Seasoned crypto investors and pro gamers recommend holding onto crypto-assets and avoid using Coinbase’s crypto debit card. Coinbase recently launched new features for its debit card users riding on the crypto train. Cardholders will have access to their crypto funds via Google Pay and Apple Pay, but the card needs to be linked to your […]

Global crypto ranking top 5’s

The most comprehensive overview of active crypto economies across the globe for investors, journalists, and residents interested in the cryptoeconomy.

| 1 | USA | 25 | |

| 2 |  |

United Kingdom | 17 |

| 3 |  |

Switzerland | 8 |

| 4 | Japan | 8 | |

| 5 | Germany | 6 |

| 1 |  |

UAE | 1 |

| 2 |  |

Bahamas | 2 |

| 3 |  |

Bermuda | 3 |

| 4 | Cayman Islands | 4 | |

| 5 |  |

Seychelles | 5 |

| 1 | USA | 554m | |

| 2 | India | 348m | |

| 3 | Indonesia | 227m | |

| 4 |  |

Turkey | 215m |

| 5 | Philippines | 201m |

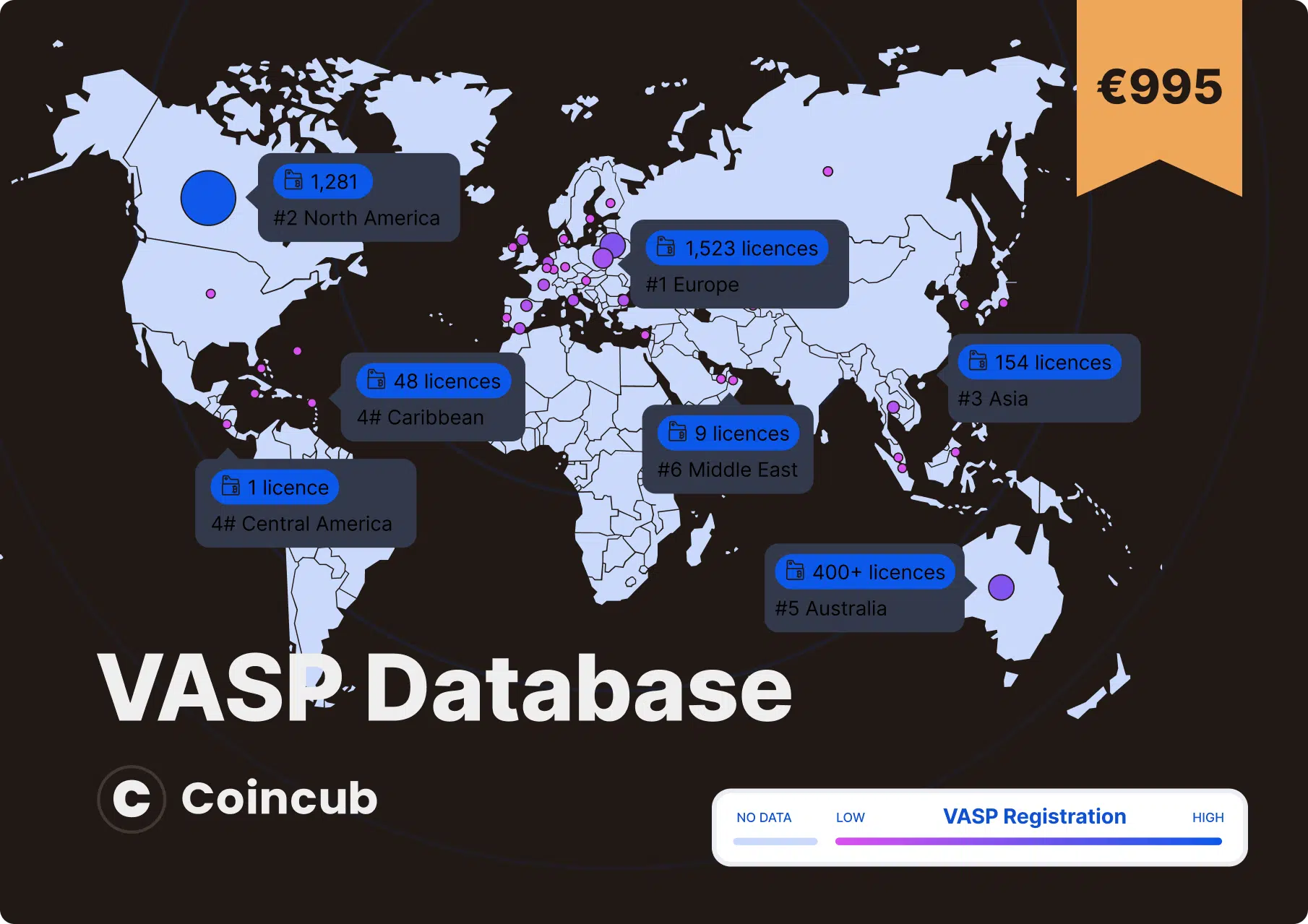

| 1 | Canada | 1,254 | |

| 2 |  |

Lithuania | 694 |

| 3 |  |

Australia | 400+ |

| 4 |  |

Poland | 381 |

| 5 | Italy | 97 |

What’s hot

We review the hottest crypto projects to keep you in trend

Recently, it appears that index trading has become the new hot issue among Nigerian investors looking to diversify their portfolios and ride market trends. Consider this: indexes are like a mixed bag of goods, providing a glimpse into how a specific market or sector is performing without delving into individual equities. It’s similar to having […]

Platform Overview and Core Features At the core of CryptoStake.com is a groundbreaking approach to crypto staking. They offer a non-custodial solution, ensuring that you always maintain ownership and control over your digital assets. This means that the platform does not hold your crypto; you do, just like keeping your money safe with a key […]

