Crypto-Backed Loans Explained: How Figure Markets Keeps You Liquid Without Selling

Liquidity Crunch

Liquidity has quietly become one of the biggest challenges in crypto. After years of expansion, 2024 and 2025 have been marked by sharp slowdowns. Venture funding that once flooded Web3 projects has thinned out. Central banks, meanwhile, have kept monetary conditions tight, making capital across the board harder to access, both in traditional finance and deep into crypto markets too.

For traders and long-term holders, this has created a familiar dilemma. Many still believe in the upside of their assets but are reluctant to liquidate positions at current valuations. Whether it’s Bitcoin, Ethereum, or other major tokens, the idea of selling in a suppressed market feels like locking in losses. Yet, sitting idle isn’t without its own risks. Life expenses, new opportunities, and margin needs continue to arise, pressing users to find ways to unlock capital without giving up their crypto exposure.

This is the climate in which alternative liquidity solutions are gaining traction. Crypto-backed loans, in particular, are emerging as a way to bridge the gap, giving users access to funds while still holding onto their positions. But not all solutions are created equal, and the way platforms structure these loans makes all the difference.

The Dilemma: Sell Your Crypto, or Unlock It?

For most crypto holders, selling is the last thing they want to do in a down market. Once you sell, you’re out of the game, and if prices rebound, there’s no easy way back in without paying more. It’s not just about price, either. Selling means exiting positions built over time, missing out on potential upside, and in some cases, triggering taxable events that eat further into your capital.

This is why more traders and holders look for alternatives. The goal is to stay exposed to crypto while still accessing liquidity when it’s needed. Staking offers some yield, but it doesn’t solve immediate cash flow needs. P2P lending exists, but it carries counterparty risk and often lacks transparency.

Crypto-backed borrowing, on the other hand, strikes a clearer balance. It lets users tap into the value of their assets without giving them up. The premise is simple: post your crypto as collateral, receive cash or stablecoins in return, and keep your market exposure intact. If prices recover, you still benefit. If they fall, you’ve at least used your assets productively rather than letting them sit idle.

Of course, the way these loans are structured matters just as much as the idea itself, and that’s where Figure Markets steps in differently.

The Rise of Crypto-Backed Loans

Crypto-backed loans (CBLs) have grown quietly but steadily alongside the rest of the market. What started as a niche service has become a go-to option for anyone looking to unlock liquidity without walking away from their holdings. At the core, it’s a simple value proposition: use your Bitcoin or Ethereum as collateral, get cash or stablecoins in return, and stay in the market.

For crypto holders, this solves a major problem. You don’t have to sell and miss potential price rebounds, and you don’t have to wait around hoping for staking rewards to accumulate. Instead, you keep ownership of your crypto while accessing immediate capital for whatever you need, covering expenses, funding new investments, or simply sitting on liquidity as a hedge.

But like anything in crypto finance, it’s not without risks. The biggest is liquidation. If the value of your collateral drops below a certain threshold, lenders will liquidate your assets to cover the loan. Rehypothecation is another concern: some platforms lend out or leverage your collateral behind the scenes, meaning your assets are no longer just yours. Add in counterparty risk, the chance that the platform itself becomes insolvent or suffers a security breach, and it’s clear that not all crypto-backed loans are created equal.

The good news? Some platforms are working to eliminate these risks, not just minimize them. And this is exactly where Figure Markets takes a different approach.

Figure Markets CBL

This is where Figure Markets stands out from the crowded lending field. Instead of layering risk on top of risk, they’ve built crypto-backed loans that keep users in control from start to finish.

The foundation is self-custody. When you use Figure Markets, you don’t hand over your crypto to an opaque third party. Their multi-party computation (MPC) wallet architecture ensures your assets remain under your control, even while they’re securing your loan. There’s no rehypothecation here, no hidden leverage or behind-the-scenes lending of your collateral. What you post is what you keep, and no one is quietly using your funds elsewhere.

