Dublin, April 28, 2025 – Coincub has published its landmark Crypto Asset Risk Report 2025, revealing a dramatic reshuffling of global leadership in digital asset regulation and innovation. The report, compiled with insights from industry experts and enforcement data, provides a comprehensive jurisdictional risk assessment and a comparative analysis of regulatory clarity, enforcement, and security incidents worldwide.

Main Findings:

-

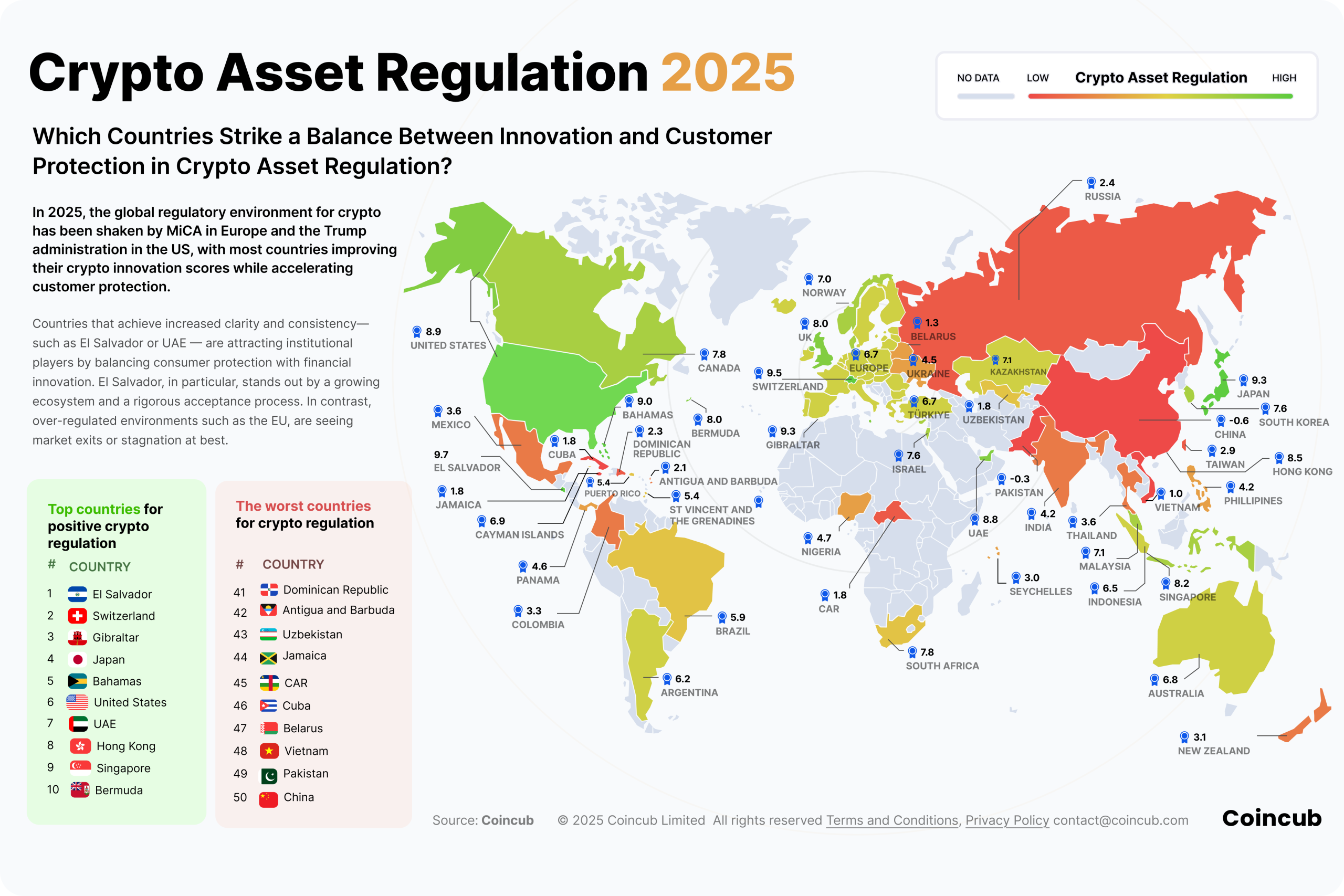

El Salvador Tops Global Rankings: El Salvador has emerged as the world leader in Bitcoin and digital asset regulation, praised for its clear, innovative legal framework, robust consumer protections, and openness to international collaboration. The country’s “clean slate” approach, including creating the National Commission of Digital Assets (CNAD), has attracted global players and fostered exponential growth in digital asset management, with over $150 billion managed this year.

-

Switzerland, Japan, and the UAE Set the Standard: Switzerland, Japan, and the UAE are recognized for offering the most predictable and consistent regulatory environments. These countries combine mature licensing structures with integrated oversight, enabling sustainable innovation while maintaining strong compliance and enforcement.

-

Asia’s Balanced Approach: South Korea and Singapore demonstrate that clear, demanding rules can support market stability and innovation. Their transparent licensing and robust enforcement have increased institutional adoption and reduced operational risk1.

-

U.S. Remains High-Risk, High-Reward: The United States remains the most capital-rich market but is becoming riskiest. Recent regulatory reforms have clarified some aspects, but political shifts and the reclassification of memecoins as collectibles have increased uncertainty and exposure to speculative risk.

-

Europe’s MiCA Backfires: The EU’s Markets in Crypto-Assets (MiCA) regulation, intended to harmonize the market, has created a regulatory bottleneck. Compliance costs have soared, licensing uptake remains low, and more than 75% of previously registered VASPs are expected to lose their status by year-end. This has triggered an exodus of talent and startups, with Europe falling to 22nd place in global rankings.

-

Security Breaches and Enforcement Rising: 2025 has seen a resurgence in high-value security breaches, notably a $1.5 billion theft at ByBit. Enforcement actions are accelerating, with regulators targeting platforms based on user geography and headquarters. Binance leads in sanctions count, while Bitpanda stands out for its clean compliance record.

-

Industry-Wide Risk Context: Despite the sector’s reputation, crypto’s aggregate penalties ($13.5 billion) remain a fraction of those in traditional finance. Most enforcement actions focus on regulatory compliance rather than large-scale fraud, and the industry is maturing with increased alignment to global standards.

Conclusion:

The 2025 Coincub Crypto Asset Risk Report underscores a new global order in digital asset regulation. Jurisdictions that balance innovation with robust compliance – like El Salvador, Switzerland, Japan, the UAE, South Korea, and Singapore – are attracting capital and talent. In contrast, regions with fragmented or burdensome regulation, notably the EU, risk permanent decline in the global crypto arena. The report calls for regulators and industry leaders to prioritize sustainable growth, clear rules, and international cooperation as the sector evolves.

For the full report and detailed rankings, visit https://coincub.com/ranking/crypto-asset-risk-2025/

Media Contact

Dren Hima

Editor

press@coincub.com