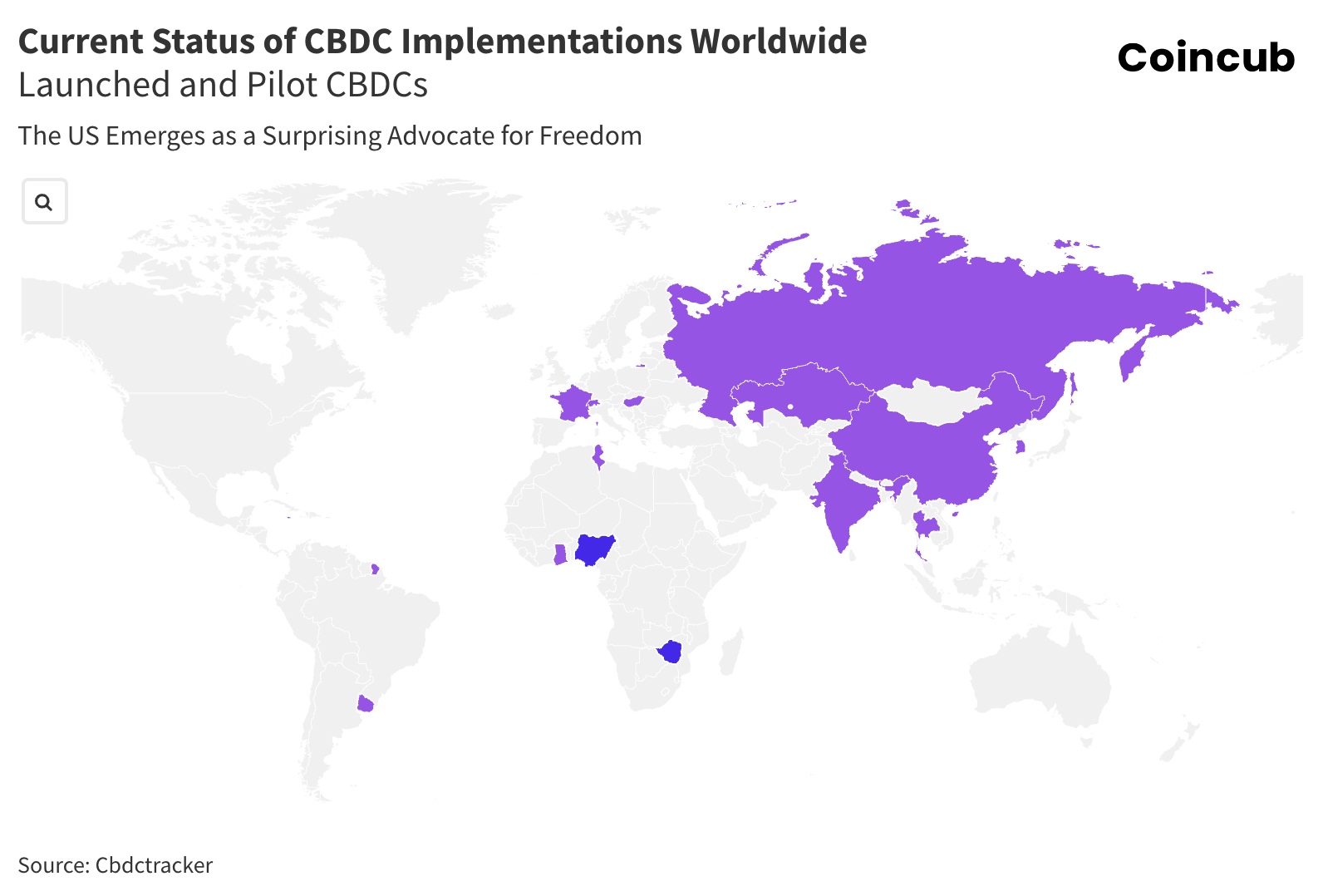

The US emerges as a surprising advocate for freedom in the fight against CBDCs

China, historically known as the birthplace of paper money, is piloting a new form of money with Central Bank Digital Currencies (CBDCs). China’s innovation in the financial sector has been around for a while. The country led the world in developing paper money during the Tang and Song dynasties (618–1279 AD). This innovation was later adopted globally, revolutionizing trade and commerce. Today, China is again at the forefront of financial innovation with its digital yuan (e-CNY) project, setting a precedent for CBDC development worldwide. China’s influence is felt worldwide as it forges ahead with multiple CBDC projects, including an astounding seven projects in Hong Kong. This trend is not limited to China alone, with many countries in Asia and parts of Africa also venturing into CBDCs, heralding a seismic change in the future of financial systems.

However, in a remarkable twist, the US, often seen as a follower, is now taking a stand to curb its proliferation, marking a significant shift in the global financial landscape. In contrast to China’s proactive approach, the United States has emerged as a surprising advocate for freedom, raising concerns over the potential risks and loss of privacy associated with CBDCs. The United States is leading the counter-movement with legislative efforts, spearheaded by figures such as Senator Ted Cruz, aiming to ban the issuance of a US CBDC digital dollar, citing concerns over privacy and government overreach. This stance positions the US as a potential champion of freedom, resisting the tide of digital surveillance that CBDCs could bring. To understand why this is important, let’s explain first what the CBDCs are and why you should care.

What are CBDC?

A Central Bank Digital Currency (CBDC) is a digital currency issued by a country’s central bank. It is similar to cryptocurrencies, except that its value is fixed by the central bank and is equivalent to the country’s fiat currency. Unlike Bitcoin, which is decentralized and operates without a central authority, CBDCs are centralized and function under the central bank’s control. They are designed to complement traditional physical currency (like banknotes and coins) and can be used for everyday transactions in a digital format.

