AIOZ Network Price Prediction: Can It Compete in Web3 Space?

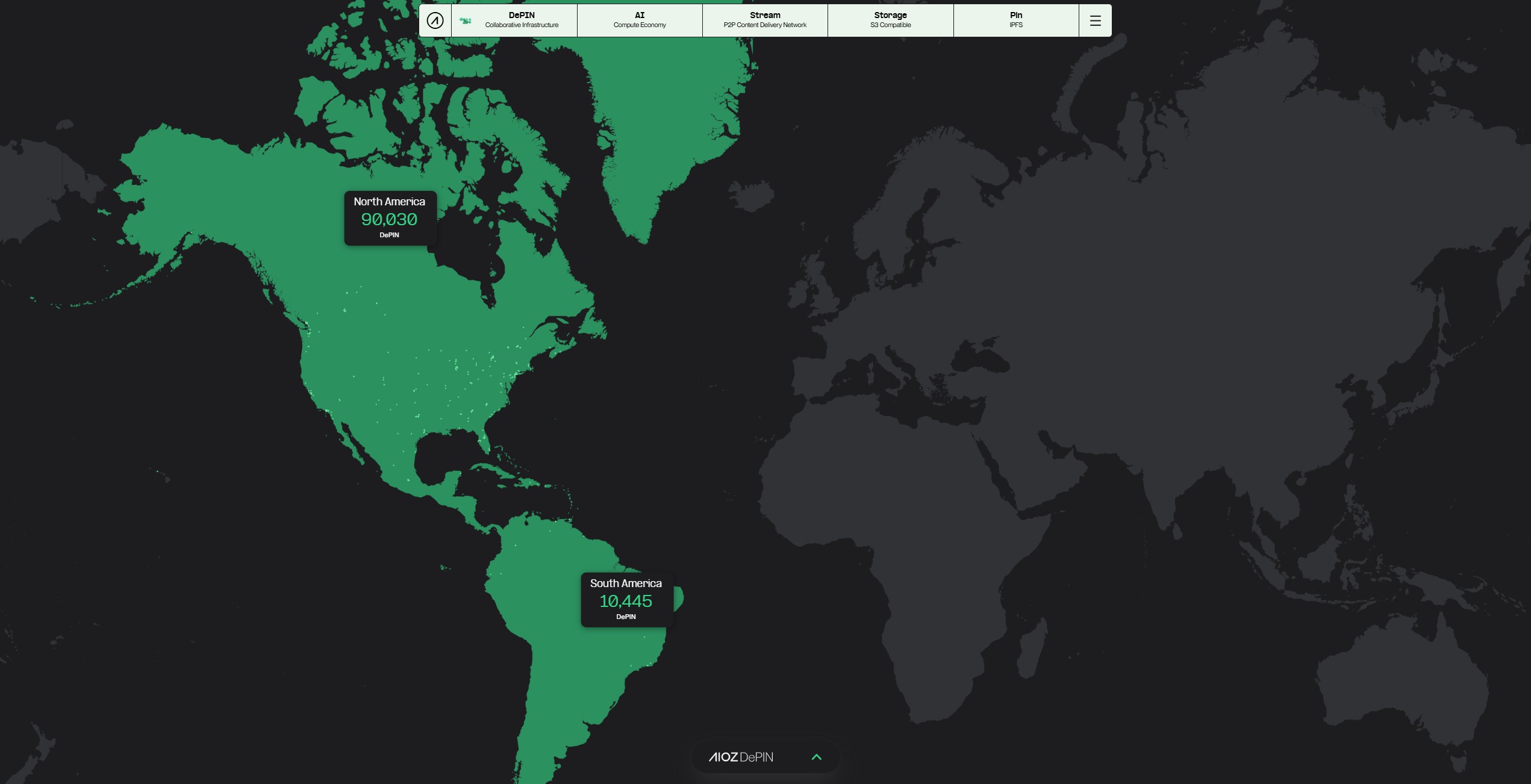

AIOZ Network is a Web3 infrastructure platform providing decentralized storage, AI computation, and video streaming services. It operates on a blockchain that integrates Ethereum Virtual Machine (EVM) compatibility with the Cosmos ecosystem, enabling interoperability and scalability. It uses Decentralized Physical Infrastructure Network (DePIN) to connect a global network of nodes to offer a cost-efficient alternative to centralized cloud providers like AWS, Google Cloud, and YouTube’s content delivery system.