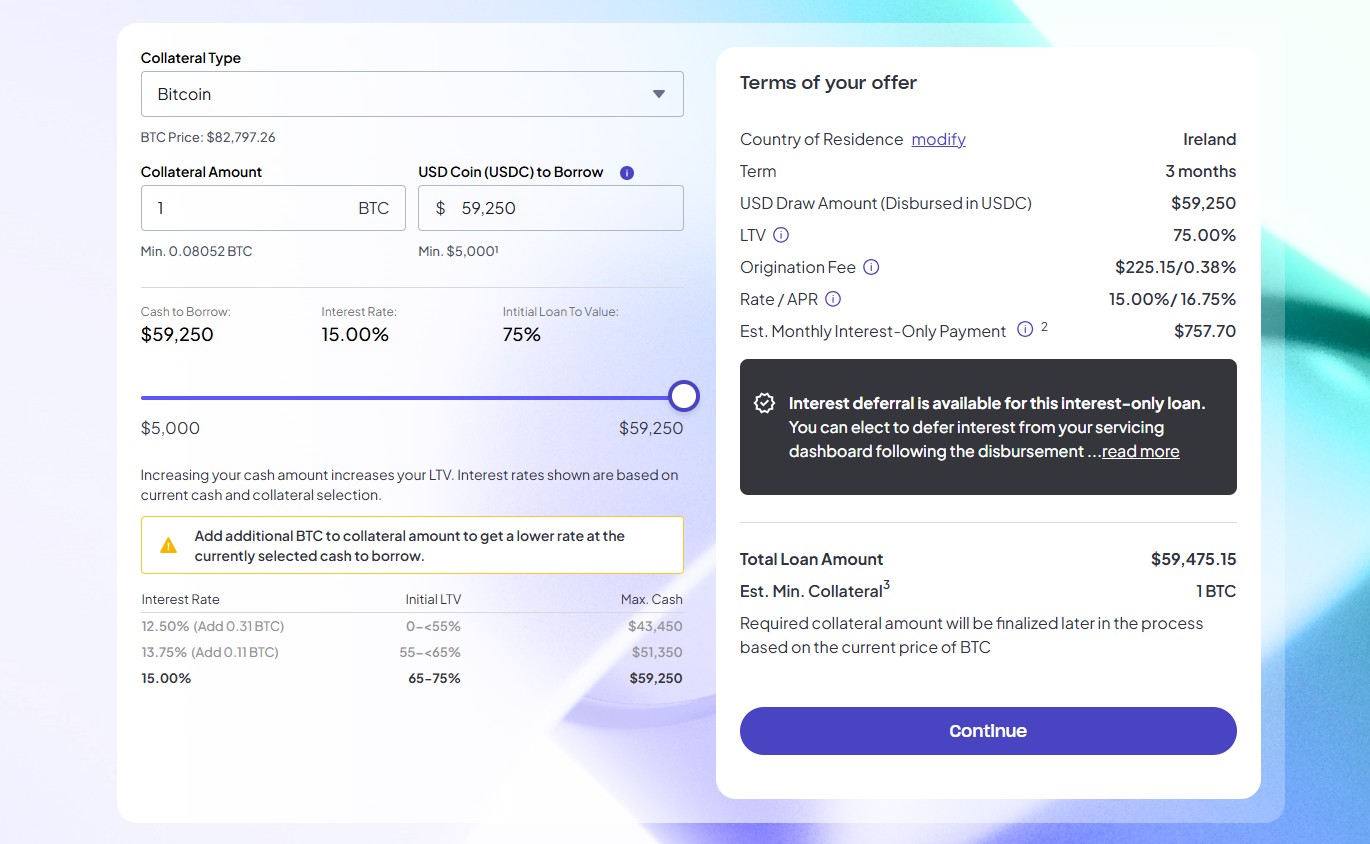

The process is fast and straightforward. There’s no credit check involved, making these loans accessible to a wider range of users. Approval typically happens the same day, giving you quick access to liquidity when you need it most. Loan-to-value ratios go as high as 90%, making it one of the more competitive offers in the market, especially for borrowers looking to maximize value without selling their crypto holdings.

Repayment is flexible too. You can choose interest-only payments over the 3-month term, defer interest until the end, or repay early with no penalties. This flexibility allows users to manage loans on their terms, adjusting as market conditions shift.

On top of this, Figure Markets includes a built-in loan calculator to give full visibility upfront. Users can see exactly how much they can borrow, understand repayment schedules, and monitor their loan health in real time. It’s a refreshing contrast to platforms that bury crucial details in the fine print.

Risk Management

Risk management isn’t afterthought at Figure Markets since it’s built into the way their crypto-backed loans operate. One of the biggest concerns with leveraged products is the threat of sudden liquidation, especially in volatile markets. Figure Market tackles this head-on with clear, transparent systems.