CBDCs can be used by individuals to pay businesses, shops or each other (a “retail CBDC”), or between financial institutions to settle trades in financial markets (a “wholesale CBDC”).

In theory, CBDCs could decrease the maintenance cost of a complex financial system, reduce cross-border transaction costs, and provide lower-cost options for those who currently use alternative money-transfer methods1.

- Centralized Issuance: Issued by the central bank, ensuring trust and stability.

- Legal Tender: Recognized as an official payment medium for all public and private debts.

- Digital Nature: Exists only in electronic form, accessible via digital wallets, smartphones, or computers.

- Interoperability: Can be used in conjunction with existing financial systems and infrastructures.

- Security: Employs advanced encryption and security measures to prevent fraud and cyberattacks.

So, CBDCs are not the same as virtual currency or cryptocurrency. A CBDC would be issued by a state. Most CBDC implementations will likely not use or need any distributed ledger like a blockchain.

US ban on CBDCs – Leading the world away from a dystopian future. Yes but why?

The legislative moves in the United States to potentially ban Central Bank Digital Currencies (CBDCs) have sparked significant debate. The US House of Representatives has passed a bill prohibiting the Fed from issuing a CBDC, reflecting widespread apprehensions about the implications of a government-controlled digital currency.

The Federal Reserve (Fed) is the central bank of the United States, and it comprises 12 regional Federal Reserve Banks. These banks are not government-owned but are structured as private corporations with member banks holding shares in them.

Member banks receive dividends on their shares and have voting rights in certain decisions, such as electing some members of the regional Federal Reserve Banks’ boards of directors.

The boards of directors of the regional Federal Reserve Banks include representatives from commercial banks, providing these banks with influence over the governance and policies of the Fed.

Potential influence on government direction and CBDC policies

Banks have a vested interest in monetary policies that affect their profitability. Through their influence in the Fed, they can indirectly impact interest rates, lending practices, and other monetary policies.

Banks can push for regulatory frameworks that favor their operations, potentially lobbying against regulations that they view as harmful to their interests.

