and related industry news.

More recently, Coinbase became the first crypto exchange platform to go public and list on the NASDAQ stock exchange with a total value of over $90 billion. Coinbase offers an affiliate program where users can recommend the exchange to others to earn rewards.

Coinbase has stated that its main aim is to expand worldwide access to various currencies by making buying and selling digital currency easy. Some of Coinbase’s benefits include:

- Free transfer of digital currency between online Coinbase wallets.

- Extensive insurance.

- Coinbase is a “one stop shop” – a wallet, an exchange, and merchant tools within one simple easy to use interface.

- Coinbase Earn – an easy way to “earn while you learn”. Users can earn small amounts of cryptocurrency by watching a series of videos and answering related questions.

- Coinbase Pro – Coinbase’s advanced charting platform, which allows users to place market, limit and stop orders whilst also having access to a few more cryptocurrencies.

- Coinbase Card is accepted anywhere Visa® debit cards are accepted, at over 40M+ merchants worldwide.

Coinbase is one of the first and certainly one of the best when it comes to the cryptocurrency space. It has a smooth and intuitive platform making it seamless for those new to the world of crypto trading.

This simplicity comes at a high price however as the fees add up quickly, especially if you’re aiming to trade regularly.

For those with a bit more knowledge when it comes to trading, Coinbase Pro may be more suitable.

Coinbase Security

Coinbase is a trusted exchange, and for good reason. It’s one of the few crypto exchanges that hasn’t been hacked (yet). Their security is above industry standard, with many measures taken to ensure that user funds are protected.

All bitcoins stored in Coinbase online wallets are insured, and 98% of customer funds are kept in highly encrypted cold wallets.

The exchange hosts sensitive data on air-gapped servers, and stores wallets and private keys using standard and proven AES-256 encryption. There is also a longstanding bug bounty program that helps alert the security team to potential exploits. During the high-profile 2020 Twitter hack, Coinbase intervened to prevent customers from sending bitcoin to hackers in a proactive move.

Due to Coinbase’s popularity, users with Coinbase accounts can be high-profile targets. Coinbase users are at risk of fraud and theft, but security gaps almost always come from the user’s side. Coinbase is one of the more trustworthy exchanges, but users need to be careful.

0.004% of Coinbase users experienced account takeovers in 2020. The number seems low until you realize that Coinbase has 56 million customers. That’s 224,000 hacks in one year. The exchange does offer educational resources for users looking to improve their personal security and encourages users to implement two-factor authentication.

Opening an Account and Trading

How to get started with Coinbase?

