Self-custody and full control.

Cart

Self-custody and full control.

Cart

Figure Markets Review 2025

Our review on Figure Markets, the self-custody exchange with SEC-approved products.

Figure Markets info

| Founded | 2024 |

| Headquarters | USA |

| Website | https://www.figuremarkets.com/mobile/refer/V0IYTCEF |

| Daily volume trading | Not disclosed (early-stage exchange) |

| Number of cryptocurrencies | Less than 10 |

| Crypto licences | Multiple (federal and state level), SEC-registered products |

| Cryptocurrency Fees | 0% |

| Minimum deposit | $0 for crypto deposits; $5,000 for loans (domestic), no minimum for international loans |

| Digital Wallet | Yes |

| Promotion | No |

| Currency | USD, USDC |

| Deposit Method | Bank transfer (ACH, Wire), Crypto (USDC), SEPA/SWIFT coming soon |

Coincub Score

Figure Markets Review

Figure Markets is built on the idea that users should always control their assets. Instead of holding your funds in a centralized wallet, you manage them directly through self-custody.

The platform removes trading fees entirely and skips the typical hidden spreads found elsewhere. But it doesn’t stop at trading. Figure Markets combines professional-grade tools, lending products, and yield opportunities to create a more complete experience for casual and advanced users.

Users can earn passive returns on idle stablecoins, access crypto-backed loans with flexible terms, or trade confidently, knowing their assets remain under their control. The goal is to merge decentralized finance’s control with a centralized platform’s usability without sacrificing security or transparency. Figure Markets skips the typical complexity of legacy exchanges, focusing on usability from the start. On that note, new users also have an incentive to test the waters, with a $50 reward for completing their first $100 in deposits and trades within the first 14 days.

As a newer player in the market, Figure Markets focuses on building an efficient, feature-first experience from the start.

Core Features

Self-Custody as Default

Figure Markets puts self-custody at the center of its platform. When you create an account, your assets stay controlled through an MPC wallet system. Private keys are split and held across multiple parties, meaning no single entity can access your funds, not even Figure Markets. This approach protects users against platform failure or misuse and removes the risks of traditional custodial exchanges.