CBDC Developments

Commercial banks may see CBDCs as a threat to their traditional business models, as CBDCs could enable individuals to hold accounts directly with the central bank, bypassing commercial banks.

Banks might leverage their influence to advocate for policies that delay or limit the implementation of CBDCs, arguing that these digital currencies could disrupt the financial system and their business operations.

What are the top 10 commercial banks that own the FED?

While the Federal Reserve is an independent entity, it is comprised of 12 regional Federal Reserve Banks that are owned by member banks. Here are ten prominent commercial banks, among others, that hold significant stakes in these regional Federal Reserve Banks:

- JPMorgan Chase & Co.

- Bank of America Corp.

- Wells Fargo & Co.

- Citigroup Inc.

- Goldman Sachs Group Inc.

- Morgan Stanley

- U.S. Bancorp

- PNC Financial Services Group

- Capital One Financial Corp.

- TD Bank, N.A.

These banks, as members of the Federal Reserve System, hold shares in their respective regional Federal Reserve Banks, which entitles them to certain dividends and voting rights, though the actual control and governance of the Federal Reserve remain with the Board of Governors.

Outside from competing with local banks, what are other main criticisms of CBDCs?

While Central Bank Digital Currencies (CBDCs) present numerous advantages, they also face significant criticisms and concerns. Here are the primary criticisms:

- Privacy Concerns:

- Surveillance: CBDCs can enable central banks and governments to monitor individual transactions, raising concerns about financial privacy and the potential for state surveillance.

- Data Security: The digital nature of CBDCs makes them susceptible to hacking and cyberattacks, posing risks to users’ financial data and privacy.

- Centralization:

- Control: Unlike decentralized cryptocurrencies, CBDCs are controlled by central banks, which can lead to concerns about overreach and misuse of power.

- Single Point of Failure: Centralized systems can be more vulnerable to systemic failures, as opposed to decentralized systems that distribute risk.

- Financial Inclusion:

- Digital Divide: Access to CBDCs requires digital infrastructure such as smartphones and internet connectivity, potentially excluding segments of the population that lack these resources.

- Usability: Older generations and less tech-savvy individuals may find it difficult to adapt to a digital currency system.

- Impact on Banking Sector:

- Disintermediation: CBDCs could reduce the role of commercial banks in the financial system, as individuals might hold accounts directly with the central bank, potentially leading to reduced liquidity and higher funding costs for banks.

- Bank Runs: In times of financial crisis, the ease of transferring funds from commercial banks to CBDCs could exacerbate bank runs.

- Economic Stability:

- Monetary Policy: The introduction of CBDCs could complicate the implementation of monetary policy, as it might change the demand for traditional currency and impact interest rates.

- Negative Interest Rates: Some critics fear that CBDCs could facilitate the implementation of negative interest rates, which can have adverse effects on savers and the broader economy.

- Technological and Operational Risks:

- Implementation Costs: Developing and maintaining a CBDC infrastructure can be costly and resource-intensive.

- Interoperability Issues: Ensuring that CBDCs work seamlessly with existing financial systems and across borders can be challenging.

- Economic Inequality:

- Access and Usage: The adoption of CBDCs may disproportionately benefit those with better access to technology and financial literacy, potentially widening the gap between different socio-economic groups.

- Global Implications:

- Currency Competition: The widespread adoption of CBDCs by various countries could lead to competition between national currencies, affecting global trade and financial stability.

- Geopolitical Risks: The introduction of CBDCs could have geopolitical implications, particularly if major economies use their digital currencies to exert influence on other countries.

Understanding these criticisms is crucial for policymakers, financial institutions, and the public to address potential challenges and ensure that the implementation of CBDCs is both effective and equitable.

