Self-custody and full control.

Cart

Self-custody and full control.

Cart

Bakkt Review 2025

Bakkt Review 2024: Crypto Brokerage & Custody Solutions

Coincub Score

Bakkt info

EXCHANGE INFO

| Founded | 2018 |

| Headquarters | Alpharetta, Georgia, USA |

| Website | https://bakkt.com/ |

| Target clients | Institutional clients, businesses, retail investors |

| Employees | 500+ |

Financials

| Market cap | Not disclosed |

| Daily volume trading | $476.5 million (3Q24) |

| Revenue | $328.4 million (3Q24) |

Currencies

| Fiat supported | USD, EUR, GBP; fiat onramps/offramps supported via ACH and wire transfer. |

| Cryptocurrencies | 15+ supported, including BTC, ETH, and stablecoins, with frequent new coin listings. |

FEES AND TRADING

| Pricing Plans | Transparent pricing, tailored for institutional clients. |

| Cryptocurrency Fees | Competitive spreads and low latency for institutional trades. |

Crypto services

| Tokenization services | |

| Offers Bitcoin ETF | |

| Staking services | |

| Interest on savings | Supports stablecoins |

| Crypto Custody | |

| Crypto Trading |

Business services

| Invoicing service | |

| Payments Services | |

| Cards | |

| API | |

| Insurance Coverage | |

| Interest on savings | N/A |

REGISTRATIONS

| Crypto licenses VASP | NYDFS BitLicense and FinCEN Money Service Business (MSB) registration. |

| Banking licenses (IBAN) | Not applicable; operates as a regulated infrastructure provider. |

| Money Transmitter or E-Money Licences | Licensed in all 50 US states. |

Explore Bakkt

Key Features

What is Bakkt?

Bakkt is a US-regulated crypto platform that was established in 2018. Similar to other crypto banks, Bakkt aims to bridge the gap between traditional finance and the digital asset economy. Its headquarters are in Alpharetta, Georgia. It primarily services institutional clients and businesses, but also retail investors by offering a long range of services including custody, trading, and fiat-to-crypto onramps.

Since it primarily caters to institutional needs, Bakkt uses advanced security protocols, is regulatory compliant, and has a very user-friendly interface. Its trading platform delivers high-speed execution, deep liquidity, and optimized risk management for professional traders. Beyond trading, Bakkt provides white-label API solutions for businesses.

In this report, we dive deeper into Bakkt, its features, its compliance efforts, pricing structures, and customer feedback. Overall, based on this Bakkt review, the platform is well–positioned as a leading player in the digital space.

Company Profile

Bakkt Holdings, Inc. was established in 2018 as a fintech company specializing in digital asset management. Besides its headquarters in Georgia, it provides additional operations in New York City. In a nutshell, Bakkt customers can buy, sell, and store cryptocurrencies in a secure manner. The company operates through key platforms.

Bakkt Marketplace allows users to manage and transact digital assets within an integrated web experience. Bakkt Crypto provides a range of crypto solutions tailored for institutional clients. Last but not least, Bakkt Trust offers institutional-grade custody services for digital assets.

Bakkt was initially founded as a subsidiary of Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, which retains a 55% ownership stake in Bakkt.

Back in October 2021, Bakkt became a publicly traded entity on the New York Stock Exchange under the ticker symbol “BKKT” following a merger with VPC Impact Acquisition Holdings, a special-purpose acquisition company.

In April 2023, Bakkt exchange expanded its service offerings by acquiring Apex Crypto, a Chicago-based integrated crypto trading platform. This helped enhance Bakkt’s capabilities in providing crypto trading solutions.

Currently, Bakkt employs more than 700 individuals. In November 2024, reports indicated that Trump Media & Technology Group was in advanced discussions to acquire Bakkt for a potential expansion into the crypto sector. Overall, Bakkt continues to make a name for itself in the digital asset space and helps it get closer to its mission of bridging the gap between traditional finance and crypto.

Key Features

One of the primary features of Bakkt is its Crypto Custody Services. Bakkt exchange offers secure solutions for digital assets, utilizing institutional-grade custody services. The platform supports multiple cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Dogecoin (DOGE), Ethereum Classic (ETC), Litecoin (LTC), Shiba Inu (SHIB), and USD Coin (USDC).

Next is the Bakkt Crypto Trading Platform. Through its trading platform, the company provides a US-regulated trading venue that leverages industry-leading market infrastructure and credit facilities so that businesses can execute crypto transactions efficiently. Bakkt’s Brokerage Services offers a deep liquidity network and full-stack APIs so that businesses can seamlessly integrate crypto trading solutions with their customers.