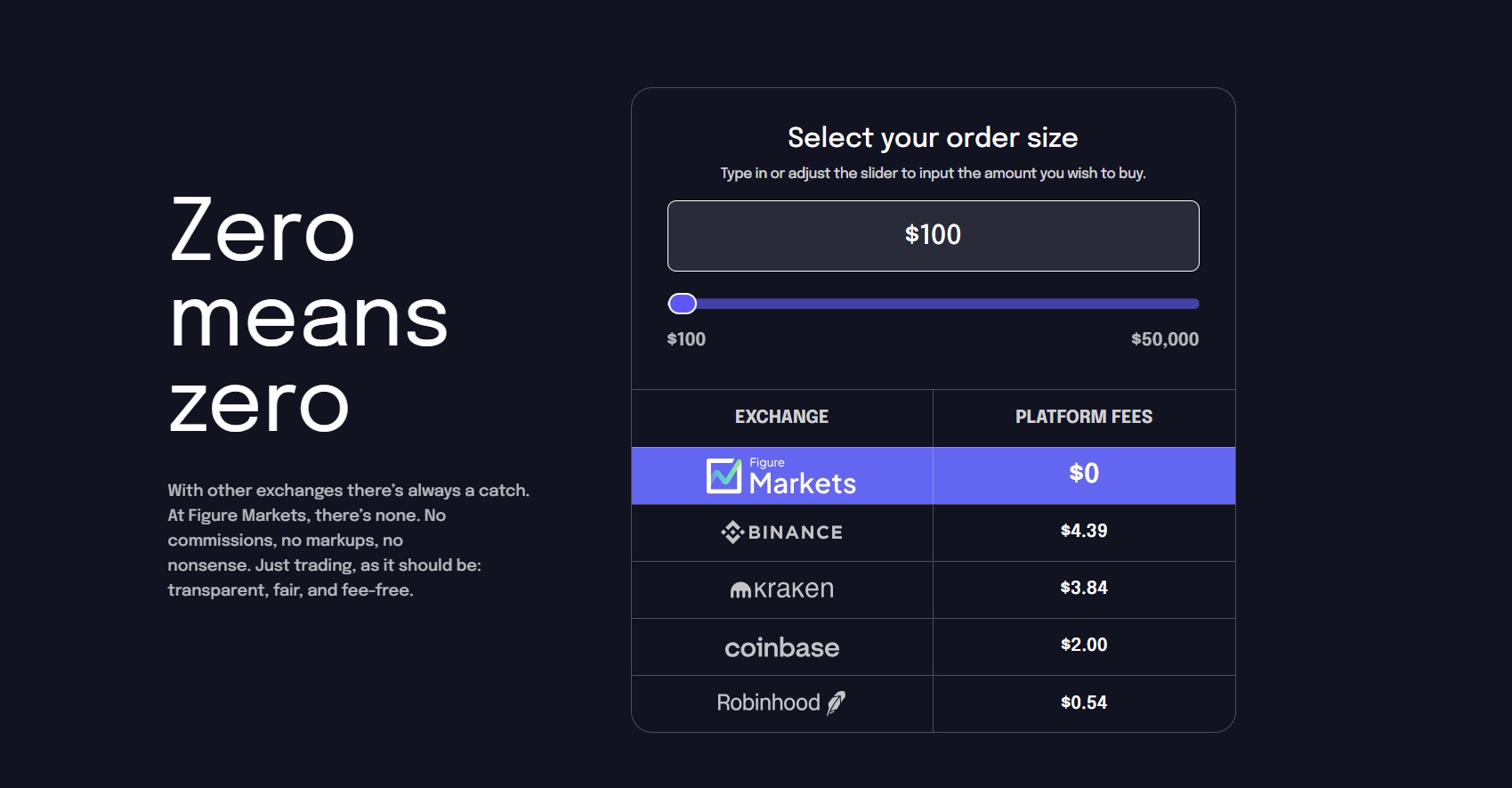

Zero Trading Fees

There are no trading fees on Figure Markets. You pay exactly what the market price shows, with no hidden spreads or surprise costs at checkout. While most exchanges add a quiet markup on trades, Figure keeps the process transparent. Every trade is executed at the best market price, giving users full value without gimmicks.

Pro Trading Tools

Figure Markets offers users a complete pro trading interface beyond simple buy-and-sell functions. The platform includes advanced charting, order books, and multiple order types like limit and stop-limit. Traders can monitor market depth, track real-time order flow, and set execution preferences to match their strategy. Whether you’re making fast moves or planning longer-term trades, the tools are designed for precision.

Speed & Ease of Use

Account setup on Figure Markets is fast. KYC is straightforward, and funding your account takes only a few steps. U.S. customers can use ACH or wire transfers, while international users can deposit with USDC. Once funds are in, you can start trading immediately. The platform runs on an efficient off-chain matching engine, keeping the trading experience fast and responsive across web and mobile.

Security Approach

Figure Markets is built around self-custody, using multi-party computation (MPC) to secure user assets. Private keys are split into fragments and distributed across multiple hosts, which means no single party, not even the platform itself, can move your funds.

This setup removes the typical risks of centralized custody. Even in a system failure, users retain access to their assets. Transactions require multiple approvals, and there’s no single point of failure. By design, Figure Markets keeps control in the hands of the user at all times.