Privacy and surveillance examples

Critics argue that CBDCs could enable unprecedented levels of government surveillance. Unlike cash, digital currencies can be tracked and monitored easily, allowing the government to scrutinize every transaction. This level of oversight could lead to significant erosions of financial privacy and personal autonomy. In authoritarian regimes, such as China, the potential for abuse is even more pronounced. The Chinese government has integrated its CBDC, the digital yuan, with its social credit system, using it as a tool for surveillance and control. Alex Gladstein states, “The end of cash and the insta‐analysis of financial transactions enable surveillance, state control, and, eventually, social engineering on a scale never thought possible.”

The social credit system assigns scores based on individuals’ behavior, and these scores can impact access to services. For instance, in 2018, millions were barred from purchasing plane and train tickets due to low social credit scores. The digital yuan facilitates this system by enabling real-time monitoring of financial transactions, which can be linked to social credit scores.

The US’s stance on CBDCs also has significant economic and geopolitical implications. Some argue that by opting out of CBDC development, the US risks falling behind other nations embracing digital currencies, potentially weakening the dollar’s global dominance. However, banning CBDCs could position the US as a leader in protecting individual freedoms and privacy, setting an international precedent against the potential dystopian uses of digital currencies.

Observations by region of CBDC projects

The development and implementation of CBDCs involve a complex interplay of advanced technologies and strategic collaborations. Countries leverage DLT, blockchain, and digital identity systems to create secure and efficient digital currencies. With significant contributions from technology companies like IBM, R3, and Consensys, the global CBDC landscape is rapidly evolving, promising to transform the future of money and payments.

Asia

- China: The e-CNY (digital yuan) is one of the most advanced CBDCs globally and is already in extensive pilot phases. It aims to enhance payment systems and international trade efficiency. China leverages its domestic tech giants, including Ant Group and Tencent, for this development.

- Hong Kong: Hong Kong is involved in several CBDC projects like mBridge and e-HKD, focusing on cross-border payments and integration with China’s digital yuan.

Europe

- France: France’s Banque de France is active in wholesale CBDC projects, exploring the potential of DLT for interbank settlements and cross-border payments. Collaborations include Project Jura with Switzerland.

- Sweden: Sweden’s e-Krona is in the proof-of-concept stage, aiming to address the declining use of cash and ensure the robustness of the payment system.

North America

- United States: The US Federal Reserve is researching various CBDC models, with projects like Project Hamilton focusing on understanding the technical and policy implications of a digital dollar.

- Canada: Canada’s Project Jasper, in collaboration with R3, explores the use of DLT for secure and efficient interbank payments.

Middle East

- United Arab Emirates: The UAE’s involvement in projects like mBridge and Aber showcases its commitment to enhancing cross-border payment systems using CBDCs. These projects often collaborate with neighboring countries and other global financial hubs.

Africa

- Nigeria: Nigeria’s e-Naira is a fully launched CBDC aimed at enhancing financial inclusion and reducing transaction costs. The project uses blockchain technology to ensure secure and efficient transactions.

Top 10 countries with CBDC projects

Countries around the world are at different stages of researching, developing, and implementing CBDCs. Below is an overview of key projects by some leading nations:

- Hong Kong (Projects: 7 – Score: 18)

- Key Initiatives: e-HKD (proof of concept), mBridge (pilot)

- Details: Hong Kong is actively exploring both retail and wholesale CBDCs, participating in multiple cross-border payment projects like mBridge, which involves collaboration with Thailand, the UAE, and China.

- Thailand (Projects: 5 – Score: 16)

- Key Initiatives: mBridge (pilot), Inthanon (proof of concept)

- Details: Thailand is heavily invested in CBDC development, focusing on wholesale CBDCs to improve cross-border transactions and financial inclusivity.

- Singapore (Projects: 5 – Score: 13)

- Key Initiatives: Project Ubin+ (pilot), Mandala (research)

- Details: Singapore’s approach includes extensive pilot programs for wholesale CBDCs, aiming to enhance the efficiency of its financial markets.