The word through the grapevine is that the crypto markets are heating up for a new bullish cycle. With Bitcoin halving in April 2024 and approvals of BTC spot ETFs in January 2024, the upside potential is palpable. Consequently, investors are looking for the best ways to exchange ETH to BTC safely and reliably. This […]

Early this year, the U.S. Securities and Exchange Commission (SEC) approved the trading of spot Bitcoin ETFs, granting the cryptocurrency entry into the traditional securities market. Digital assets are becoming increasingly popular, with statistics expecting the number of users in the market to climb by 24% and hit over 865 million by the end of […]

Sometimes, we all need a little financial boost. Whether for an emergency, a business opportunity, or personal development. This is where online loans come in handy. In this article, we highlight why you might need to look into why you might be interested in legit loan apps with low interest, and offer valuable tips on […]

How to Buy Bitcoin With a Credit Card Since its inception in 2009, Bitcoin (BTC) – the world’s premier cryptocurrency – has made significant waves on the global stage. Its nature as a digital currency presents a unique investment opportunity, with individuals worldwide benefiting from its fluctuating prices. There are many ways to purchase the […]

The potential classification of Ether as a security by the Securities and Exchange Commission (SEC) could have profound long-term implications for various sectors within and adjacent to the crypto industry. Let’s explore these implications for the crypto industry, tokenization, Bitcoin, and the broader strategies of companies like BlackRock. A) Crypto Industry The classification of Ether […]

Coincub books

Here are some of our favourite books

- Environmental sustainability and blockchain technology

- Government initiatives

- CBDCs

- NFTs

- How to get started with bitcoin

- Avoid scams and get to know the biggest hacks

- Find out regulatory requirements

- 65 pages of packed information

Just in: Crypto Banking Database 2024

Biggest VASP and Crypto Licensing Database available now, including Entity, Name, Licence type, Regulating institution, Country, Region

Global crypto ranking - quarterly top five evolution

Coincub has been compiling the global crypto country ranking since 2021. Our vision is to provide the most comprehensive overview of active crypto economies across the globe for investors, journalists, and anyone interested in the cryptoeconomy.

| COUNTRY | Q3 2021 | Q4 2021 | DIFF. | |

|---|---|---|---|---|

| Germany | 1 | 1 | ||

| USA | 1 | 3 | +2 | |

|

Singapore | 3 | 2 | -1 |

|

Australia | 4 | 4 | |

|

Switzerland | 5 | 5 | |

| COUNTRY | 2022 | 2021 | DIFF. | |

|---|---|---|---|---|

| Germany | 1 | 4 | +3 | |

|

Singapore | 2 | 1 | -1 |

| USA | 3 | 3 | ||

|

Australia | 4 | 2 | -2 |

|

Switzerland | 5 | 8 | +3 |

| COUNTRY | 2023 | 2022 | DIFF. | |

|---|---|---|---|---|

| USA | 1 | 7 | +6 | |

| Germany | 2 | 1 | -1 | |

|

Singapore | 3 | 5 | -2 |

|

Hong Kong | 4 | 8 | +3 |

|

Switzerland | 5 | 2 | -3 |

New: Crypto Banking Report 2024

Download Now

I agree with the privacy policy and accept the rules for processing personal data

Crypto country updates

The latest headlines from the global crypto economy

#33

Sweden

#33

Sweden  #21

Romania

#21

Romania  #68

Latvia

#68

Latvia  #55

Belgium

#55

Belgium Exchange reviews

Honest reviews of the world's most influential exchanges

| NAME | RATING | FOUNDED DATE | DEPOSIT METHOD | BASED IN | REVIEW | SIGN UP | ||

|---|---|---|---|---|---|---|---|---|

| #1 |

|

Kraken | 4.3 | 2011 | Card Bank | San Francisco | Coincub Review | Register Now |

| #2 |

|

Bybit | 4.2 | 2018 | Card Crypto Sepa Wise | UAE | Coincub Review | Register Now |

| #3 |

|

Uphold | 4.17 | 2015 | Bank account Credit/debit card Apple/Google Pay Wire transfer Crypto networks | USA | Coincub Review | Register Now |

| #4 |

|

Bitget | 4.17 | 2018 | Card Bank P2P | Seychelles | Coincub Review | Register Now |

| #5 |

|

Revolut | 4.0 | 2015 | Credit Card Bank Transfer | London, UK | Coincub Review | Register Now |

| #6 |

|

Coinbase | 3.9 | 2012 | Credit Card Bank Transfer | USA | Coincub Review | Register Now |

| #7 |

|

Crypto.com | 3.8 | 2016 | Credit Card Bank Transfer | Hong Kong | Coincub Review | Register Now |

| #8 |

|

Blockchain.com | 3.8 | 2011 | Credit card | Luxembourg | Coincub Review | Register Now |

| #9 |

|

eToro | 3.6 | 2007 | Credit Card Bank Transfer | Cyprus | Coincub Review | Register Now |

| #10 |

|

Luno | 3.6 | 2013 | Card Bank | United Kingdom | Coincub Review | |

| #11 |

|

KuCoin | 3.5 | 2017 | Credit Card Bank Transfer | Mahé, Seychelles | Coincub Review | Register Now |

| #12 |

|

Gate.io | 3.3 | 2013 | Bank Transfer | Cayman Islands | Coincub Review | Register Now |

| #13 |

|

CEX.IO | 3.2 | 2013 | Card bank transfer Skrill Advcash and Epay. | United Kingdom | Coincub Review | Register Now |

| #14 |

|

Binance | 2.8 | 2017 | Card Bank | Cayman Islands | Coincub Review | Register Now |

Pick the best exchange in your country to trade crypto

All exchangesShop Databases

Have a look at our new shop fill with data and insights