The demand for decentralized storage, AI processing, and high-quality video streaming is increasing as Web3 adoption grows. Centralized platforms face challenges related to data sovereignty, censorship, high costs, and single points of failure. Decentralized alternatives like AIOZ provide distributed object storage, AI computing power, and streaming infrastructure, ensuring lower costs, improved data security, and censorship resistance. The rise of AI-based applications has also driven the need for decentralized computing resources, as GPU shortages and cloud service monopolization limit access to AI model training and execution.

AIOZ’s DePIN model allows individuals to contribute computing power, bandwidth, and storage in exchange for AIOZ tokens. This creates an incentive-driven network that improves efficiency while reducing reliance on traditional cloud services. Unlike centralized content delivery networks (CDNs), which require significant infrastructure investments, AIOZ’s peer-to-peer model enables scalable content distribution with minimal operational costs.

This article evaluates AIOZ Network’s potential by analyzing its technology, tokenomics, competitive landscape, and price trajectory.

AIOZ Network

AIOZ Network is built on a blockchain that combines Cosmos SDK and Ethereum Virtual Machine (EVM) compatibility, enabling seamless interaction with both Cosmos-based and Ethereum-based applications. It uses the Tendermint Core consensus mechanism for high transaction throughput, low fees, and scalability. The Gravity Bridge facilitates asset transfers between Ethereum and Cosmos ecosystems, allowing AIOZ to integrate with major blockchain networks.

AIOZ’s infrastructure is designed to support decentralized storage, AI computation, and video streaming. AIOZ Storage provides a cloud storage solution that is fully compatible with Amazon S3, allowing businesses and developers to store and retrieve data in a decentralized manner without relying on centralized providers. Data is distributed across AIOZ’s network, eliminating single points of failure and enhancing security.

AIOZ AI enables decentralized AI computation, allowing users to execute AI tasks directly on AIOZ nodes instead of centralized cloud servers. This reduces computational costs and improves data privacy by keeping AI processing local. The platform supports AI model execution, training, and monetization, creating a decentralized AI marketplace where developers can sell and access AI models.

AIOZ Stream functions as a decentralized content delivery network (dCDN) for video streaming and media distribution. Unlike traditional CDNs that rely on centralized data centers, AIOZ Stream utilizes peer-to-peer nodes to store and deliver content, reducing costs and improving scalability. This model benefits video platforms, e-learning services, and gaming applications that require high-performance content delivery.

AIOZ Pin is an IPFS-based decentralized storage system designed for NFTs, metaverse assets, and Web3 applications. It provides long-term data persistence by pinning files across multiple nodes, ensuring that digital assets remain accessible without reliance on a single storage provider. This makes it suitable for NFT marketplaces, gaming platforms, and metaverse projects that require secure and permanent file storage.

AIOZ addresses several limitations of Web2 infrastructure, including centralization, high operational costs, censorship risks, and data security vulnerabilities. By leveraging a peer-to-peer model, AIOZ reduces dependency on major cloud providers, increases accessibility for developers, and enhances data sovereignty for users. Its integration of decentralized storage, AI computing, and streaming into a single ecosystem makes it a scalable Web3 infrastructure solution.

Tokenomics

AIOZ Network has updated its tokenomics to ensure long-term economic stability by gradually reducing inflation and implementing a structured token burn mechanism. Initially set at 9%, inflation will decrease by 1% annually until 2026, reaching a final rate of 5%. This adjustment aims to balance rewards for network participants while maintaining token scarcity. The staking model incentivizes validators and delegators, while governance mechanisms allow token holders to participate in decision-making processes.

AIOZ tokens are used across the network for payments, staking, and governance. Users pay for storage, AI computation, and streaming services using AIOZ tokens, integrating real-world utility into the ecosystem. Staking secures the network, with validators earning rewards while contributing to blockchain security and efficiency. Governance mechanisms enable token holders to vote on protocol upgrades, economic adjustments, and infrastructure developments.

The platform incorporates a token burn system to regulate supply and enhance long-term value. A percentage of transaction fees, DePIN rewards, and dApp-generated revenue are allocated for burning, reducing circulating supply over time. The following table outlines the updated economic model:

| Category | Details |

| Inflation Reduction | 9% (2023) → 8% (2024) → 7% (2025) → 6% (2026) → 5% (final) |

| Staking Incentives | Validators and delegators earn AIOZ for securing the network |

| Token Utility | Payments for storage, AI computation, and streaming services |

| Governance | Token holders vote on protocol changes and upgrades |

| Burn Mechanism | % of transaction fees, DePIN rewards, and dApp revenue burned |

AIOZ’s tokenomics aim to create a sustainable economic model by balancing incentives, supply control, and real-world utility.