- France (Projects: 4 – Score: 12)

- Key Initiatives: French Wholesale CBDC (pilot), Project Mariana (research)

- Details: France focuses on wholesale CBDCs, exploring their potential to streamline interbank settlements and international trade.

- United States (Projects: 5 – Score: 11)

- Key Initiatives: Project Hamilton (proof of concept), Digital Dollar (research)

- Details: The U.S. is in the research and proof of concept stages, analyzing the implications of a digital dollar on its financial system.

- United Arab Emirates (Projects: 3 – Score: 11)

- Key Initiatives: mBridge (pilot), Aber (pilot)

- Details: The UAE is exploring wholesale CBDCs through collaborations like Aber with Saudi Arabia, focusing on cross-border payment systems.

- South Korea (Projects: 4 – Score: 11)

- Key Initiatives: Digital Won (pilot), Mandala (research)

- Details: South Korea’s CBDC initiatives include both retail and wholesale applications, aimed at enhancing the domestic payment infrastructure.

- Switzerland (Projects: 4 – Score: 10)

- Key Initiatives: Helvetia (pilot), Project Mariana (research)

- Details: Switzerland is examining wholesale CBDCs to improve its financial market infrastructure, focusing on cross-border and interbank payments.

- China (Projects: 3 – Score: 10)

- Key Initiatives: e-CNY (pilot), mBridge (pilot)

- Details: China is leading the charge with its digital yuan, aiming for widespread domestic adoption and international influence through projects like mBridge.

- Australia (Projects: 4 – Score: 9)

- Key Initiatives: eAUD (proof of concept), Mandala (research)

- Details: Australia’s CBDC research includes both retail and wholesale applications, focusing on future-proofing its financial ecosystem.

As countries continue to develop and implement CBDCs, the landscape of global finance is set to change dramatically. While the potential benefits that governments advertise include greater financial inclusion and more efficient payment systems, the risks related to privacy and governmental control cannot be ignored. European governments like France might face a crude backlash as they strive to strike a balance between innovation and safeguarding individual freedoms.

The interesting case of Brazil’s CBDC efforts

Brazil is actively exploring the potential of central bank digital currencies (CBDCs) through its comprehensive pilot project known as the Digital Real. This initiative involves a wide array of technology providers and financial institutions, making it one of the most inclusive and extensive CBDC projects globally.

What’s interesting about the Digital Real project is the sheer number of stakeholders involved. Unlike in other parts of the world, where governments are often taking control and sidelining banks, Brazil is fostering an environment of collaboration. Major banks and technology partners are invited to participate and lead in the project, ensuring a balanced approach between private and public sectors.

In contrast to the strong influence of Wall Street on financial regulation in the United States, Brazil’s approach to CBDCs is notably different. In the US, financial powerhouses like BlackRock exert significant influence, as seen with the rapid approval of ETFs for Ethereum and Bitcoin. The simultaneous approval of an Ethereum ETF and the banning of CBDCs underscores the power and synchronization of financial lobbying in America, often protecting the interests of large banks and institutions.

Brazil, however, is taking a new path with its CBDC strategy, potentially offering long-term benefits for the government. This collaborative model, which includes both private and public sectors, may lead to a more balanced and sustainable financial ecosystem, although the direct benefits for the general populace remain to be fully understood.

Here are the key players and their contributions to the Digital Real project:

- Bradesco, Nubank, Banco Inter: These major banks are contributing their financial infrastructure and expertise.

- Microsoft, 7Comm: Providing cloud computing and technological solutions.

- Santander, Santander Asset Management, F1RST, Toro CTVM: Exploring financial management and investment potentials.

- Itaú Unibanco: Developing retail applications for the Digital Real.

- Basa, TecBan, Pinbank, Dinamo, Cresol, Banco Arbi, Ntokens, Clear Sale, Foxbit, CPqD, AWS, Parfin: Offering a range of technical and operational support, from security to blockchain infrastructure.