Bakkt has established partnerships with major brands to enhance its service offerings. Notably, it collaborated with Mastercard to offer crypto and loyalty solutions.

Operating as a New York Department of Financial Services (NYDFS)-chartered qualified custodian, Bakkt puts emphasis on regulatory compliance and security. It holds licenses to operate across all 50 US states.

Pricing Plans

Bakkt employs a fee structure for crypto transactions, with fees varying based on the transaction amount. For transactions up to $500, fixed fees are applied, while transactions exceeding $500 incur a percentage-based fee. The detailed fee schedule is as follows:

| Minimum Order Amount ($) | Maximum Order Amount ($) | Max Transaction Fee |

| $0.01 | $10.00 | $0.49 |

| $10.01 | $25.00 | $0.69 |

| $25.01 | $50.00 | $1.19 |

| $50.01 | $100.00 | $1.69 |

| $100.01 | $250.00 | $3.29 |

| $250.01 | $500.00 | $6.29 |

| $500.01 | Unlimited | 1.25% of order amount |

There are no fees for account opening, adding funds from a bank account, or withdrawing funds to a bank account.

Is Bakkt safe?

Bakkt exchange puts emphasis on security and regulatory compliance. Customer funds are fully backed 1:1 and kept separately in an entity that is regulated by NYDFS. In terms of new coin listings, Bakkt first has to get approval from the NYDFS so that the coin listing uses best practices.

Bakkt uses SOC1 Type 2 and SOC 2 Type 2 compliance efforts. It uses third-party penetration testing to make sure its security is top-notch. It has dedicated teams for compliance and auditing as well to make sure Bakkt continues operations without hassles. It does help that Bakkt is a subsidiary of Intercontinental Exchange (ICE).

Financial Highlights

In terms of financials, Bakkt has revealed its Third Quarter 2024 highlights:

- Total Revenues: $328.4 million, reflecting an increase in gross crypto services revenues driven by Bakkt Crypto.

- Net Loyalty Revenues: $12.1 million, a decrease of 7.2% year-over-year, attributed to lower notional traded volume and redemption.

- Total Operating Expenses: $355.8 million, including an increase in crypto costs and execution, clearing, and brokerage fees associated with Bakkt Crypto.

- Operating Loss: $27.4 million, an improvement of 48.2% year-over-year, primarily due to the absence of a $23.3 million goodwill and intangible asset impairment recorded in the third quarter of 2023, along with higher crypto services revenue and reduced compensation, SG&A, and acquisition-related costs.

- Net Loss: $6.3 million, an 87.8% improvement year-over-year, benefiting from a $20.0 million gain on the fair value of warrant liability.

In terms of key performance indicators (KPI), there has been an increase of 6.7% (6.5 million) in cry[pto-enabled accounts. Around 39% decrease year-over-year in decreased activity from transacting accounts mainly due to reduced activity from customers in international markets. They reported a 26.6% increase ($672 million) in increased trading volume due to higher trading prices for crypto assets. Last but not least, $975 million or an increase of 47.7% in reported assets under custody due to higher trading prices for crypto assets.

In a few words, there have been areas where Bakkt has improved but still, losses incurred by the bank as of Q3 2024. We will wait and see how the yearly financial highlights turn out after Q4.

Recent Developments

Bakkt Holdings, Inc. has made advancements in recent years, making a name for itself as a key player in the cryptocurrency ecosystem. In April 2023, the company completed the acquisition of Apex Crypto LLC, a platform for integrated crypto trading. This move enhanced Bakkt’s crypto capabilities by providing access to approximately 5.8 million crypto-enabled accounts and strengthening its position as a leading B2B2C crypto provider.

Later that year, in December 2023, Bakkt relaunched its custody services with enhanced features like segregated wallets and a flexible policy engine. The relaunched platform expanded its cryptocurrency support to include assets such as Bitcoin Cash (BCH), Dogecoin (DOGE), Ethereum Classic (ETC), Litecoin (LTC), Shiba Inu (SHIB), and USD Coin (USDC).

In 2024, Bakkt focused on expanding its cryptocurrency offerings and institutional trading capabilities. In September, the company added nine new coins to its platform, followed by the inclusion of six more assets in November, including Arbitrum (ARB), Bonk (BONK), The Graph (GRT), Eos (EOS), Basic Attention Token (BAT), and Fantom (FTM). These additions diversified the assets available for trading.