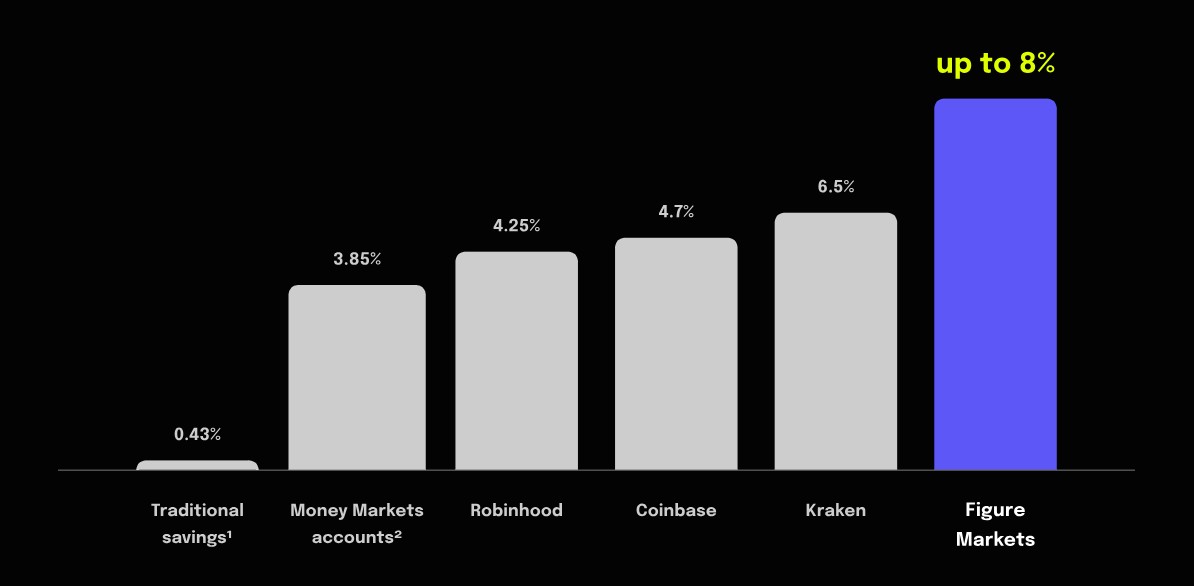

Yield & Earning Opportunities

Forward Vault

Forward Vault turns idle stablecoins into an income stream. By depositing USD or USDC, users can earn up to 8% APY, with funds automatically swept into a portfolio backed by U.S. home equity loans. There’s no lock-up period, and liquidity is available daily, so you can access your funds whenever needed. The yield comes from real-world assets, giving a level of stability rare in crypto-native products.

YLDS Token

YLDS is a yield-bearing stablecoin registered with the SEC. It pays interest daily, calculated at the SOFR rate minus 0.50%, and pays monthly in YLDS. You can buy or sell YLDS directly on Figure Markets, transfer it peer-to-peer, or off-ramp to fiat during U.S. banking hours. It works like a traditional fixed-income product but lives on the blockchain, giving users a familiar way to earn passive income in a crypto environment.

Introducing the first-ever new type of SEC-regulated, yield-bearing stablecoin that is transferable: $YLDS

✅Yield variable at SOFR minus 50bps (current ~3.85%)

✅No staking or lockups

✅Buy/sell 24×7It’s time for real assets with real value. pic.twitter.com/Yuw7igB79x

— Figure Markets (@FigureMarkets) February 21, 2025

P2Prime Lending

P2Prime connects lenders and borrowers through a Dutch auction system. Lenders set the minimum rate they’re willing to accept, and borrowers compete for available funds. Even if you set a lower rate, you receive the highest matched rate in the auction. Loan terms run hourly, and Figure Markets manages collateral and repayments automatically. Assets not in use can be withdrawn at any time, keeping your capital flexible.