- SFCoop: Ailos, Cresol, Sicoob, Sicredi, Unicred: Ensuring the CBDC meets cooperative banking needs, enhancing financial inclusion.

- XP, Visa, Banco BV, Banco BTG, Banco ABC, Hamsa, LoopiPay: Focusing on payment solutions and merchant integration.

- Banco B3, B3 Digitas: Exploring implications for securities trading and settlement.

- ABBC: bancos Brasileiro de Crédito, Ribeirão Preto, Original, ABC, BS2, Seguro; ABBC, BBChain, Microsoft, BIP: Contributing to the overall framework and regulatory compliance.

- Banco do Brasil: Leveraging extensive network and technological capabilities for national deployment.

Brazil’s inclusive approach to developing its CBDC, the Digital Real, involves a collaborative effort that may serve as a model for other countries seeking to balance innovation with existing financial structures.

Technologies driving the global CBDCs

Key technologies

Distributed Ledger Technology (DLT): DLT, including blockchain, is central to many CBDC projects. This technology ensures secure, transparent, and tamper-proof transactions. Prominent implementations include Hyperledger Fabric and R3’s Corda.

Blockchain: Blockchain provides a decentralized ledger for recording transactions. It is favored for its security and transparency. Ethereum and private blockchains are often used in pilot projects.

Digital Identity Systems: Ensuring user identification while maintaining privacy is critical. Projects often use digital identity verification technologies to securely authenticate users without compromising their privacy.

Encryption and Security Protocols: Robust encryption and security measures are integral to protect CBDC transactions from cyber threats. These protocols ensure the integrity and confidentiality of financial data.

Key players in CBDC launches

1) eCurrency Mint

eCurrency Mint is a technology provider specializing in secure and scalable central bank digital currency (CBDC) solutions. The company offers a comprehensive suite of technologies that enable central banks to issue, distribute, and manage digital fiat currency.

- Security and Compliance: eCurrency Mint provides cryptographic security features that ensure the integrity and authenticity of digital currency. Their solutions are designed to comply with regulatory standards.

- CBDC Projects: eCurrency Mint has been involved in various CBDC projects globally, providing technology that supports the lifecycle of digital currency issuance and management.

Notable Implementations:

- Sand Dollar: eCurrency Mint has partnered with the Central Bank of The Bahamas to develop and launch the Sand Dollar, one of the first fully implemented CBDCs in the world.

2) Bitt Inc.

Bitt Inc. is a fintech company that develops digital currency infrastructure for central banks. Their platform focuses on creating secure, efficient, and inclusive financial ecosystems through the implementation of blockchain technology.

- Digital Wallets and Payments: Bitt provides digital wallet solutions that enable users to store and transact digital currency seamlessly. Their platform also supports merchant payments and cross-border transactions.

- CBDC Expertise: Bitt has extensive experience working with central banks to design and deploy digital currencies tailored to the needs of various economies.

Notable Implementations:

- DCash: Bitt has been instrumental in the Eastern Caribbean Central Bank’s (ECCB) DCash project, which aims to enhance payment systems and financial inclusion in the Eastern Caribbean region.

- eNaira: Bitt collaborated with the Central Bank of Nigeria to launch the eNaira, Nigeria’s digital currency, aimed at improving financial inclusion and reducing transaction costs.

3) Movmint

Movmint is a digital currency technology provider focused on developing robust platforms for central bank digital currencies. Their technology supports the secure issuance, distribution, and redemption of digital currency.

- Interoperability and Integration: Movmint’s solutions emphasize interoperability with existing financial systems, enabling seamless integration with traditional banking infrastructure.

- Scalable Solutions: The company provides scalable digital currency solutions designed to meet the growing needs of central banks and financial institutions.

Notable Implementations:

- E-cedi: Movmint has partnered with the Bank of Ghana to develop and pilot the e-cedi, Ghana’s digital currency, aimed at modernizing the country’s payment systems and enhancing financial inclusion.