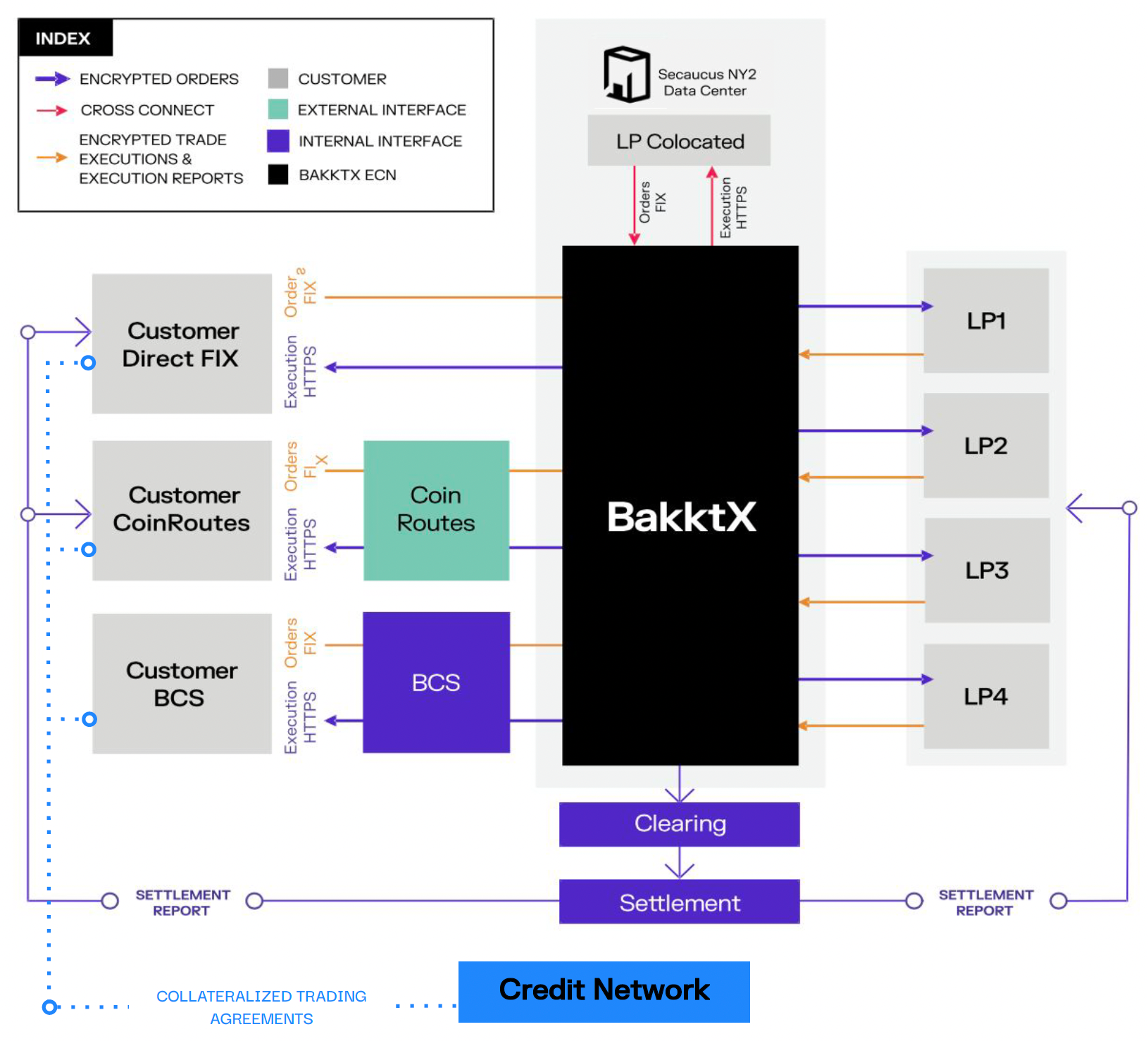

The development of BakktX, a high-performance crypto Electronic Communication Network (ECN), marked another milestone. In partnership with Crossover Markets, Bakkt launched this platform to deliver customized liquidity solutions and ultra-low-latency trade execution, enhancing its US institutional trading capabilities.

Financially, Bakkt reported substantial improvements in 2024. The third quarter saw a net loss reduction of 87.8% year-over-year, and trading volumes surged, with $279 million transacted by mid-November, surpassing October’s total of $165 million in just 12 days.

As of late 2024, reports emerged that Trump Media & Technology Group is in advanced discussions to acquire Bakkt.

BREAKING: President-elect Donald Trump’s $DJT in talks to buy crypto trading platform Bakkt. pic.twitter.com/KzTpTqWtiw

— Altcoin Daily (@AltcoinDailyio) November 19, 2024

This potential acquisition could signify a strategic expansion into the cryptocurrency sector for Trump Media, highlighting Bakkt’s growing influence in the industry.