First, they’ve set liquidation thresholds in plain sight. If your Loan-to-Value (LTV) ratio creeps toward 90%, the platform automatically steps in to protect both you and your collateral. Idle funds sitting in your account are used to pay down the loan balance as a buffer against rising risk. This automated repayment reduces the chance of unexpected liquidations, buying you more breathing room during market swings.

Notifications keep borrowers in the loop. When your margin levels move into risky territory, Figure sends both email and push alerts. These are not vague, delayed warnings, they’re timely prompts that give you the chance to act before liquidation becomes unavoidable.

Importantly, there’s no guesswork around costs. Figure’s borrowing model runs on transparent hourly interest cycles, visible upfront through the platform’s loan tools. Borrowers know exactly what they’re paying, with no hidden fees or sneaky accruals lurking in the background. Rates are determined through a Dutch auction system, matching supply and demand in real time, rather than locking users into inflated, arbitrary percentages.

While other platforms quietly shift risk onto their users, Figure keeps it clear and under control. You always know where you stand, and you keep more control over your assets, even when markets get unpredictable.

Who Is This For?

First, there are the active traders. In a market where timing is everything, access to fast liquidity can make the difference between seizing an opportunity or watching it slip away. Instead of liquidating their holdings to raise cash, traders can unlock value from their Bitcoin or Ethereum, keeping positions open while deploying capital elsewhere.

Then, there are the long-term holders, the ones sitting tight during market downturns, waiting for the next upside. Selling feels like defeat, but holding through turbulence can leave you strapped for cash. Figure’s CBLs offer a way to tap into the value of these assets without sacrificing future potential. You stay exposed to the market while solving immediate liquidity needs.

Finally, there’s a growing group of crypto users looking to escape the weight of high-interest debt. With traditional credit costs rising, and many alternative lending platforms tacking on hidden fees, Figure’s transparent loan terms and flexible repayment options provide an appealing path to consolidate or manage debt more efficiently.

For anyone holding crypto and needing liquidity, without giving up control or falling into opaque lending traps, Figure Markets is building a practical solution.

Need cash but don’t want to sell your Bitcoin or ETH? A crypto-backed loan lets you:

– Access cash

– Keep your crypto

– Reinvest, consolidate debt, or make a large purchase pic.twitter.com/G4SvjlmwR8— Figure Markets (@FigureMarkets) April 10, 2025

Conclusion

Crypto-backed loans have quietly become one of the smarter tools in the market’s liquidity toolkit. They let you unlock capital without forcing the tough choice of exiting positions too early. With Figure Markets, this approach feels less like a compromise and more like proper financial strategy.

Their model makes the process as straightforward as it is secure. Whether you’re a trader chasing opportunities, a long-term holder needing cash flow, or someone looking to escape high-interest debt, the platform puts you in control at every step.

In a market that punishes both panic and passivity, crypto-backed loans offer a third path, and Figure Markets is making it accessible.

Frequently Asked Questions (FAQ)

What is a crypto-backed loan?

A crypto-backed loan lets you borrow cash by using your cryptocurrency holdings as collateral. Instead of selling your crypto, you lock it up and access liquidity while still keeping market exposure. These loans are typically used by traders or holders who want to avoid selling their assets during volatile markets.

How does Figure Markets’ crypto-backed loan work?

Figure Markets offers crypto-backed loans with same-day approval, no credit checks, and flexible repayment terms. Users can borrow against Bitcoin or Ethereum with up to 90% loan-to-value (LTV). The platform also provides a built-in loan calculator, so you can clearly see borrowing limits and repayment projections before you apply.

What happens if the value of my collateral drops?

If your crypto collateral loses value and your loan-to-value ratio (LTV) crosses the risk threshold (around 90%), Figure Markets automatically initiates partial liquidation to keep the loan healthy. You’ll receive notifications as you approach this level, and any idle funds in your account will be used automatically to repay your loan and reduce risk.

Is there rehypothecation risk with Figure Markets?

No. Unlike some platforms, Figure Markets does not rehypothecate your collateral. This means your crypto stays securely in your self-custody MPC wallet and is never lent out to third parties, reducing counterparty risk.

Are crypto-backed loans better than selling my crypto?

That depends on your goals. If you need liquidity but believe in your crypto’s long-term value, a loan helps you avoid selling at a low point in the market. However, keep in mind the risks of liquidation if prices fall sharply. Platforms like Figure Markets offer flexible terms and clear risk management tools to help you make informed decisions.