4) R3 Corda

R3 Corda is a distributed ledger technology (DLT) platform designed specifically for businesses. It is known for its high levels of privacy, security, and efficiency, making it a preferred choice for financial institutions and central banks.

- Interoperability: Corda allows seamless integration with existing financial systems, ensuring smooth transitions to digital currencies.

- Privacy: The platform ensures transactional privacy, which is crucial for financial institutions.

- Scalability: Corda is designed to handle large volumes of transactions, making it suitable for national and international financial systems.

Notable Implementations:

- Project Jasper: In collaboration with the Bank of Canada, Project Jasper used R3 Corda to explore the feasibility of a wholesale CBDC.

- Project Inthanon-LionRock: A joint effort between the Hong Kong Monetary Authority and the Bank of Thailand, this project aimed to enhance cross-border payments using Corda.

5) Consensys

Consensys is a leading blockchain technology company that focuses on building infrastructure, applications, and tools for the Ethereum blockchain. Their expertise extends to CBDCs, where they provide end-to-end solutions.

- Ethereum Expertise: Consensys leverages the Ethereum blockchain for secure and programmable digital currencies.

- Smart Contracts: Their use of smart contracts facilitates automated, transparent, and efficient transactions.

- Consulting and Development: Consensys offers consulting services to central banks, helping them design and implement CBDCs.

Notable Implementations:

- Project Ubin: In partnership with the Monetary Authority of Singapore, Consensys worked on this project to explore the use of blockchain for clearing and settlement of payments and securities.

- CBDC Pilots: Consensys has been involved in various CBDC pilot projects worldwide, providing technical expertise and blockchain solutions.

5) Ripple

Ripple is known for its digital payment protocol and network, which facilitates real-time cross-border payments. Ripple’s technology aims to provide fast, low-cost, and secure global financial transactions.

- RippleNet: A global payments network that connects banks, payment providers, and digital asset exchanges, enabling seamless and instant cross-border transactions.

- XRP Ledger: Ripple uses the XRP Ledger, which offers high throughput and low transaction costs, making it suitable for CBDCs.

Notable Implementations:

- RippleNet Adoption: Various financial institutions use RippleNet for international payments, highlighting its potential for CBDC implementation.

- CBDC Partnerships: Ripple has partnered with several central banks to explore the potential of XRP and RippleNet in supporting CBDC infrastructure.

6) Stellar

Stellar is an open-source blockchain network designed to facilitate cross-border transactions. It focuses on providing financial infrastructure for developing economies and fostering financial inclusion.

- Speed and Cost: Stellar offers fast and low-cost transactions, making it ideal for micropayments and cross-border transfers.

- Interoperability: Stellar’s network supports integration with existing financial systems and digital assets.

Notable Implementations:

- Stellar Lumens (XLM): The native cryptocurrency of the Stellar network is used to facilitate transactions and support the network’s operations.

- CBDC Projects: Stellar has been involved in several projects aimed at developing CBDCs, particularly in regions looking to enhance financial inclusion.

7) Mastercard

Mastercard, a global payment technology company that currently went live with crypto credential, has been exploring blockchain and digital currency solutions to enhance its payment infrastructure. The company has developed blockchain solutions on the Ethereum network.

- Blockchain Integration: Mastercard integrates blockchain technology to improve payment efficiency, security, and transparency.

- Ethereum-Based Solutions: Leveraging Ethereum’s smart contract capabilities, Mastercard develops programmable payment solutions.

Notable Implementations:

- CBDC Pilots: In 2020, Mastercard partnered with the Reserve Bank of Australia to research a retail Central Bank Digital Currency (CBDC) project known as eAUD, utilizing the Ethereum blockchain.

These companies are at the forefront of CBDC development, providing essential technologies and expertise to support the issuance and management of digital currencies. Their contributions are shaping the future of digital finance, enhancing efficiency, security, and financial inclusion on a global scale, and might soon be your banking provider of digital currency. Watch this space.