🚨 BREAKING:

PRESIDENT ELECT DONALD TRUMP‘s $DJT IS IN TALKS TO BUY CRYPTO TRADING PLATFORM BAKKT! 🇺🇸

BAKKT ONLY GOT 16 CRYPTO ASSETS LISTED AND #XRP IS ONE OF THEM! 💎

Source: https://t.co/wS7mih7Bru pic.twitter.com/bprxOLGNXz

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) November 19, 2024

User Experience and Customer Support

We used the experiences reflected on review platforms for both customers as well employees to show a more nuanced review of the overall perception of Bakkt.

Positive Feedback

- Ease of Use: Some customers praised the platform for being user-friendly and providing straightforward navigation for deposits and withdrawals, comparable to traditional banking systems.

- Innovative Services: Certain reviews highlighted Bakkt’s efforts to provide advanced cryptocurrency custody and trading solutions, particularly for institutional clients.

- Work-Life Balance (Employee Perspective): Employees noted benefits like flexibility in scheduling, remote work options, and a collaborative work environment, which contributed to a positive workplace culture.

Negative Feedback

- Fund Accessibility Issues:

- Many users reported difficulties accessing their funds, citing unexplained account freezes and prolonged delays in withdrawal processes.

- One user shared that funds were withheld despite completing commission payments, while another experienced locked accounts without adequate resolution from customer service.

- Customer Support Challenges:

- Customers expressed frustration with the platform’s customer service, labeling it as “unresponsive” or “incompetent.”

- Cases of being “passed around” among customer support agents without meaningful solutions were frequently noted.

- Concerns About Transparency and Trust:

- Several users accused the platform of unethical practices, such as manipulating bid and ask prices, denying access to profits, and hosting fraudulent activities under the Bakkt name without intervention.

- Operational Issues:

- Users cited discrepancies in trading, such as losses appearing inexplicably in accounts.

- There were also allegations of slow responses to scams associated with the Bakkt name.

Employee Feedback

- Workplace Environment:

- Employees appreciated a collaborative atmosphere but also reported issues like micromanagement, unstable job security, and toxic workplace dynamics.

- Concerns about company stability due to its heavy involvement in the volatile cryptocurrency market were raised.

- Compensation:

- While pay was generally seen as fair, employees noted inconsistencies in additional compensation, such as bonuses and stock options.

FAQs

Which assets does Bakkt Custody support?

Bakkt Custody supports Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Bitcoin Cash (BCH), Shiba Inu (SHIB), Litecoin (LTC), and USD Coin (USDC).

What is the Bakkt Custody withdrawal process?

The withdrawal process is designed for ease and security, involving authorized wallet addresses and multiple verification steps.

What type of wallets does Bakkt Custody support?

Bakkt Custody offers both warm and cold wallet storage, maintaining segregated wallets for clients’ assets.

What is Bakkt’s approach to risk and security?

Bakkt employs a three-pronged security approach encompassing systems, operations, and facilities to safeguard assets.

How does Bakkt optimize disaster resiliency plans?

Bakkt’s platform is replicated in real-time to secondary regions capable of supporting all production workloads.

What are the fees of Bakkt?

Fees vary by service; for example, there’s a $100 fee for inbound and outbound crypto wallet transfers.

How to buy and sell crypto with Bakkt?

Users can buy and sell crypto through partner platforms that utilize Bakkt’s brokerage services.

How do I transfer the crypto in my Bakkt Crypto Account to an external wallet (and vice versa)?

Contact Bakkt Crypto support at cryptotransfers@bakkt.com to initiate transfers; a $100 fee applies per transfer.

Can I place crypto trades directly with Bakkt Crypto on their own website?

No, Bakkt Crypto facilitates trades through partner platforms, not directly on its own website.

When are the crypto trading hours of Bakkt?

Crypto trading is available 24/7, except during scheduled maintenance periods.

How do I withdraw funds from my Bakkt crypto account?

After selling crypto, funds are deposited into your brokerage account and can be withdrawn typically after two business days.

Conclusion

Challenges such as issues with fund accessibility, transparency, and customer service undermine user trust. Employee reviews also highlight internal instability and inconsistent management, which could impact efficiency and morale.

Despite these obstacles, Bakkt’s financial performance is improving, supported by new cryptocurrency offerings and the launch of its high-performance trading platform, BakktX. These developments reflect its commitment to growth in a competitive market.

To maintain leadership, Bakkt must enhance customer support, address trust issues, and continue innovating to meet the needs of its diverse clientele. There’s a lot of room for improvement. Overall, this Bakkt review suggest that it is a decent platform for crypto-trading, especially for institutional clients.

Crypto insights delivered straight to your inbox

Subscribe to our newsletter, you are in very good company