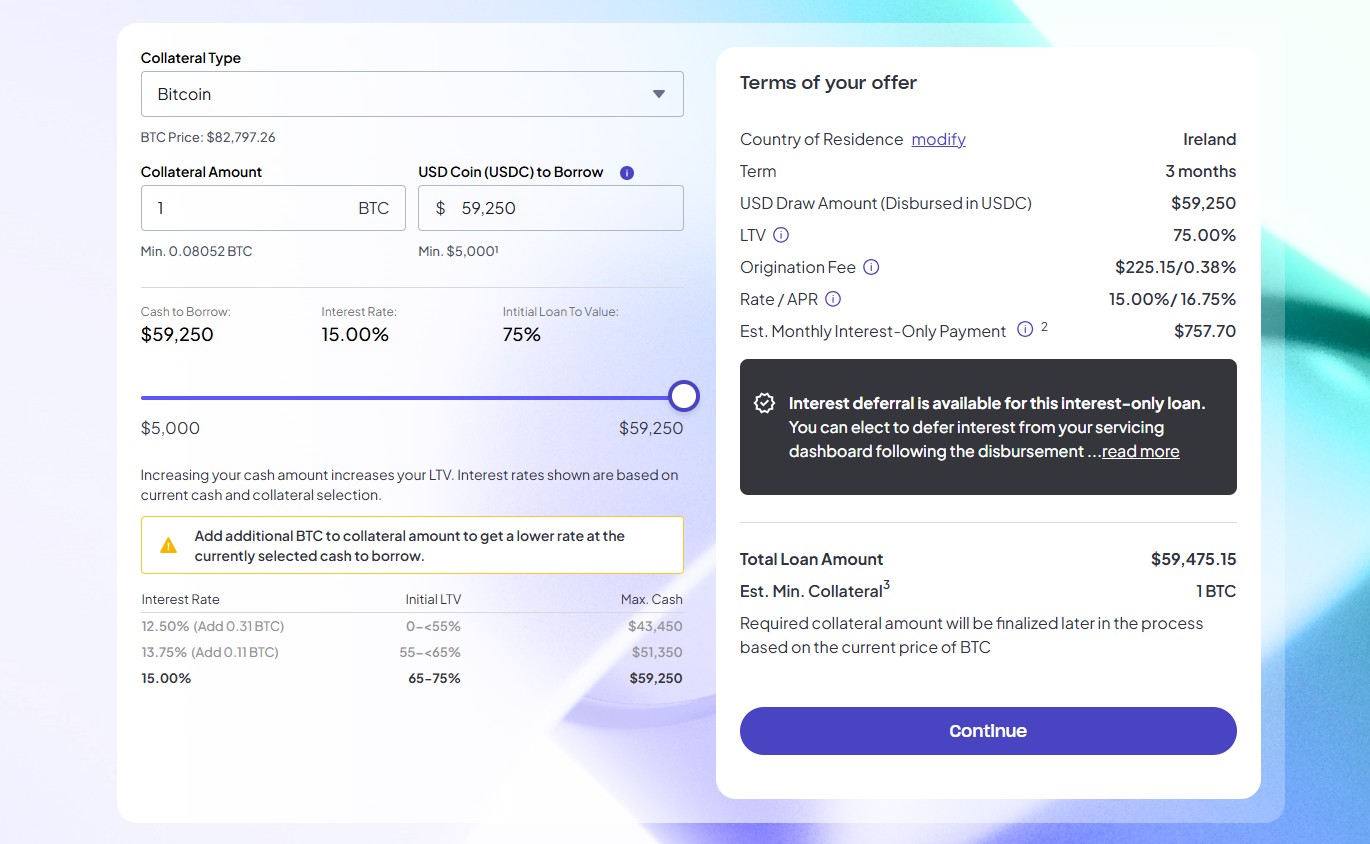

Crypto-Backed Loans

Figure Markets offers crypto-backed loans without the usual challenges. There’s no credit check, and approval is often completed on the same day. Users can borrow against Bitcoin or Ethereum with loan-to-value ratios reaching up to 90%, making it one of the more aggressive lending offers in the market.

The platform keeps repayment flexible. Loans run on a 3-month term, with the option to make monthly interest-only payments or defer interest until the end of the term. There are no prepayment penalties, so you can repay quickly and free up your collateral early.

Figure Markets also provides an integrated loan calculator showing how much you can borrow based on your crypto holdings. As prices fluctuate, you can adjust your collateral to manage your loan health and avoid liquidation triggers.

Margin Trading & Short Selling

Figure Markets gives traders up to 5x leverage through its margin trading system. Borrowing works hourly, with rates determined by a Dutch auction that balances borrower demand with available supply. When you place a margin trade, the platform secures a loan for you, which renews automatically at the top of each hour until it’s repaid.

Risk management is built into the system. Users must monitor their Loan-to-Value (LTV) ratio closely to avoid liquidation. If your LTV approaches 90%, the platform will automatically sell assets to bring it back under control. Idle funds in your account go toward repaying margin loans, helping you stay ahead of interest accrual.

Short-selling is available for Bitcoin, Ethereum, and Solana. Once margin trading is enabled, you can borrow and sell these assets to repurchase them at a lower price. The same hourly loan cycle and risk controls apply, keeping the experience consistent across leveraged strategies. Interest rates for borrowed assets follow the Dutch auction model, giving transparency to costs with every trade.

Expansion Potential

Figure Markets currently support Bitcoin, Ethereum, USDC, Solana, Chainlink, and HASH trading. While the selection is tight, the platform focuses on delivering depth over quantity at this early stage.

What sets it apart is the inclusion of tokenized assets beyond standard crypto pairs. Users can trade FTX claims and invest in closed-end funds, adding variety beyond typical exchange offerings.