Market Performance

| Metric | Value |

| Current Price | $0.2830 |

| Market Cap | $329.32M |

| Trading Volume (24h) | $20.13M |

| All-Time High (ATH) | $2.67 (April 2021) |

| All-Time Low (ATL) | $0.01106 (September 2023) |

| Liquidity & Trading | High activity on Bybit, KuCoin, Coinbase, Gate.io, PancakeSwap, Uniswap |

AIOZ has experienced significant volatility, with an 85% drop from its all-time high and a strong recovery from its all-time low in late 2023. Recent price movements show support around $0.20, with resistance near $0.50–$1.00. Market sentiment is driven by Web3 storage, decentralized AI, and video streaming adoption, along with broader crypto trends.

Price Prediction for 2025 & 2030

AIOZ’s future price will depend on adoption trends, competition, and broader market conditions. Its Decentralized Physical Infrastructure Network (DePIN) model positions it as a competitor in Web3 storage, AI computation, and video streaming, but its success will depend on whether it can capture market share from centralized and decentralized alternatives.

AIOZ Price Prediction for 2025

By 2025, decentralized storage, AI, and streaming sectors will likely be more competitive. Filecoin (FIL) and Arweave (AR) are expanding Web3 storage, while Render (RNDR) and Bittensor (TAO) are leading decentralized AI computation. Web3 streaming is also growing, with Theta (THETA) and Livepeer (LPT) scaling their networks. The macroeconomic environment will influence institutional investment in decentralized infrastructure.

| Scenario | Price Range | Key Factors |

| Bullish | $1.50 – $2.00 | AIOZ’s DePIN model sees large-scale adoption in AI, storage, and streaming. Institutional investment supports decentralized infrastructure. Strong dApp partnerships drive utility. |

| Base Case | $0.80 – $1.00 | Moderate adoption across Web3 services. Competition from Filecoin, Theta, and Arweave limits growth. A recovering crypto market supports gradual price increase. |

| Bearish | $0.20 – $0.40 | Centralized providers (AWS, Google Cloud) maintain dominance. Developer adoption is slow. A market downturn weakens demand for Web3 infrastructure. |

AIOZ Price Prediction for 2030

By 2030, decentralized AI and cloud infrastructure may either be widely adopted or overshadowed by hybrid solutions. If decentralized AI computation proves more cost-effective than centralized services like AWS and OpenAI, AIOZ and similar networks could see significant enterprise adoption. Regulatory clarity will also impact how Web3 storage and AI evolve, determining whether platforms like AIOZ can scale.

| Scenario | Price Range | Key Factors |

| Bullish | $5.00 – $8.00 | Decentralized AI and storage become essential for enterprises. AIOZ’s infrastructure is widely used in Web3 applications. Thousands of dApps rely on AIOZ’s DePIN network. |

| Base Case | $2.50 – $4.00 | AIOZ secures a competitive position but does not fully replace centralized cloud providers. Steady adoption in AI, media, and enterprise sectors. Tokenomics support price stability. |

| Bearish | $0.50 – $1.50 | Traditional cloud providers integrate hybrid Web3 features, reducing the need for fully decentralized solutions. AIOZ struggles with incentives for node operators. Regulatory restrictions slow Web3 adoption. |

AIOZ’s price trajectory depends on whether its decentralized infrastructure can offer better scalability, cost-efficiency, and accessibility than centralized competitors. Adoption within AI computation, storage, and streaming will determine its long-term growth and market positioning.

1/2 We are pleased to announce the release of the AIOZ Network 2025 Roadmap!

In 2025, we will introduce new developments and releases designed to empower users to store, stream, and compute the web3 way.

Visit our blog for the full details of our roadmap!… pic.twitter.com/ZgGgGzpMQr

— AIOZ Network (@AIOZNetwork) February 25, 2025

Challenges & Risks

AIOZ Network faces several challenges that could impact its adoption and long-term viability. Regulatory uncertainty remains a significant factor, as governments worldwide are still developing policies for decentralized storage, AI computation, and blockchain infrastructure. Regulations concerning data privacy, AI governance, and digital asset transactions could either accelerate AIOZ’s adoption by providing legal clarity or create barriers that limit its ability to operate in key markets.