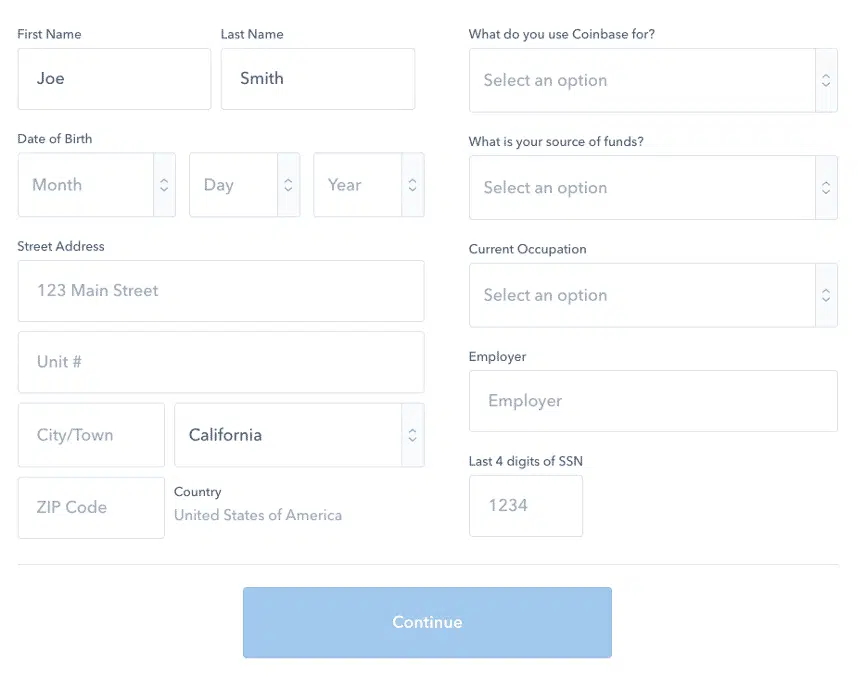

Getting started with Coinbase is straightforward. The platform requires extensive information, including your legal name, home address, date of birth, last four digits of your Social Security number/Government issued ID and how you plan to use Coinbase.

These ensure you can comply with federal regulations. Keep reading for a step-by-step guide to signing up for Coinbase.