Expansion is already on the roadmap. Figure Markets plans to extend its product range to include stocks, bonds, and a broader selection of cryptocurrencies. The goal is to create an “exchange for everything,” combining crypto markets with traditional financial products under one self-custodial platform.

UX & Flow

Figure Markets keeps the user experience straightforward across both web and mobile platforms. Account setup is fast, and the interface is clean, making it easy to navigate whether you’re trading casually or using advanced features.

The Quick Buy and Sell flow allows users to place orders directly from their cash balance, linked bank account, or crypto wallet without delays. There’s no spread manipulation baked into the pricing. You get the actual market rate at the time your order is placed. Estimated amounts are shown clearly before execution, but the final trade always reflects the best price.

The Pro interface offers a full suite of trading tools for more advanced users. Real-time charts, market depth visuals, and flexible order types give you control over every trade. The platform avoids clutter, focusing instead on speed, transparency, and straightforward execution.

User Profile: Who is Figure Markets For?

Figure Markets is built for users who want complete control over their crypto. Self-custody is the default, making it a clear choice for anyone looking to keep their assets out of centralized hands.

It also appeals to yield seekers. Between Forward Vault, the YLDS token, and P2Prime lending, users have several ways to put idle funds to work and earn passive income.

Active traders will find value in the platform’s pro tools. With advanced order types, real-time data, and transparent pricing, Figure Markets delivers a trading experience without hidden fees or markups.

Finally, it’s a solid option for crypto borrowers. Users can unlock liquidity without giving up ownership of their assets, borrowing against Bitcoin or Ethereum with flexible terms and no credit checks.

Opening an Account and Trading

Getting started on Figure Markets is a smooth process. It follows a few essential steps: account creation, funding, and trading, each with its own specifics that matter to the user experience.

Creating an Account

Sign-up begins either on the web platform or through the mobile app (for web sign-ins, you will need to scan a QR code with your phone). The registration flow asks for basic personal information and a Know Your Customer (KYC) verification. You must upload a government-issued ID and a selfie to confirm your identity. If applicable, proof of address might also be required.

After that, Figure Markets automatically generates your self-custody wallet. Unlike other exchanges, you don’t rely on a central wallet owned by the platform. Instead, you receive a recovery phrase, typically a 12 to 24-word seed phrase, essential for accessing your funds. Figure clearly emphasizes safeguarding this phrase because account recovery isn’t impossible without it. The wallet is MPC-powered, meaning your keys are split across multiple hosts, and you can only approve transactions with it.

Funding Your Account

Once your KYC is approved and your wallet is set up, you can fund your account and start trading immediately. For new users, there’s also a $50 reward available when you deposit and trade at least $100 within the first 14 days, a small but welcome bonus to get started.

For U.S. users, there are two cash funding options:

- ACH bank transfer: Link your bank account through the platform, allowing instant deposits of up to $25,000. Once connected, funds show up in your balance immediately, making this the fastest cash funding option domestically.

- Wire transfer: Use the provided bank details to initiate a wire from your external account. Processing times depend on your bank, but this method supports more extensive deposits.

Global users have access to crypto funding:

- USDC transfer: Generate a unique Ethereum address within your Figure Markets account. The funds will appear in your account once you send USDC to this address from an external wallet or another exchange.

- Upcoming methods: SEPA and global USD SWIFT transfers will launch soon, expanding fiat funding options for international customers.

The platform also sends confirmations for every cash or crypto deposit, keeping users informed at each step.

Post-Funding

Trading starts as soon as your account is funded. The Quick Buy and Sell option makes purchasing crypto directly from your balance or linked bank account simple. There’s no spread fee, and the platform displays the estimated conversion before you confirm your trade. For users looking for more control, the Pro interface offers advanced charting, order types, and market depth tools to support precision trading.

Withdrawals are also kept simple. Crypto withdrawals require selecting the asset and entering the destination wallet address, while cash withdrawals follow standard banking procedures. The process is fully integrated across web and mobile, keeping account management smooth from start to finish.

Capital Backing and Regulatory Milestone

Figure Markets started with a lot of ambition. In early 2024, the company secured $60 million in Series A funding. Heavyweight backers like Jump Crypto, Pantera Capital, Lightspeed Faction, and others saw potential in the model: a self-custody exchange built from the ground up with compliance baked in. This wasn’t your typical crypto startup scrambling for licenses after launch. They raised serious capital to build serious infrastructure from day one.