Competitive pressure is another risk, as AIOZ operates in sectors dominated by well-funded decentralized and centralized companies. Filecoin and Arweave lead decentralized storage, Render and Bittensor dominate AI computation, and Theta and Livepeer control Web3 streaming. These projects already have established networks, partnerships, and developer ecosystems, making it difficult for AIOZ to differentiate itself. Additionally, centralized providers like AWS, Google Cloud, and Microsoft Azure continue to expand their infrastructure and may introduce hybrid blockchain solutions that reduce demand for fully decentralized alternatives.

Adoption bottlenecks could also hinder AIOZ’s growth, particularly in developer onboarding and ecosystem expansion. For AIOZ to succeed, it must attract dApp developers, enterprise clients, and node operators to its network. If the onboarding process is complex, requires high technical expertise, or lacks clear incentives, growth could stall. The scalability of its DePIN model depends on the number of active participants, and if rewards for running nodes are not competitive, participation may decline.

Conclusion

AIOZ Network positions itself as a scalable Web3 infrastructure provider, offering decentralized storage, AI computation, and streaming through its DePIN model. Its architecture integrates Cosmos SDK and EVM compatibility, enabling interoperability across major blockchain ecosystems. The network’s core strength lies in its ability to replace centralized cloud services with a decentralized alternative that lowers costs, reduces reliance on single points of failure, and enhances data sovereignty. However, its success depends on how effectively it competes against established players in Web3 storage, AI, and streaming while proving that decentralization offers a practical advantage over traditional solutions.

AIOZ’s price will be influenced by adoption, competition, tokenomics, and broader market conditions. Its gradual inflation reduction and burn mechanisms aim to create a sustainable token economy, but the network must secure meaningful adoption across dApps, enterprises, and developers to maintain demand. The presence of well-funded competitors such as Filecoin, Render, and Theta means that AIOZ must offer superior efficiency, better incentives for network participants, and strong integration with existing Web3 infrastructure to gain market share. The macroeconomic climate will also play a role, as the next crypto cycle could either accelerate institutional interest in Web3 infrastructure or shift attention to competing technologies.

By 2025, AIOZ’s adoption rate and network activity will determine whether it moves toward its bullish ($1.50-$2.00) or bearish ($0.20-$0.40) price range. By 2030, its role in the decentralized AI and cloud infrastructure sector will be clearer, with scenarios ranging from widespread adoption ($5.00-$8.00) to limited use ($0.50-$1.50) depending on competition and regulatory developments.

The bigger question is not just whether AIOZ will appreciate in value but whether it will fundamentally shift how digital infrastructure operates. If the future of computing, content delivery, and AI is decentralized, then AIOZ could be at the forefront. If not, it risks becoming another Web3 experiment that failed to scale beyond niche adoption. The investment case for AIOZ depends on whether its technology proves necessary rather than just innovative.

Frequently Asked Questions (FAQ)

What is AIOZ Network?

AIOZ Network is a decentralized Web3 infrastructure platform that provides cloud storage, AI computation, and video streaming using a peer-to-peer (P2P) network. It leverages blockchain technology and DePIN to offer scalable, low-cost alternatives to traditional cloud services.

How Many $AIOZ Tokens Are There?

AIOZ has a total supply of 1.16 billion tokens, with a circulating supply of 1.16 billion AIOZ as of 2024. The tokenomics include staking, governance participation, and periodic token burns to regulate supply.

Can AIOZ Reach $5?

AIOZ could reach $5 by 2030 if adoption in Web3 storage, AI computing, and streaming increases significantly. Growth in decentralized infrastructure, strong tokenomics, and mainstream adoption will be key drivers.

Will AIOZ Reach $10?

AIOZ may reach $10 if demand for decentralized AI and cloud storage surpasses centralized competitors like AWS and Google Cloud. Mass enterprise adoption, regulatory clarity, and sustained network growth are essential for this price level.

Is AIOZ Network a Good Investment?

AIOZ offers strong fundamentals in Web3 storage, AI, and streaming, but competition from Filecoin, Render, and Theta presents challenges. Its long-term value depends on adoption, market conditions, and its ability to outpace centralized cloud providers.

How Does AIOZ Work?

AIOZ operates a decentralized content delivery and computing network (DePIN) where users contribute storage, computing power, and bandwidth in exchange for AIOZ tokens. The blockchain ensures scalability, security, and low-cost access to Web3 infrastructure.