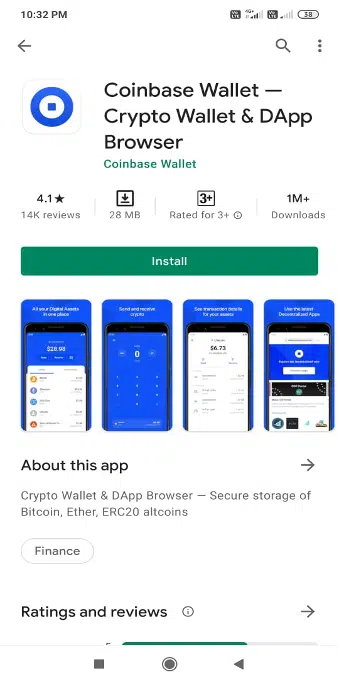

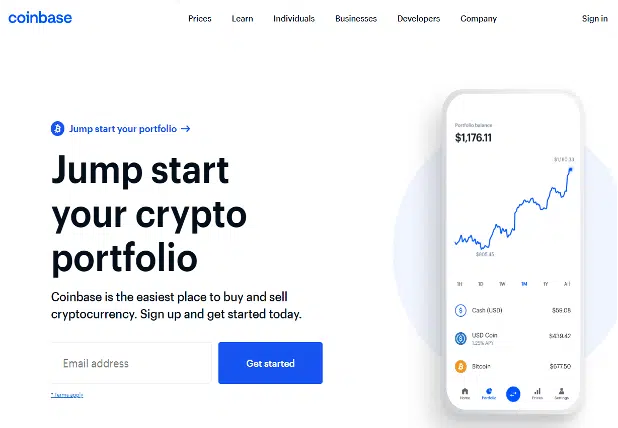

1. Download the Coinbase app for iPhone or Android, or visit the website.

2. Open Coinbase and tap “Get started”.

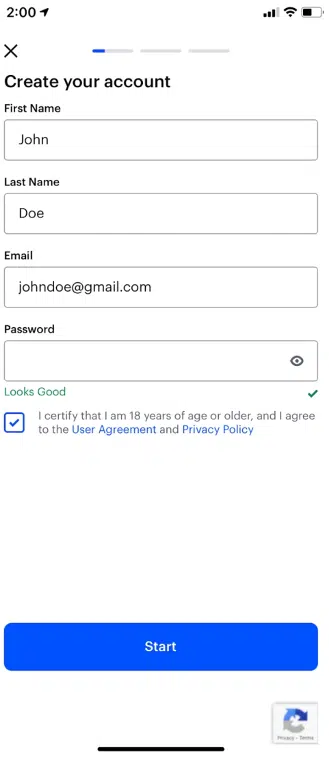

3. Create an account with your name, email address and strong password and tap “Start”.

4. Verify your email by tapping a link that was sent to your inbox

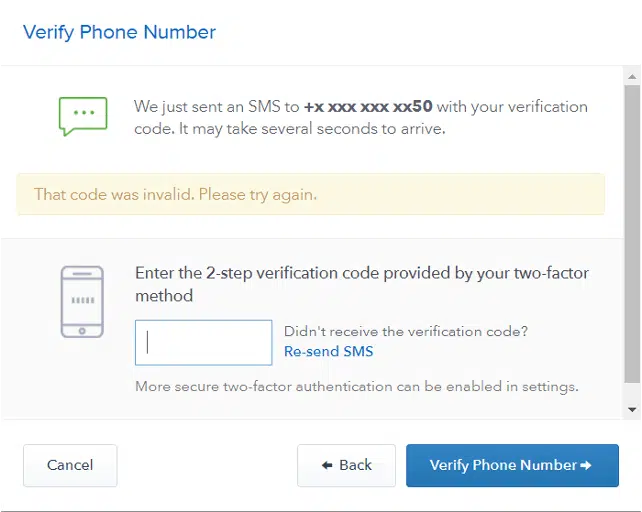

5. Enter your phone number and verify it by entering a code that was texted to you.

6. Enter in your name, date of birth, address, reasons for using Coinbase, source of funds, job role and the last four digits of your Social Security number (US users only).

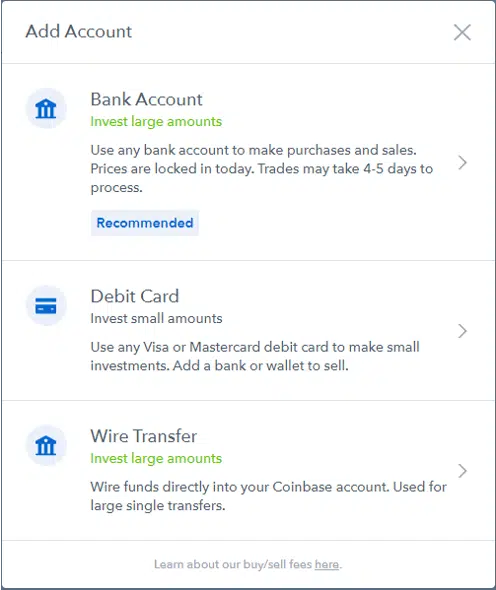

7. Now you can link your bank account. Search for your bank.

8. Log into your bank account with the username and password you normally use for banking.

9. Select the bank account you want to link to Coinbase for purchases and tap “Continue”

10. Congrats! You’re synced up and ready to go.

This link provides a full breakdown of all supported cryptocurrencies on Coinbase and Coinbase Pro broken down by core countries also.

Founded in 2012, Coinbase is one of the first and leading cryptocurrency exchanges in the world. Based in the United States, Coinbase is fully regulated and is one of the market leaders in the crypto exchange space.

With a smooth trading interface and a variety of well-integrated mobile apps, Coinbase overall has a very pleasant user experience.

The first exchange to launch on the stock exchange as of April 2021, Coinbase holds over $90 billion worth of assets. Funds are insured and kept offline in cold storage for maximum security.

It also provides trading access for over 50 cryptocurrencies including major coins such as Bitcoin, Ethereum, XRP and others.

Coinbase is a secure platform available both online and as an app for buying, selling, transferring and storing digital currencies. Coinbase app reviews often mention the clean interface and ease of use. It provides access to crypto such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Cardano (ADA), and 50+ others.

Launched in 2012, it is one of the oldest crypto exchanges in the space and has grown rapidly in the last decade. Coinbase can be used to convert one cryptocurrency to another or to send and receive cryptocurrency. Traders can view price movement, trends, portfolio summaries, and related industry news.

More recently, Coinbase became the first crypto exchange platform to go public and list on the NASDAQ stock exchange with a total value of over $90 billion. Coinbase offers an affiliate program where users can recommend the exchange to others to earn rewards.

Coinbase has stated that its main aim is to expand worldwide access to various currencies by making buying and selling digital currency easy. Some of Coinbase’s benefits include:

- Free transfer of digital currency between online Coinbase wallets.

- Extensive insurance.

- Coinbase is a “one stop shop” – a wallet, an exchange, and merchant tools within one simple easy to use interface.

- Coinbase Earn – an easy way to “earn while you learn”. Users can earn small amounts of cryptocurrency by watching a series of videos and answering related questions.