The funding wasn’t about marketing hype or vanity plays. It went straight into developing the core exchange, custody systems, and product stack that now power Figure Markets. This includes their standout achievement: the first SEC-approved, yield-bearing stablecoin. That approval landed in early 2025 and immediately set Figure Markets apart from the crowd.

While most exchanges wrestle with unclear regulation and scramble to patch compliance gaps, Figure Markets flipped the script. Launching a fully SEC-registered yield product early has made it a credible alternative for retail and institutional users fed up with regulatory uncertainty elsewhere. This is not a mere legal win. This is a direct trust signal to the market.

This gives Figure Markets a legitimate shot at pulling market share from more prominent, more exposed competitors. Investors and traders looking for yield opportunities without the regulatory gray zone now have a straightforward option. Institutional players watching from the sidelines because of compliance fears will find onboarding easier.

Top things we love, annoying things about exchange

Things we love about Figure Markets

- SEC-registered products from the start

- True self-custody as default setup

- Zero trading fees, no hidden spreads

- Crypto-backed loans up to 90% LTV

- Advanced pro trading tools and fast execution

Annoying things about Figure Markets

- Limited asset selection (BTC, ETH, USDC mainly)

- Global fiat funding options not fully live yet

- Short lending cycles (1-hour periods)

- New platform, liquidity still developing

- Margin trading limited to a few assets

FAQs

What is Figure Markets?

Figure Markets is a self-custody cryptocurrency exchange that allows users to buy, sell, and borrow digital assets like Bitcoin (BTC) and Ethereum (ETH). The platform emphasizes user control, offering decentralized custody through multi-party computation (MPC) wallets. This ensures that users maintain full control over their assets at all times.

How do I create an account on Figure Markets?

To create an account, visit the Figure Markets website or download the mobile app. You’ll need to complete a Know Your Customer (KYC) verification process, which requires providing personal information and a government-issued ID. Once verified, a self-custody wallet will automatically be generated for you.

What funding options are available in Figure Markets?

U.S. residents can fund their accounts via ACH bank transfers or wire transfers. Once their bank accounts are linked, ACH transfers of up to $25,000 are available instantly. International users can deposit funds using USDC by transferring to a unique Ethereum address provided by the platform. SEPA and SWIFT transfer options are expected to be added soon.

Does Figure Markets charge trading fees?

Currently, Figure Markets offers zero trading fees as part of its launch promotion. Users can trade without incurring additional costs, though it is advisable to check the platform for any updates on fee structures.

What cryptocurrencies can I trade on Figure Markets?

As of now, Figure Markets supports trading for cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and USD Coin (USDC). The platform also offers tokenized assets like FTX claims and plans to expand its offerings to include stocks, bonds, and additional cryptocurrencies.

How secure is Figure Markets?

Figure Markets prioritizes security. The platform utilizes multi-party computation (MPC) technology for decentralized custody, ensuring that private keys are split and distributed across multiple hosts. This design eliminates single points of failure and ensures that only users can control their assets.

Can I earn interest on my holdings with Figure Markets?

Yes, Figure Markets offers several yield-generating products:

- Forward Vault: Allows users to earn up to 8% APY on idle stablecoins by investing in a portfolio backed by U.S. home equity loans.

- YLDS Token: An SEC-registered yield-bearing stablecoin that pays interest daily, calculated at the SOFR rate minus 0.50%, with monthly payouts in YLDS.

Does Figure Markets offer crypto-backed loans?

Yes, users can borrow against their Bitcoin or Ethereum holdings. The platform offers loans with up to 90% loan-to-value (LTV) ratios, same-day approval, and no credit checks. Flexible repayment options are also available.

Is margin trading available on Figure Markets?

Figure Markets provides margin trading with up to 4x leverage on eligible assets. Users should monitor their loan-to-value (LTV) ratios to avoid liquidation events.

How can I withdraw funds from Figure Markets?

Withdrawals can be made in both crypto and fiat currencies. For crypto withdrawals, select the asset and enter the destination wallet address. For fiat withdrawals, follow the prompts to transfer funds to your linked bank account. Processing times may vary based on the method chosen.

Visit Figure Markets

Coincub verdict: Buy here

Crypto insights delivered straight to your inbox

Subscribe to our newsletter, you are in very good company