- Coinbase Pro – Coinbase’s advanced charting platform, which allows users to place market, limit and stop orders whilst also having access to a few more cryptocurrencies.

Coinbase is one of the first and certainly one of the best when it comes to the cryptocurrency space. It has a smooth and intuitive platform making it seamless for those new to the world of crypto trading.

This simplicity comes at a high price however as the fees add up quickly, especially if you’re aiming to trade regularly.

For those with a bit more knowledge when it comes to trading, Coinbase Pro may be more suitable.

Coinbase Supported Currencies

Coinbase provides support for a variety of currencies, but this is largely dependent on location. As mentioned above, the ability to buy, sell, deposit and withdraw certain cryptocurrencies is dependent on the cryptocurrency, the user’s location and the payment method available.

FAQs

Is Coinbase Safe/Legit?

Although there is no 100% guarantee of safety when using any online exchange, Coinbase does pride itself in its extensive security profile. Skeptics will be happy to know that the exchange also ensures online holdings.

In which country is Coinbase registered?

Coinbase has obtained a VASP (Virtual Asset Service Provider) registration status in the following countries

How to withdraw money from Coinbase?

To withdraw your funds, sign in to your Coinbase account or open the Coinbase app on your mobile phone. To withdraw money, you need to:

- Ensure that any cryptocurrencies you hold have been sold for the respective fiat currency you want to cash out in e.g. US dollars or Pounds sterling.

- Click withdraw, and enter the amount you wish to withdraw from your balance.

- Select the destination of the withdrawal e.g. bank account or Paypal.

- Confirm by clicking ‘Withdraw now’.

How to send/receive Bitcoin on Coinbase?

Coinbase wallets are able to send or receive supported cryptocurrencies. These features are available both via the web and mobile app.

To send crypto on the web app,

- Navigate to the Dashboard, and select Pay from the left side of the screen.

- Select Send and enter the amount of crypto you’d like to send.

- Enter the address of the crypto, email address and phone number of the recipient.

- Select Continue to review and confirm the details of this send.

- Sending crypto on mobile

- For mobile, tap the direction button, then click send.

- Select the desired asset and enter the amount of cryptocurrency you would like to send.

- Tap continue to review and confirm the details of the transaction.

- Enter the recipient address from Contacts, enter their email, crypto address or scan their QR code.

- Leave an optional reference note and follow any remaining prompts to complete the transaction.

Receiving crypto

- For the web, on the main dashboard, select ‘Pay’ and then ‘Receive’.

- When selected your wallet QR code and address will appear which can be used to receive the relevant cryptocurrency.

- On mobile, tap the directional button and select ‘Receive’.

- Select the crypto asset you would like to receive under ‘Currency’.

- When selected, the QR code and address should appear.

Which coin will Coinbase add next?

Coinbase covers assets that makeup around 90% of the total crypto market, however, Coinbase is constantly evaluating new cryptocurrencies they believe to be secure and beneficial to their customer base.

How do you transfer from Coinbase to Binance?

Once in your Coinbase account, click the “Accounts” tab then select the cryptocurrencies you want to transfer.

Click on the “Send” button, when prompted to enter the “Recipient Address” paste the Binance wallet address of the associated cryptocurrency you want to send.

How to avoid Coinbase fees?

Coinbase withdrawal fees can be quite high especially if users withdraw cryptocurrency to external wallets. Coinbase charges users a fee based on the estimated network transaction fee.

The high fees can be somewhat avoided however as Coinbase doesn’t charge for transferring cryptocurrency between Coinbase wallets.

Since Coinbase and Coinbase Pro (GDAX) are owned by the same company, any exchanges between both would be instant and free.

From Coinbase Pro, you can then send your cryptocurrencies to an external wallet outside the Coinbase platform without paying any network transfer fees.

Visit CoinbaseCoincub verdict: Buy here

Crypto insights delivered straight to your inbox

Subscribe to our newsletter, you are in very good company